AmorePacific to rebalance China-heavy global business

It targets 10% annual sales growth in the 2024-2027 period with an operating profit margin of 12% by 2027

By Nov 13, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

AmorePacific Corp., South Korea’s No. 1 cosmetics group, will rebalance its China-heavy global business to focus on the US and Europe while looking for new brand acquisitions, the company said on Wednesday.

The portfolio rebalancing will mark a drastic strategic adjustment for the company reeling from a sharp sales drop in China, especially poor duty-free sales heavily dependent on Chinese group tourists to South Korea.

“We have expanded business with a focus on China and mainly through duty-free channels,” AmorePacific said in material prepared for its Investor Day presentation on Wednesday.

“Due to our concentration on specific regions and [sales] channels, we were late in coping with the changing [business] environment. Our growth potential and profitability deteriorated.”

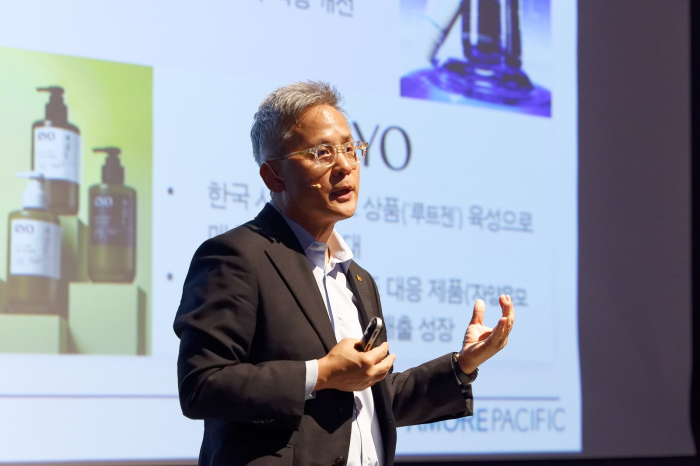

Its co-CEO Kim Seung-hwan gave the presentation. It was the first time that an AmorePacifc chief executive presented its growth strategy to analysts in public and shared it with the media.

China accounted for half of its Asian operations in terms of revenue in 2023. Asia represented 76% of its global sales, with the US making up 20%.

The proportion of China sales shrunk to 31% in the first nine months to September this year. By comparison, sales from Western countries expanded to 40% of its total revenue in the same period, versus 24% in 2023.

Since 2017, South Korean cosmetics brands have been hit hardest by China’s ban on group tours to South Korea and import restrictions in retaliation for Seoul’s decision in 2016 to deploy the US terminal high altitude area defense (THAAD) missile system. COVID-19 lockdowns dealt another heavy blow.

In China, foreign big names such as L'Oréal and Lancôme have elbowed out premium Korean brands, while Chinese brands have rapidly ascended to catch up to budget Korean brands.

In the presentation materials, the beauty company said it will focus on Western countries and pursue M&As of new brands.

"To accelerate our global [business] rebalancing, we'll target the US, Japan, Europe, India and the Middle East as our major strategic markets," said Kim.

In the US, Europe and Japan, AmorePacific will strengthen its partnership with Sephora, a French beauty products retailer, to expand its customer base.

AmorePacific is aiming for a 10% sales growth annually in the 2024-2027 period to lift its operating profit margin to 12% by 2027 from 2.9% in 2023.

It also targets an average return on equity of 7-8% during the same period, from 3.7% in 2023.

In the third quarter ending on September 30, its revenue climbed 10% to 977.2 billion won, compared with the year prior. Operating profit nearly quadrupled to 65.2 billion won, over the same period.

In 2023, the company's sales contracted to 4.0 trillion won versus 6.7 trillion won in 2016.

Write to Hun-Hyoung Ha at hhh@hankyung.com

Yeonhee Kim edited this article.

-

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platforms

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platformsSep 26, 2024 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsShinsegae buys low-cost cosmetics brand Amuse from Naver Snow

Beauty & CosmeticsShinsegae buys low-cost cosmetics brand Amuse from Naver SnowAug 05, 2024 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsKorean cosmetics makers see record Q2 profits led by exports

Beauty & CosmeticsKorean cosmetics makers see record Q2 profits led by exportsJul 17, 2024 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsCJ Olive Young beats Amorepacific to become K-beauty king

Beauty & CosmeticsCJ Olive Young beats Amorepacific to become K-beauty kingMar 22, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsAmorepacific's profit halves on weak sales in China; shares drop

Beauty & CosmeticsAmorepacific's profit halves on weak sales in China; shares dropJan 31, 2024 (Gmt+09:00)

2 Min read -

-

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands grow

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands growJan 18, 2024 (Gmt+09:00)

2 Min read -

Leadership & ManagementCosmetics giant Amorepacific hints at succession plan change

Leadership & ManagementCosmetics giant Amorepacific hints at succession plan changeJul 31, 2023 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsAmorepacific to strengthen partnership with A.S. Watson

Beauty & CosmeticsAmorepacific to strengthen partnership with A.S. WatsonJun 27, 2023 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsHeyday over for Amorepacific, LG Household in China’s beauty market

Beauty & CosmeticsHeyday over for Amorepacific, LG Household in China’s beauty marketJun 26, 2023 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsLG Household to lower reliance on Chinese market as shares slump

Beauty & CosmeticsLG Household to lower reliance on Chinese market as shares slumpMar 25, 2022 (Gmt+09:00)

4 Min read