Batteries

Solus Advanced Materials poised to lead EV copper foil market: CEO

It expects to benefit from the IRA tax breaks once its C$750 million plant in Quebec is up and running by 2026

By Mar 26, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

It supplies copper foil, a core material used to make batteries, to big names such as Tesla Inc. and LG Energy Solution Ltd., the world’s No. 2 battery maker.

Formerly Doosan Solus Co., Solus Advanced Materials is the only Korean company building a huge copper foil manufacturing plant in Canada to benefit from tax breaks under the US Inflation Reduction Act (IRA).

Nevertheless, Chin Dae-je, the company's chief executive, says business conditions are getting tougher, although his company has a competitive edge.

“The battery-related industry is in a game of chicken. Just like the smartphone and semiconductor industries, only a handful of battery-related firms will survive,” the CEO said in a recent interview with The Korea Economic Daily.

By every measure, Chin is a top-notch semiconductor and information technology expert.

Having led the system chip and digital media business at Samsung Electronics Co. for over a decade, he served as Korea’s minister of information and telecom in the early 2000s before becoming the CEO and chairman of private equity firm SkyLake Investment Co. in 2013.

As the leader of SkyLake, Chin acquired Doosan Solus in 2020 for 700 billion won ($522 million) and renamed it Solus Advanced Materials.

“Just three to four years ago, copper foil prices were eight to 10 dollars per kilo. Now prices have been cut in half. There are over 40 copper foil makers in China alone and industry officials say they expect 20 to 30 companies to fall soon,” he said.

Back in 1985, he said, there were about 50 chipmakers around the world and in 2000, there were some 50 mobile phone makers in Korea alone.

“They are all gone. Only three to four leading companies remain. Battery makers and copper foil makers will face similar fates,” he said.

CEO EXPECTS A PROFITABLE YEAR IN 2025

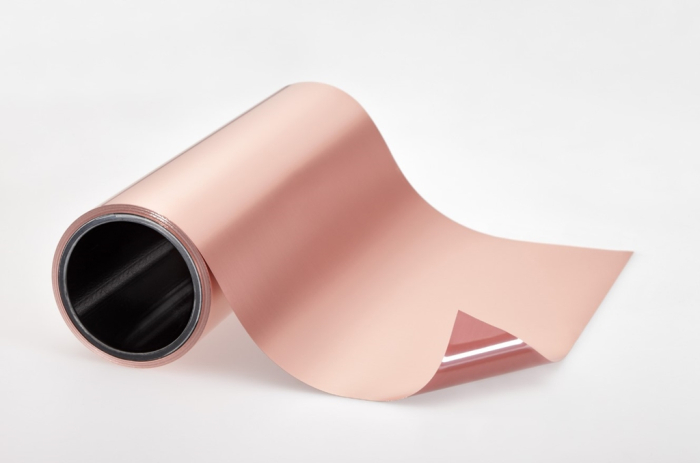

Copper foil is a foil-based form of copper and a core material that surrounds the anode, the negative end of a lithium-ion battery.

Solus Advanced Materials posted an operating loss of 73.4 billion won on sales of 429.4 billion won last year.

Chin said he expects the company to swing to profit in the fourth quarter of this year and then remain in the black throughout 2025 on an annual basis.

One of the company’s key technological strengths is to mass-produce copper foil with a thickness of 6 micrometers – one of the industry’s finest technologies. Solus has also produced 4-micrometer copper foil.

“When we acquired the company, its product yield stood at around 50%. Now, we boast a product yield of 80%. We can say it’s one of the industry’s highest levels,” said the chief executive.

PLANT IN CANADA

Solus is building a manufacturing plant in Quebec, Canada, slated to begin mass production in 2026.

The C$750 million factory is Solus Advanced Materials’ third overseas plant after those in Luxemburg and Hungary.

In the first year of its operation, the Quebec plant will produce 25,000 tons of copper foil, company officials said.

The plant is expected to produce up to 63,000 tons of battery copper foil by 2027 annually, enough for 2.5 million EV batteries.

“We’re getting orders while the plant construction is still underway. We have an inventory worth six months. Chinese companies, which have difficulty setting up facilities in North America, will have a large inventory buildup, meaning they’ll be forced to sell them at deep discounts,” he said.

Korean EVs and battery makers, including its bigger rival SK Nexilis Co., are ramping up production in North America so that buyers of their cars are eligible for US tax credits under the US IRA.

In 2022, Solus became the first Korean company to directly supply battery materials to Tesla, which churns out both EVs and batteries.

LEGAL DISPUTE WITH SK NEXILIS

Solus is currently in a legal dispute with SK Nexilis, a unit of chemical materials maker SKC Ltd., over copper foil patent rights.

“SK’s patent is part of a technology that has existed for a long time. So, there is a high possibility that it will be invalidated in the US,” he said. “Korean companies should not engage in a fight among themselves at a time when Chinese rivals are disrupting the market with extensive ramp-ups,” he said.

Solus recently spun off its electronics materials division to separately produce copper foils for electronics goods.

“With the rise of the OLED market, demand for related materials is also rising. Copper foil for that segment posted an operating profit margin of 13.8% last year,” he said.

Write to Hyung-Kyu Kim and Woo-Sub Kim at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesLotte Energy Materials to build copper foil plant in US for EV makers

BatteriesLotte Energy Materials to build copper foil plant in US for EV makersSep 17, 2023 (Gmt+09:00)

3 Min read -

BatteriesSolus aims to mass-produce copper foil in Canada from 2026

BatteriesSolus aims to mass-produce copper foil in Canada from 2026Sep 06, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK Nexilis to unveil ultra-high strength EV battery copper foil

BatteriesSK Nexilis to unveil ultra-high strength EV battery copper foilAug 03, 2022 (Gmt+09:00)

2 Min read -

Battery materialsKorea’s Solus supplies battery copper foil to Tesla

Battery materialsKorea’s Solus supplies battery copper foil to TeslaFeb 16, 2022 (Gmt+09:00)

2 Min read -

Lotte Group to invest $258 mn in Doosan Solus to boost footing in EV market

Lotte Group to invest $258 mn in Doosan Solus to boost footing in EV marketSep 23, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN