Korean firms confident they can outpace China in LFP battery race

Solid-state batteries are likely to remain negligible in the EV battery market for years to come, POSCO Future M CEO says

By Sep 11, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s leading battery and materials makers on Monday shared their concerns about Chinese rivals’ ascent, but expressed confidence that they can stay ahead in both the high-nickel and lithium iron phosphate (LFP) battery markets.

China's clout in the rechargeable battery market is growing, mainly with LFP batteries, as electric vehicle makers are increasingly adopting the low-cost batteries to produce affordable vehicles.

“Excluding the Chinese market, LG Energy Solution ranks first in the global electric vehicle battery market, but the gap is narrowing very quickly,” LG Energy Solution Co. Chief Technology Officer Shin Youngjoon said on Monday.

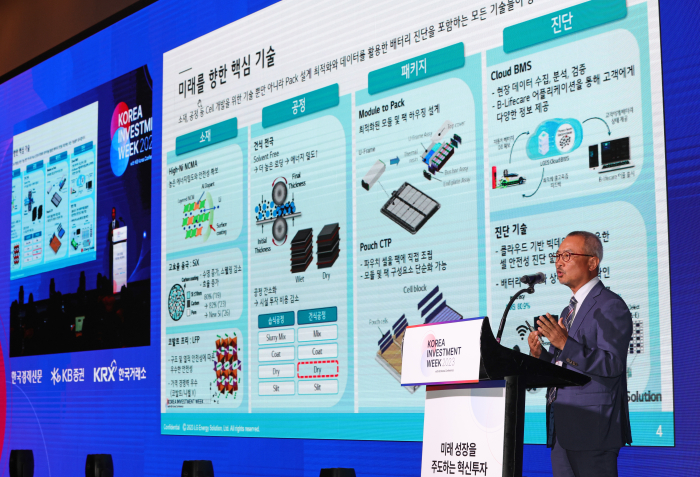

He gave the remarks during a panel discussion for The Korea Investment Week hosted by The Korea Economic Daily. The conference will run through Sept. 15.

“Nevertheless, there are enough cards to maintain our lead,” he said.

South Korean battery makers are jumping into the LFP battery market dominated by Chinese companies. China trails behind in the ternary battery market, which includes nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) batteries.

“We are only doing it now because there is demand,” Shin said. “If we decide to do it, there is absolutely no reason for Korea to fall behind.”

LG-made LFP batteries are being verified by an EV company to install them in its vehicles to be released in 2026, Shin added.

POSCO Future M Co. and EcoPro Co. will begin to churn out LFP cathodes as early as 2025, their executives said.

“If a Korean company produces LFP cathode materials and supplies them to the US, it can also benefit from a 27% tariff exemption under Korea-US Free Trade Agreement regulations, thereby maintaining price competitiveness over Chinese products,” POSCO Future M CEO Kim Jun-hyung told the panel session.

The company is developing mass production systems that exclude Chinese technology to meet the requirements of the US Inflation Reduction Act (IRA). It will complete their verification by the end of this year.

It is also building a cathode manufacturing plant in Pohang, South Korea, jointly with China’s Zhejiang Huayou Cobalt Co.

“We will be able to supply LFP cathodes in partnership with a Chinese company within two years.”

In the high-performance, high-price ternary battery segment, Korea maintains its leadership in both technology and price competitiveness.

“As Chinese battery companies prepare to enter Europe, their thirst for high nickel is growing,” said Ecopro CEO Song Ho-jun.

“We are receiving many requests (from Chinese companies) for cooperation in this regard," Song added, "We will diversify our portfolio into LFP, cobalt-free NMX and others.”

SOLID-STATE BATTERIES

Regarding solid-state batteries, known as dream batteries, the three companies gave no details on their development plans.

“Solid-state batteries are the direction to go, but there are still many challenges to achieve mass production and marketability,” LG Energy Solution’s Shin said.

LG aims to mass-produce semi-solid batteries from 2026 and solid-state batteries from 2030.

“Even if solid-state batteries are mass-produced, their market share is expected to be less than 5% by 2030,” POSCO Future’s Kim said.

A solid-state battery uses solid electrolytes, unlike a lithium-ion battery using liquid electrolytes. It boasts higher energy density than lithium-ion batteries.

