Batteries

LG Energy barely fends off CATL in global EV battery market

The gap between the S.Korean EV battery giant and runner-up CATL was less than 1 percentage point

By Oct 13, 2023 (Gmt+09:00)

3

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

UAE to invest up to $1 bn in S.Korean ventures

US multifamily market challenges create investment opportunities

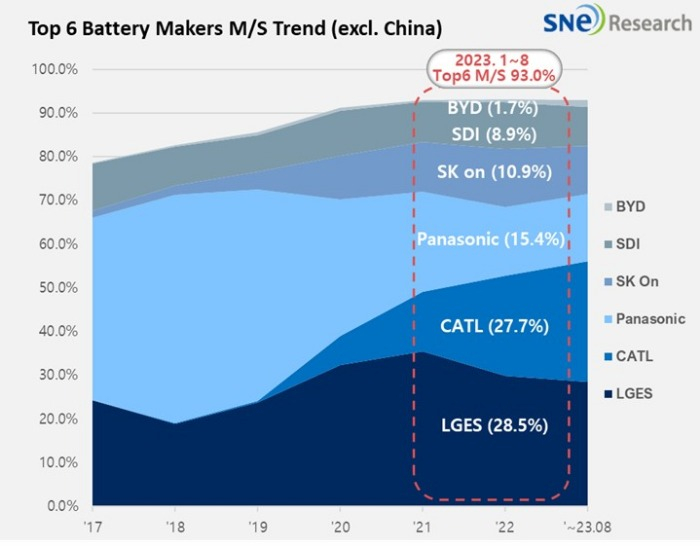

LG Energy Solution Ltd. retained the top position in the global electric vehicle battery market excluding China in the first eight months of this year, but its gap with runner-up Contemporary Amperex Technology Co. Ltd. (CATL) has narrowed to a mere 0.8 percentage point.

Global EV battery usage in the market excluding China from January to August this year reached 197.6 Gigawatt hours (GWh), up 58.9% from the same period last year, according to SNE ResearchŌĆÖs Global EV and Battery Monthly Tracker published on Friday.

South KoreaŌĆÖs No. 1 EV battery maker LG Energy Solution commanded the largest share of 28.5% in the market after recording 56.3 GWh in EV battery usage over the same period, the report said.

Its latest battery usage was 59.7% higher from a year ago.

The other two Korean battery majors SK On Co. and Samsung SDI Co., respectively, controlled the fourth and fifth-largest market share after beefing up battery usage 16.1% to 21.6 GWh and 33% to 17.5 GWh over the same period.

The second-largest share of 27.7% was taken by ChinaŌĆÖs battery giant CATL, which saw its battery usage in the global market outside its home turf more than double on-year to 54.7 GWh.

The market share gap between LG Energy Solution and CATL has sharply narrowed to 0.8 percentage point from 7.5 percentage points a year ago, underscoring the fast ascent of Chinese EV battery players on the global stage.

GROWING LFP BATTERY DEMAND SHORES UP CHINESE BATTERY MAKERS

Another major Chinese battery maker BYD Co. climbed up to sixth place in the ex-China global EV battery market with a battery usage of 3.3 GWh, up a whopping 472.7% on-year.

The advance of Chinese battery makers outside of their home ground is largely attributed to the growing global demand for lithium iron phosphate (LFP) batteries, the Korean energy market tracker said.

LFP batteries were shunned by non-Chinese EV brands before due to their poorer performance in driving range, power and size compared to other lithium-ion batteries powered by some variation of nickel-cobalt chemistry.

But the LFP battery is more economical because it is cheaper to produce, making them the No. 1 battery choice for EVs in China.

After the LFP battery technology has advanced a lot in recent years, and the raw material costs for non-LFP batteries have soared, the demand for LFP batteries from non-Chinese EV makers has also grown.

Chinese battery makers are leaders in LFP battery technology, with CATL leading the pack.

CATL has recently developed the LFP battery that guarantees a driving range of over 700 kilometers on a single charge.

A growing number of global carmakers, including even Korean auto giants Hyundai Motor Co. and Kia Corp., have decided to use LFP batteries by CATL or BYD in their EVs.

ŌĆ£It seems that xEV battery market has gradually tilted towards LFP battery of which price competitiveness is higher than that of others, especially, in the market of entry models where cost-effectiveness is a key,ŌĆØ said SNE Research in a press release on Friday.

ŌĆ£Particularly in Europe, where the usage of LFP battery is low, attention should be drawn to changes in the market shares of Chinese cell makers and usage of LFP battery.ŌĆØ

LG Energy, SK On and Samsung SDI together controlled 48.3% of the ex-China global battery market by usage in the first eight months of this year, but they could lose ground to Chinese rivals if the LFP battery boom continues.

Korean battery makers have been focusing on the development of ternary batteries, which are nickel, cobalt and manganese (NCM), as well as nickel, cobalt and aluminum (NCA) batteries, for better EV performance.

To meet the higher LFP battery demand, Korean battery makers have also joined a race to develop LFP batteries.

Write to Nan-Sae Bin at binthere@hankyung.com

Sookyung Seo edited this article.

More to Read

-

BatteriesKorean firms confident they can outpace China in LFP battery race

BatteriesKorean firms confident they can outpace China in LFP battery raceSep 11, 2023 (Gmt+09:00)

5 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read -

BatteriesLG Energy Solution tops global EV battery market excluding China in H1

BatteriesLG Energy Solution tops global EV battery market excluding China in H1Aug 07, 2023 (Gmt+09:00)

1 Min read -

BatteriesKorea EV cell makers unveil new products to expand market

BatteriesKorea EV cell makers unveil new products to expand marketMar 16, 2023 (Gmt+09:00)

2 Min read -

EV BatteriesTeslaŌĆÖs shift to LFP cells to shake global battery industry

EV BatteriesTeslaŌĆÖs shift to LFP cells to shake global battery industryOct 22, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN