SK Nexilis inks $1.5 bn copper foil deal with Envision AESC

SK Nexilis, Envision AESC to mull further supply deals as the battery maker is expanding capacity to 240 GWh from 35 GWh

By Sep 05, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

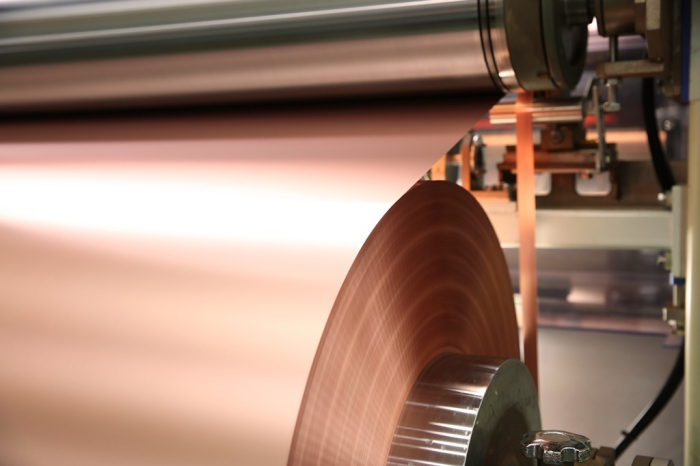

SK Nexilis Co. has signed a 2 trillion won ($1.5 billion) contract to supply copper foil, a core material in electric vehicle cells, to Chinese secondary battery maker Envision Automotive Energy Supply Corp. (AESC), indicating the expanding presence of South Korean cell ingredient manufacturers in the global market.

SK Nexilis, a subsidiary of Korean chemicals maker SKC Ltd., is set to supply copper foil to Japan-based Envision AESC for 10 years from 2025, according to industry sources in Seoul on Tuesday. The South Korean company is likely to provide more than half of Envision AESC’s global operation needs with a 35 gigawatt-hour (GWh) total annual capacity, the sources said.

“We have inked the deal,” said an SKC official, declining to provide details such as supply volumes.

SK Nexilis and Envision AESC, which supplies batteries to Nissan Motor Co. and BMW, were known to agree to considering further supply deals as the cell maker is working to expand its global capacity to 240 GWh by 2026 by adding facilities in North America and Europe.

China’s Envision Group in 2018 acquired AESC, a joint venture between Nissan, NEC Corp. and Tokin Corp. to launch Envision AESC.

The copper foil manufacturer has bagged major deals this year. The company signed a 1.4 trillion won deal with Northvolt AB, Europe’s largest EV battery maker in February. It also agreed with Japanese top automaker Toyota Group’s trading unit to set up a joint venture in North America to produce core materials for the anode, the negative end of a lithium-ion battery.

SURGING DEMAND

Global copper foil demand is forecast to more than double to 750,000 tons by 2025 from 270,000 tons in 2021 due to rapid growth in the global EV market, according to battery industry analysis firm SNE Research.

SK Nexilis is a major producer of high-quality copper foil wider than 1 meter, which improves battery production yield and cuts manufacturing costs, analysts said.

“Demand for the wider copper foil is expanding faster than overall copper foil market growth as battery makers can raise productivity with the wider models,” said an industry source in Seoul.

SK Nexilis is fully operating six production lines at its South Korean plant with an annual capacity of 52,000 tons while accelerating the construction of overseas facilities. It has nearly completed a factory in Malaysia and aims to conclude works for a facility in Poland next year. The factories' capacity is 57,000 tons a year each.

“I am aware that South Korean copper foil makers such as SK Nexilis are poised to win supply deals with global battery makers,” said an industry source in Seoul without elaboration.

Write to Jae-Fu Kim at hu@hankyung.com

Jongwoo Cheon edited this article.

-

BatteriesSK Nexilis to sell copper foil to German battery maker Varta

BatteriesSK Nexilis to sell copper foil to German battery maker VartaAug 07, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK Nexilis signs $1 billion deal to supply copper foil to Northvolt

BatteriesSK Nexilis signs $1 billion deal to supply copper foil to NorthvoltFeb 19, 2023 (Gmt+09:00)

1 Min read -

BatteriesSK Nexilis to unveil ultra-high strength EV battery copper foil

BatteriesSK Nexilis to unveil ultra-high strength EV battery copper foilAug 03, 2022 (Gmt+09:00)

2 Min read -

BatteriesSKC breaks ground on Europe’s largest copper foil plant in Poland

BatteriesSKC breaks ground on Europe’s largest copper foil plant in PolandJul 08, 2022 (Gmt+09:00)

2 Min read -

BatteriesKorea’s SKC to build $761 mn copper foil plant in Poland

BatteriesKorea’s SKC to build $761 mn copper foil plant in PolandNov 18, 2021 (Gmt+09:00)

1 Min read -

BatteriesSKC to spend $600 mn to build copper foil plant in Malaysia

BatteriesSKC to spend $600 mn to build copper foil plant in MalaysiaJan 26, 2021 (Gmt+09:00)

2 Min read