MANUFACTURING CAPABILITIES

Strengthening manufacturing capabilities was also a common theme during the panel discussion as the firms are striving to improve production yields and cut production costs, while maintaining uniformly high product quality globally.

To this end, the three companies are strengthening the role of domestic factories as “mother factories” to ensure their production quality can be uniformly managed anywhere in the world.

Further, LG Energy Solution is close to adopting a dry process to become the first Korean battery manufacturer to do so.

“This can be applied to mass production of next-generation battery products,” its CTO Shin said.

The dry process, which does not use organic solvents when making battery electrodes, can reduce manufacturing costs while increasing energy density by up to two times compared to the wet process.

SILICON VERSUS GRAPHITE

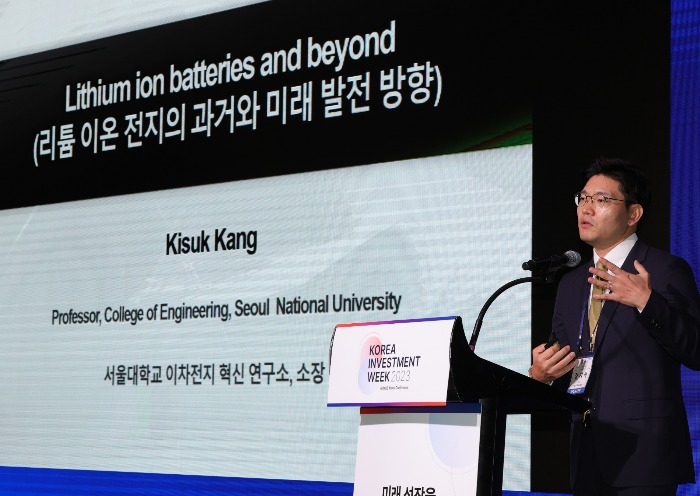

Meanwhile, Kang Kisuk, a professor at the Department of Materials Science and Engineering of Seoul National University, reminded conference attendants of the threat posed by China.

“In terms of the total number of valid patents for ‘next-generation lithium-ion batteries,' China ranks first in the world,” he said in a presentation at the conference on Monday.

He is a world-renowned scholar in the battery field.

Kang said three battery materials -- next-generation high nickel cathode with 90% nickel content, anode with a silicon content of 10% or more and solid electrolyte -- will become the core of secondary battery technology.

Energy density increases with higher nickel, but thermal stability decreases, Kang said.

Currently, batteries are made from cathode materials with 95% nickel content.

In the future, battery producers must focus on developing new types of high-nickel cathode materials, while replacing graphite with silicon as an anode material, he said.

“Graphite is currently dominated by the Chinese supply chain. Amid tensions between the US and China, we ultimately must focus on silicon, which is an alternative to graphite, and what comes after silicon is lithium metal anode material.” the professor noted.

Write to Nan-Sae Bin and Mi-Sun Kang at binthere@hankyung.com

Yeonhee Kim edited this article.

-

Electric vehiclesHyundai, LG to spend combined $7.6 bn to build EV, battery plants in US

Electric vehiclesHyundai, LG to spend combined $7.6 bn to build EV, battery plants in USSep 01, 2023 (Gmt+09:00)

1 Min read -

BatteriesSK On unveils new material to improve EV battery capacity

BatteriesSK On unveils new material to improve EV battery capacityAug 31, 2023 (Gmt+09:00)

2 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read -

BatteriesS.Korean battery trio face union risk in US after Ultium Cells’ wage deal

BatteriesS.Korean battery trio face union risk in US after Ultium Cells’ wage dealAug 25, 2023 (Gmt+09:00)

3 Min read -

BatteriesSK On to expand domestic battery cell plant for $1.1 bn

BatteriesSK On to expand domestic battery cell plant for $1.1 bnAug 16, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy Solution tops global EV battery market excluding China in H1

BatteriesLG Energy Solution tops global EV battery market excluding China in H1Aug 07, 2023 (Gmt+09:00)

1 Min read -

-

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023Mar 09, 2023 (Gmt+09:00)

2 Min read -

EV BatteriesTesla’s shift to LFP cells to shake global battery industry

EV BatteriesTesla’s shift to LFP cells to shake global battery industryOct 22, 2021 (Gmt+09:00)

3 Min read -