Batteries

Doosan secures $392 mn in cumulative PFC orders

S.Korean firm aims to double production of EV cell’s core raw material in Vietnamese plant

By Jul 31, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's Doosan Corp. announced on Monday that it has accumulated 500 billion won ($392 million) in orders for its patterned flat cable (PFC), a key component used in electric vehicles (EV), with the figures taking into account the demand from Japanese, European, and North American markets.

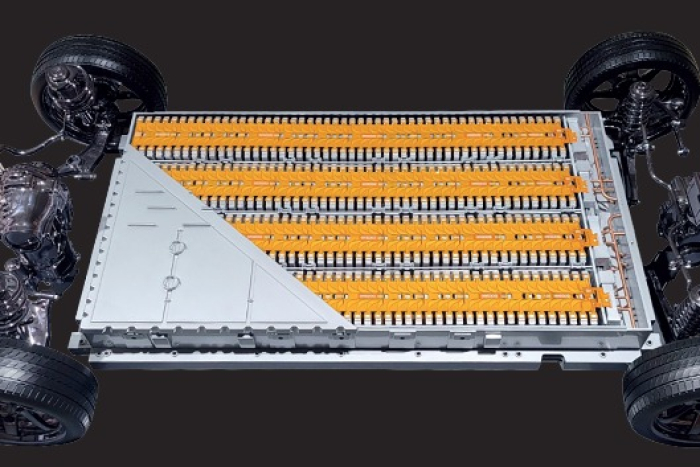

PFCs, which link the smallest unit of an EV battery known as the cell, are produced by applying an insulating film to a flexible copper clad laminate (FCCL), which already incorporates an electrical circuit.

Doosan's PFC not only incorporates critical components like a fuse for overcurrent management and a thermistor for detecting temperature changes but also includes an internal battery management system.

PFCs are proving critical in the drive towards lighter, more efficient EVs. According to Doosan, compared to traditional wiring harnesses made from copper, PFCs reduce weight and volume by more than 80%, offering significant cost savings and helping to increase the driving range of EVs.

"Our PFCs are the first to employ a roll-to-roll manufacturing process, allowing for the production of EV circuits up to three meters in length," a company source said.

The global research firm MarketandMarket forecasts that the global market size for PFC will balloon to approximately 8 trillion won ($6.6 billion) by 2026.

To capitalize on this potential, Doosan Corp. has constructed a PFC production line in Hai Duong, Vietnam, and commenced mass production last year.

The firm is also bolstering its efforts to more than double its production volume, improve yield rates, and slash costs to achieve ambitious sales targets of 50 billion won ($41 million) in 2024 and 100 billion won ($83 million) in 2025.

Write to Mi-Sun Kang at misunny@hankyung.com

More to Read

-

-

ElectronicsDoosan, Ionic Materials collaborate in liquid crystal polymer

ElectronicsDoosan, Ionic Materials collaborate in liquid crystal polymerApr 03, 2023 (Gmt+09:00)

1 Min read -

-

Hydrogen economyDoosan joins forces with S.Australian gov't to expand hydrogen business

Hydrogen economyDoosan joins forces with S.Australian gov't to expand hydrogen businessFeb 09, 2023 (Gmt+09:00)

1 Min read -

Chemical IndustryDoosan Corp. starts building flexible copper-clad layer plant

Chemical IndustryDoosan Corp. starts building flexible copper-clad layer plantDec 29, 2022 (Gmt+09:00)

1 Min read -

Socius-Well to Sea consortium to buy Doosan Corporation Mottrol for $381 mn

Socius-Well to Sea consortium to buy Doosan Corporation Mottrol for $381 mnSep 04, 2020 (Gmt+09:00)

1 Min read

Comment 0

LOG IN