Beauty & Cosmetics

CJ Olive Young beats Amorepacific to become K-beauty king

AliExpress, Temu, Daiso are unlikely to hinder CJ Olive Young’s growth in S.Korea as their products and concepts are different

By Mar 22, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

CJ Olive Young Corp., South Korea’s top beauty store chain, took the throne in the domestic cosmetics market last year, beating industry giants Amorepacific Corp. and LG H&H Co. by sales, as consumers preferred cheaper products to premium items.

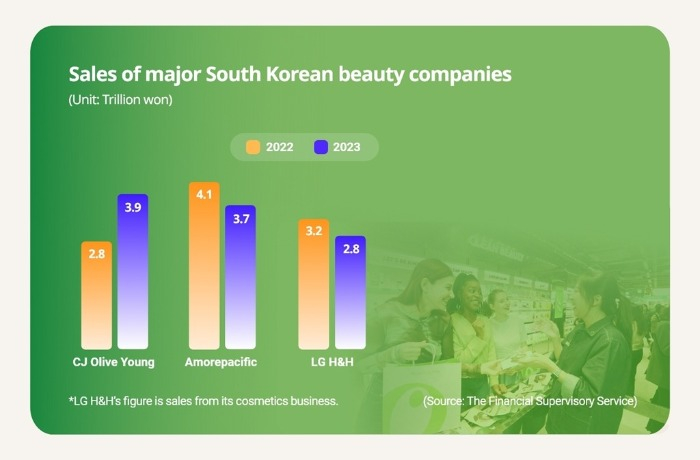

CJ Olive Young’s sales rose 39% to 3.9 trillion won ($2.9 billion) in 2023 with its net profit jumping 72.7% to 355.1 billion won, exceeding revenues of Amorepacific and LG H&H’s beauty unit for the first time, according to industry sources on Thursday. The revenue of Amorepacific, the country’s top cosmetics maker, slipped 11.1% to 3.7 trillion won, while sales of LG H&H’s beauty business fell 12.3% to 2.8 trillion won.

The beauty chain store operator is expected to maintain the top spot as it provides products from various cosmetics companies rather than focusing on only one brand, industry experts said.

“CJ Olive Young is unlikely to have a competitor for the time being, given its buying power and competitiveness in both online and offline markets,” said Park Jongdae, a former analyst at Hana Securities, who wrote a book on the South Korean beauty market.

“Major Chinese e-commerce players such as AliExpress and Temu, as well as Daiso may threaten it, but the impact will be limited as their products and concepts are different,” said Park, current CEO of a local food maker. Daiso is South Korea’s top dollar store chain.

STRUCTURAL CHANGE

CJ Olive Young took advantage of a structural change in the South Korean cosmetics industry.

Domestic beauty products were mostly sold through single-brand shops, such as Amorepacific’s Innisfree, LG H&H’s The Face Shop and Able C&C Co.'s Missha from the 2000s to mid-2010s.

Since then, however, those retail outlets have been reeling from the rapid growth in online sales and the plunge in Chinese tourists on a diplomatic row between Beijing and Seoul over South Korea’s decision to deploy a US-led Terminal High Altitude Area Defense (THAAD) anti-missile system.

Smaller and independent local beauty brands expanded their presence in the South Korean market when those cosmetics behemoths struggled.

OUTSOURCE EVERYTHING EXCEPT PRODUCT PLANNING

Those minor brands handled only product planning and outsourced everything else, including production, logistics and sales, which major cosmetics makers manage. Original design manufacturers (ODMs) such as Kolmar Korea Co. and Cosmax Inc. produce cosmetics for smaller beauty companies, while multi-brand stores such as CJ Olive Young sell those products.

Such strategies allowed companies, which have only ideas without massive production facilities or sales channels, to sell cosmetics, reviving the K-beauty industry.

CJ Olive Young utilized the growth in smaller cosmetics brands based on its merchandizing competitiveness by rapidly responding to the trend change.

“CJ Olive Young succeeded as it actively accepted new minor brands and quickly changed the composition of stores and products in line with trends,” said Park.

Clio Cosmetics Co. and Round Lab, smaller beauty companies, logged revenues of more than 100 billion won through sales at CJ Olive Young stores.

Write to Hyung-Joo Oh at ohj@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

-

Beauty & CosmeticsAmorepacific's profit halves on weak sales in China; shares drop

Beauty & CosmeticsAmorepacific's profit halves on weak sales in China; shares dropJan 31, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsCJ Olive Young opens specialized store for foreigners in Seoul

Beauty & CosmeticsCJ Olive Young opens specialized store for foreigners in SeoulNov 01, 2023 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsHeyday over for Amorepacific, LG Household in China’s beauty market

Beauty & CosmeticsHeyday over for Amorepacific, LG Household in China’s beauty marketJun 26, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN