Manyo’s Pure Cleansing Oil to hit US Costco shelves in July

With its best-selling cleansing product’s Costco debut, the S.Korean beauty product maker expects its US sales to double

By Apr 12, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s naturalism cosmetics company Manyo Co. has hit the jackpot in a deal to supply its best-selling face cleansing product, Pure Cleansing Oil, to about 300 Costco stores across the US starting in July.

“We will start supplying our mainstay product Pure Cleansing Oil to US wholesale retail giant Coscto’s some 300 locations in July,” Manyo’s Chief Executive Officer Yoo Geun-jik said in a recent interview with The Korea Economic Daily. “We will strive to double sales in the US like magic.”

Pure Cleansing Oil, launched in 2013, is still the most popular product of Manyo, accounting for 51% of the company’s total sales last year, according to the company.

Founded in 2012, Manyo owns four cosmetics brands – main skincare brand Ma:nyo, scented body care brand Banilla Boutique, vegan cosmetics line Our Vegan and vegan color cosmetics line No Mercy. It has ventured into 65 countries, including the US, Japan and China.

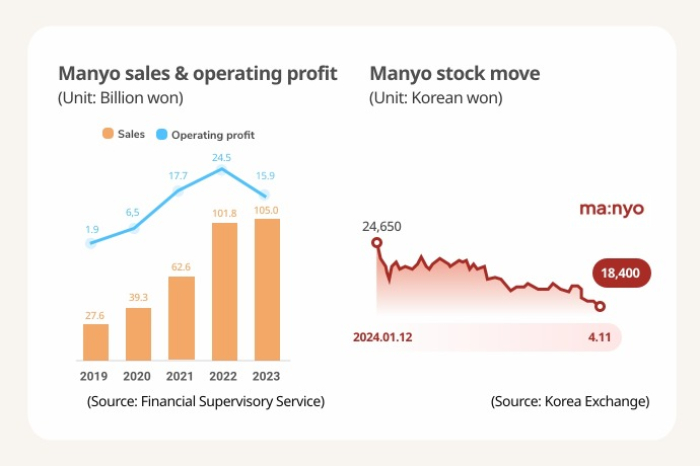

Thanks to its aggressive global push, the company’s earnings have improved significantly since 2019. Operating profit more than octupled to 15.9 billion won ($11.5 million) in 2023 from 2019, and sales nearly quadrupled to 105 billion won over the same period.

The company will continue to strive for a bigger piece of the global pie despite the overall market downturn, Yoo said.

In line with such efforts, Manyo will take over a competitive color cosmetics company this year while planning lavish spending worth about 20 billion won on marketing to expand its market share in Korea, the US and Japan, said the CEO.

In particular, it plans to broaden its sales networks at both online and offline sales channels run by Korea’s top health and beauty store chain operator CJ Olive Young Corp., the country’s portal giant Naver Corp.'s Smart Store, local retail giant Shinsegae Inc.'s SSG.COM.

It also plans to team up with Amazon.com, Singapore-based e-commerce platform Shopee, Southeast Asian e-commerce Qoo10 and Japan’s Rakuten for joint marketing.

“Our business in the US is expected to improve significantly this year as our products will start to be sold at US beauty chain Ulta Beauty stores,” said Yoo, adding that he pins high hopes on the Chinese beauty market, where Manyo has been actively seeking to expand its presence since last year.

The Korean beauty product maker also has grand plans to advance into India, the world’s most populous country, where Korean K-pop culture has taken off in recent years, in the first half of this year.

ROSY OUTLOOK FOR MANYO’S 2024 EARNINGS

Cheering the Costco news, Manyo shares ended up 4.9% at 19,300 won on Friday, recouping some of their recent losses. The stock, which made a triumphant debut on Korea’s secondary Kosdaq market in June 2023, has been lackluster since early this year.

Investors seem to welcome the company’s aggressive global expansion plan.

Of its entire sales last year, overseas sales accounted for 57% and domestic sales the remaining 43%, according to Manyo.

Its offline sales in Japan have been on the steady rise, helping Manyo earn a total of 33.9 billion won in the neighboring country as of 2023, while its sales in China nearly doubled to 11.7 billion won in a year last year.

Market analysts picture a bright outlook for Manyo’s earnings this year on growing demand for its products overseas.

Its operating profit is forecast to zoom 62% in 2024 on sales of 124.4 billion won, up 18% on-year.

Manyo’s target market, the so-called clean beauty market, is also projected to grow sixfold in five years from $6 billion in 2023, boding well for the Korean cosmetics company’s business.

Write to Hyun-Ju Yun at hyunju@hankyung.com

Sookyung Seo edited this article.

-

Korean stock marketKorea's IPO market heats up with higher price cap for new stocks

Korean stock marketKorea's IPO market heats up with higher price cap for new stocksJul 13, 2023 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsCJ Olive Young beats Amorepacific to become K-beauty king

Beauty & CosmeticsCJ Olive Young beats Amorepacific to become K-beauty kingMar 22, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands grow

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands growJan 18, 2024 (Gmt+09:00)

2 Min read -

-

Beauty & CosmeticsCJ Olive Young opens specialized store for foreigners in Seoul

Beauty & CosmeticsCJ Olive Young opens specialized store for foreigners in SeoulNov 01, 2023 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsS.Korean cosmetics overtake French as top imports in Japan

Beauty & CosmeticsS.Korean cosmetics overtake French as top imports in JapanAug 04, 2023 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsKorean cosmetics maker Able C&C rejuvenated by sales in Japan, US

Beauty & CosmeticsKorean cosmetics maker Able C&C rejuvenated by sales in Japan, USJun 20, 2023 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsKorean cosmetics shares rise as China reopens borders

Beauty & CosmeticsKorean cosmetics shares rise as China reopens bordersJan 11, 2023 (Gmt+09:00)

1 Min read