Batteries

L&F to jump-start anode business with Mitsubishi Chemical

The Korean cathode major is seeking to expand its battery material business by advancing into other key battery component markets

By Jun 23, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

L&F Co., a major cathode supplier in South Korea, has embarked on a grand plan to take its battery materials business to new heights with the addition of other key battery components to its portfolio.

The Korean battery material company announced on Friday that it has signed a memorandum of understanding with Mitsubishi Chemical Group to jointly study the development of next-generation anodes to fortify the supply chain of the anode for electric vehicle batteries.

They also review a plan to build an anode manufacturing joint venture in Korea this year.

The Tokyo-based chemical giant is a global top player in the electrolyte and anode markets. Especially its proprietary anode technology is known to prevent particle swelling, one of the downsides of natural graphite that degrades the battery life cycle. Graphite is an anode material.

The two partners are expected to produce natural graphite-based anodes of similar quality to the more expensive synthetic graphite-based anodes.

With the Mitsubishi Chemical deal, the Korean cathode supplier to Tesla Inc. is hoping to make fast inroads into the anode sector as part of its long-term plan to expand its battery material business currently centered around cathodes.

L&F and Korean battery material suppliers stand out in the cathode sector but lag their global peers in anode development.

DIVERSIFICATION OF BATTERY MATERIAL BUSINESS

The latest move comes after its chief executive earlier this month unveiled the company’s plan to diversify the battery material business beyond cathodes.

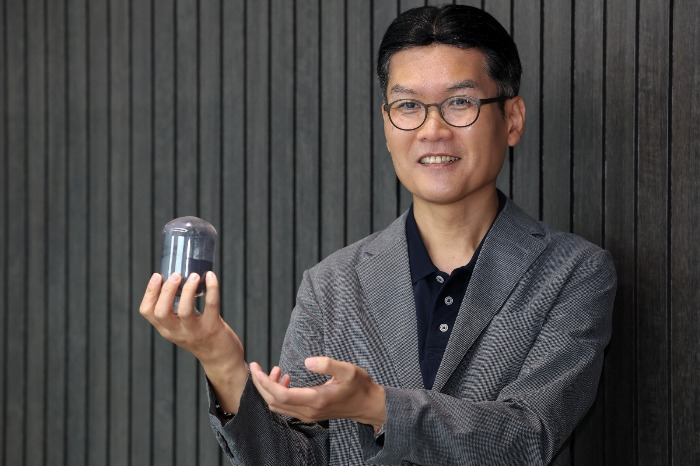

L&F CEO Choi Su-an particularly told The Korea Economic Daily in a recent interview that the company would start producing anodes that are produced in a similar process as cathodes.

Industry sources also said last month that L&F plans to spend as much as 800 billion won ($615 million) to build a precursor joint venture with an annual production capacity of 60,000-80,000 tons with LS MnM Inc., the world’s second-largest electrolytic copper maker.

Precursors make up about 70% of cathode production costs but L&F relies on Chinese companies for its precursors needs.

The company in March also set up a JV in Hong Kong to produce lithium hydroxide in Korea. They will announce a local factory construction plan later this year.

L&F’s aggressive move to advance into other key battery material sectors is expected to expand its presence in North America, the burgeoning EV market.

TO GET IRA INCENTIVES

To expand its footing in the US EV market, the Korean cathode player should reduce its reliance on Chinese battery material suppliers under the US Inflation Reduction Act (IRA), which requires that 50% of the value of battery components be produced or assembled in North America to qualify for an EV tax credit.

To get the incentive, battery material suppliers must make sure that 40% of the value of critical minerals is sourced from the US or its free trade partners.

“Finished car makers and battery cell companies are actively seeking to source battery components and materials that can enjoy IRA incentives,” Choi said on Friday. “We will take advantage of the current situation so we can take the lead in the market with our technologies.”

Lithium-ion battery cells are composed of four main components such as cathodes, anodes, separators and electrolytes.

Cathode-active materials comprise around 40% of the cost of EV batteries while anodes account for about 15%.

L&F is not considering entering the separator and electrolyte markets for now, the CEO said earlier this month.

L&F and Mitsubishi Chemical will unveil a detailed plan for their partnership, including the size of the investment, on the anode supply chain later after follow-up reviews.

Write to Mi-Sun Kang at misunny@hankyung.com

Sookyung Seo edited this article.

More to Read

-

BatteriesKorea’s cathode supplier L&F aims to make it big with anodes: CEO

BatteriesKorea’s cathode supplier L&F aims to make it big with anodes: CEOJun 11, 2023 (Gmt+09:00)

4 Min read -

BatteriesKorea’s L&F to build $609 mn EV battery precursor plant

BatteriesKorea’s L&F to build $609 mn EV battery precursor plantMay 23, 2023 (Gmt+09:00)

2 Min read -

BatteriesKorea’s L&F in $2.9 billion deal to supply battery material to Tesla

BatteriesKorea’s L&F in $2.9 billion deal to supply battery material to TeslaFeb 28, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN