Battery materials

Korea silicon anode materials makers to see quantum leap in demand

Daejoo Electronic Materials, POSCO Chemical, Hansol Chemical to chase market leader BTR

By Sep 09, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

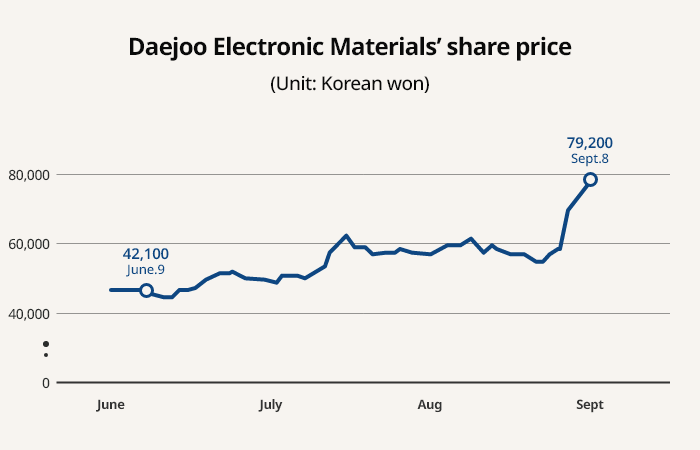

The global silicon-based anode materials market is gathering momentum as demand is expected to outpace supply on increasing production of electric vehicle batteries used the materials. Daejoo Electronic Materials Co. and other South Korean companies such as POSCO Chemical and Hansol Chemical that commercialized the anode materials are predicted to benefit from the surging demand.

QUANTUM JUMP

US battery materials startup Group14 Technologies on Sept. 7 said it plans to commercialize the silicon-based anode materials by supplying to a British EV maker. The materials industry saw it as a case indicating the global silicon-based anode materials market is about to see a quantum jump.

Lithium-ion batteries for EVs consist of four key materials – anode materials, cathode materials, separators and electrolytes. Anode materials play the most important role on the battery lifespan. The existing anode materials use graphite, but the silicon-based anode materials combine graphite and silicon that increases the quantity of lithium-ion by up to ten times, allowing quick charging. The anode materials also enable to expand battery capacity, so the industry regarded them as the next generation materials for batteries.

Global demand for the anode materials is forecast to grow 70% a year on average by 2025 to reach 3 trillion-4 trillion won ($2.6 billion-$3.4 billion), according to market research companies. The silicon anode materials have strong growth potential with its shares in the total anode materials market predicted to rise to 15% in four years from the current 3%.

“Currently, Porsche is using the silicon anode materials for the Tycan. But more companies including Volkswagen, GM, Tesla and Apple are expected to use them,” said KB Securities Co.’s analyst Kim Dong-won. “As more EV models with the silicon anode materials are launched, the materials are likely to lead the standardization of batteries in the future.”

Demand is expected to exceed supply for the time being, Kim predicted. The silicon-based anode materials are applied as a mixture of 5-10% of existing graphite anode materials currently, but the mixture ratio is forecast to rise to up to 20%, according to Kim. Battery makers are also likely to launch more batteries with the silicon anode from the next year, he added.

The smartphone industry is predicted to use the materials as increasing uses of the 5G mobile phones increased issues with batteries such as insufficient capacity.

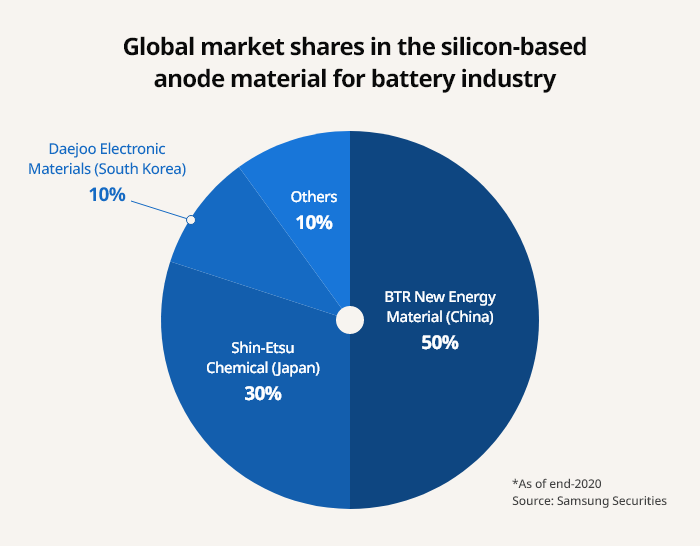

BTR, SHIN-ETSU, DAEJOO DOMINATE MARKET

The global silicon anode materials market is currently dominated by a few players. China’s BTR New Energy Material Ltd. accounted for 50% of the global market, followed by Japan’s Shin-Etsu Chemical Co. with a 30% market share. In South Korea, Daejoo occupied about 10%, becoming one of the world’s three companies that commercialized the silicon-based anode materials. The company succeeded mass production of high-efficiency silicon composite oxide for the first time in the industry and is selling it as an anode material for EV batteries.

“Many companies developed the silicon anode materials, but Daejoo is one of rare companies that mass-produce them,” said a SK Securities’ analyst Yoon Hyuk-jin.

“China’s BTR is expected to keep dominating the market in the short term. But in the mid to long term, Korea’s three battery makers will prefer to build vertical integration, helping Korean companies expand market shares, given easier quality control,” KB’s Kim said, referring to LG Energy Solution Ltd., SK Innovation Co. and Samsung SDI. Co.

South Korean makers are able to produce hundreds tons of the silicon-based anode materials a year currently, but their capacity is expected to expand to 1,500-3,000 tons from the next year to 2023.

Write to Ji-Yeon Sul at sjy@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Battery materialsPOSCO Chemical to expand EV battery materials capacity in China

Battery materialsPOSCO Chemical to expand EV battery materials capacity in ChinaAug 25, 2021 (Gmt+09:00)

1 Min read -

EV materialPOSCO Chem to build cathode factories in EU, US from 2022

EV materialPOSCO Chem to build cathode factories in EU, US from 2022Apr 18, 2021 (Gmt+09:00)

3 Min read -

Battery materialsPosco Chemical to supply EV battery materials to GM-LG Energy JV

Battery materialsPosco Chemical to supply EV battery materials to GM-LG Energy JVApr 05, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN