Battery materials

SK, POSCO in heated race for next-generation silicon battery materials

Silicon is a promising anode material but easily becomes bulky and unstable, posing a challenge for materials makers

By Oct 04, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s two big conglomerates, SK and POSCO, are setting their sights on silicon anode, a next-generation material for lithium-ion batteries, amid growing demand from electric-vehicle battery manufacturers.

Affiliates of SK, the country’s third-largest business group, are even competing among themselves to produce the material ahead of other group units and outside rivals.

According to industry officials on Monday, SK Materials Co., the industrial gas manufacturing unit of SK Group, has begun building a silicon anode plant with an aim to start commercial production in 2022.

The company is known to be planning on an output of 2,000 tons of silicon anodes in the first year and gradually expand the capacity.

An anode is one of four core materials for secondary batteries along with cathode materials, separators and electrolytes.

Anodes preserve lithium ions when batteries are being charged, and affect the charging speed and lifespan of batteries.

Silicon anode materials are said to be the next-generation materials that ensure four times larger battery capacity and much faster charging time than existing graphite anode materials. silicon anodes contain only 5 to 10% of graphite.

PROMISING ANODE MATERIAL

Silicon is a promising anode material for lithium-ion and post-lithium-ion batteries but suffers from a large volume change upon lithiation and delithiation. The resulting instabilities of bulk and interfacial structures often hamper performance severely and obstruct practical use.

So, battery materials manufacturers are competing to develop safer silicon anodes, which are in growing demand from battery makers.

The industry currently has a clear barrier to entry as only a few companies in the globe such as Korea’s Daejoo Electronic Materials Co. have the technology for mass production of silicon anode.

According to market tracker SNE Research, silicon will account for more than 10% of anode materials by 2030 ad the silicon anode market is forecast to grow to 5.5 trillion won ($4.6 billion) by 2025 from 13.3 billion won this year.

SK Materials said in mid-September it is jointly investing 850 billion won with US startup Group14 Technologies Inc. to build a battery material plant in Korea.

Group14 is specialized in anode materials.

Its silicon-carbon composite material called SCC55 can increase energy density up to 50% and battery capacity by nearly five times compared to batteries using graphite anode materials, according to SK.

SK Inc., the investment holding company of SK Group, said in August it will absorb SK Materials in corporate restructuring to ramp up investment in the battery business as the group strives to gain a greater share of the EV battery market.

SK Group also has a battery-making unit, SK Innovation Co., under its wing.

Meanwhile, SKC Corp., another SK Group affiliate, has also been aggressively seeking to enter the silicon anode business.

The company said in late September it plans to set up a joint venture with British battery materials maker Nexeon Ltd. to make silicon anodes as part of its goal to expand its battery materials business and increase its corporate value fivefold to 30 trillion won by 2025.

But earlier this month, SKC’s board of directors rejected the company’s plan to set up the JV, citing concerns about overlap in the investment in the sector among group affiliates.

Even after the rejection, SKC said it’s just a matter of time for the company to enter the silicon anode market.

POSCO UPS THE ANTE

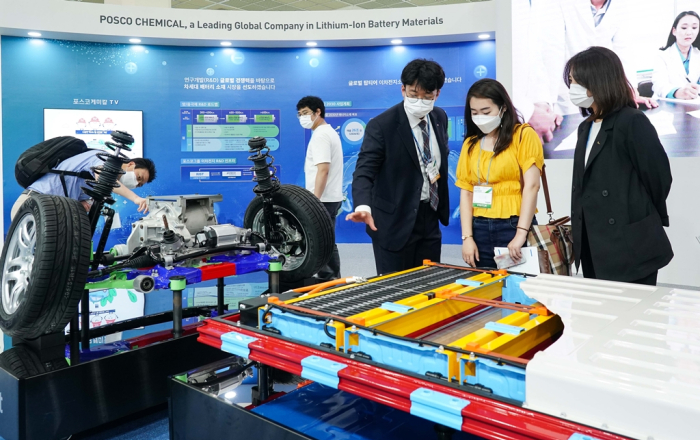

POSCO, Korea’s top steelmaker, is also actively pursuing a battery materials business, through its affiliates.

POSCO Chemical Co., which already declared it is entering the silicon anode market, is currently working on diversifying its anode business portfolio.

The steel group maintains an EV battery material value chain from the supply of raw materials such as lithium, nickel and cobalt to the production of anodes and cathodes.

In January, POSCO Chemical acquired a 15% stake for $7.5 million in Black Rock Mining, an Australia-based mining company that owns the Mahenge graphite mine in Tanzania, Africa.

Last month, the company said it is investing 4.9 billion won to acquire a 13% stake in Qingdao Zhongshuo New Energy Technology Co., a Chinese graphite processing firm.

Write to Jeong-Min Nam at peux@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Battery materialsPOSCO breaks ground on $101 million battery recycling plant

Battery materialsPOSCO breaks ground on $101 million battery recycling plantOct 01, 2021 (Gmt+09:00)

2 Min read -

Battery materialsSKC drops plan for silicon anode JV on investment overlap woes

Battery materialsSKC drops plan for silicon anode JV on investment overlap woesOct 01, 2021 (Gmt+09:00)

2 Min read -

EV materialsSK, Group14 Technologies to build $726 mn battery material plant

EV materialsSK, Group14 Technologies to build $726 mn battery material plantSep 14, 2021 (Gmt+09:00)

2 Min read -

Battery materialsKorea silicon anode materials makers to see quantum leap in demand

Battery materialsKorea silicon anode materials makers to see quantum leap in demandSep 09, 2021 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN