Battery materials

SKC drops plan for silicon anode JV on investment overlap woes

Shares tumble to 3-week low as the decision dampens hopes for battery materials business expansion

By Oct 01, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SKC’s shares on Oct. 1 tumbled to a three-week low as the decision dampened hopes for the company’s expansion in the battery business through the JV. The stocks lost up to 2.07% to 165,500 won ($139.4), the lowest since Sept. 10.

The shares already tumbled 15.08% in the previous day when SKC announced its board of directors rejected an investment in the JV with Nexeon and the company was not considering brining in the issue to the board again. The directors were known to have disagreed with the timing of the start of the business.

The decision, however, disappointed investors who thought the company should begin the business as soon as possible to meet growing demand. Many automakers announced plans to use silicon anode materials from 2023. Battery material makers need to start preparing since carmakers procure the materials though long term contracts, analysts said.

“It is hard to understand the board of directors’ decision. Considering the timing of the full-fledged silicon anode markets, it is a time to start preparing,” said a HI Investment & Securities analyst Jung Won-seok.

WORRIES ABOUT OVERLAPPING INVESTMENT

SKC, the chemical materials maker of SK Group, had planned the JV in a move to achieve SKC’s goal to expand its electric vehicle battery materials business and fivefold its corporate value to 30 trillion won by 2025. The JV plan raised worries about an overlap of investment within the group.

Last month, SK Materials Co., the group’s industrial gas manufacturer, announced a plan to jointly invest 850 billion won with US startup Group14 Technologies Inc. to build a battery material plant in South Korea.

SK Materials is set to start commercial production of silicon anode materials at the factory in 2022.

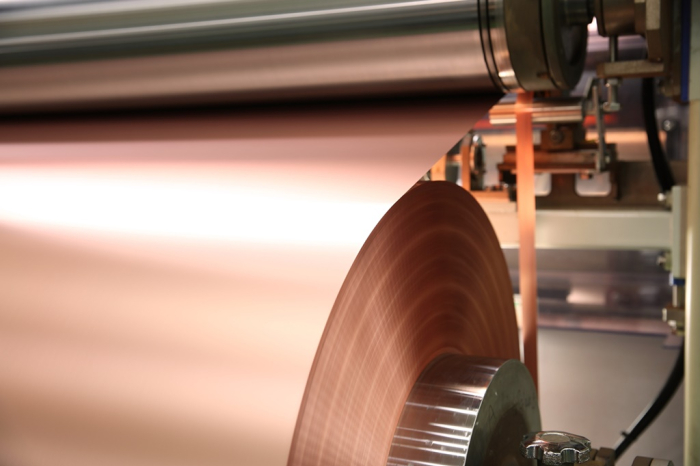

Some investors saw a decline in SKC’s stocks excessive, saying its valuation looked relatively lower than other battery materials shares. SKC’s determination remained strong, prompting market talk that the company may further expand copper foil production capacity or increase investment in cathode materials business.

Write to Yun-Sang Ko at kys@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Battery materialsSKC to form JV with British Nexeon for silicon anode business

Battery materialsSKC to form JV with British Nexeon for silicon anode businessSep 29, 2021 (Gmt+09:00)

1 Min read -

Battery materialsSKC to raise corporate value to $25 bn with battery materials

Battery materialsSKC to raise corporate value to $25 bn with battery materialsSep 24, 2021 (Gmt+09:00)

2 Min read -

EV materialsSK, Group14 Technologies to build $726 mn battery material plant

EV materialsSK, Group14 Technologies to build $726 mn battery material plantSep 14, 2021 (Gmt+09:00)

2 Min read

Comment 1

LOG IN