Batteries

Koreans’ love for EcoPro stock may jeopardize short-sellers

Retail investors have bought $1.6 bn in EcoPro, EcoPro BM shares so far this year despite growing valuation woes

By Apr 12, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean individual investors have been chasing shares in EcoPro group, the country’s major electric vehicle battery materials manufacturer, sending them to record highs and sending financial institutions betting on their drops scrambling to unwind such bearish positions.

Foreign investment banks such as Goldman Sachs and Morgan Stanley, as well as local hedge funds built up pessimistic bets on EcoPro BM Co. and EcoPro Co. on valuation worries through short-selling, an investment or trading strategy that speculates on a share's decline, according to equity market sources in Seoul. In short-selling, a position is opened by borrowing shares of a stock or other asset that the investor believes will decrease in value.

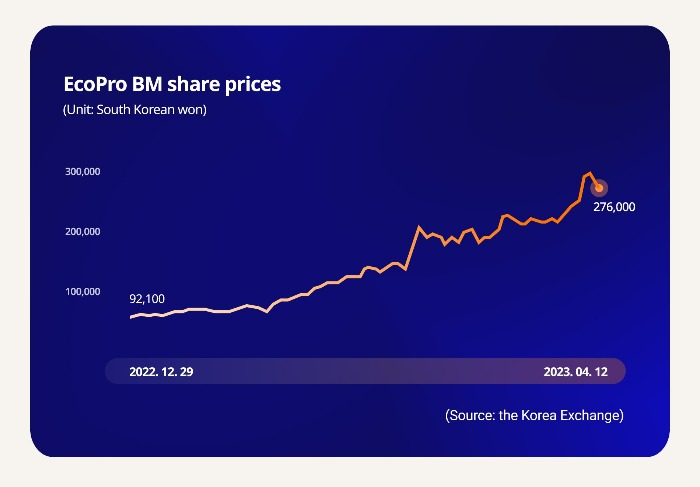

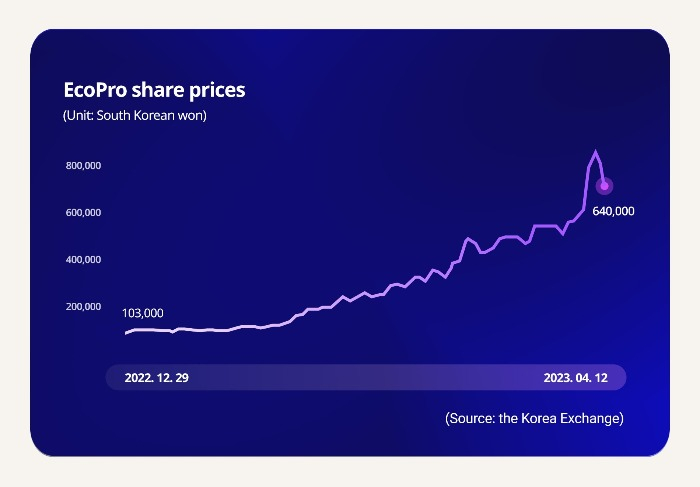

Share prices of EcoPro BM, South Korea’s top cathode maker, have nearly tripled so far this year, while those of EcoPro, its holding company, have soared by over six times. Their market capitalizations totaled 43.6 trillion won ($32.9 billion) as of Wednesday, topping the market cap of Hyundai Motor Co., the country’s largest automaker.

EcoPro and EcoPro BM have been the second and third most favored stocks -- after POSCO Holdings Inc. -- among retail investors so far this year. Individual investors have bought a net 1.3 trillion won in the holding company and 779.1 billion won in the cell materials maker, respectively, according to the Korea Exchange.

The strong appetite pushed up EcoPro and EcoPro BM’s share prices to all-time highs of 820,000 won and 315,500 won, respectively.

EcoPro BM is expected to benefit from US tax credits after Washington decided to classify cathodes as minerals for its incentives. In addition, EcoPro Materials Co., another battery materials maker, is looking for an initial public offering with an estimated enterprise value of 3 trillion won by the end of the third quarter.

Such bullish factors forced some of those short-sellers to cover their bearish positions.

“The market has sent only a few names, which have been trading at high prices, not low levels, in the secondary battery sector to another world in the last two months,” said Lee Jae-wan, CEO of South Korean asset management company Tiger, in a recent letter to clients.

“We had not considered the possibilities of such herd behavior while focusing on higher interest rates and their side effects on the economy … We are perplexed with the situation.”

VALUATION WORRIES

Institutional investors, however, had different views, saying their share prices have risen too much. Hedge funds raised bets against EcoPro and EcoPro BM while increasing holdings of L&F Co., another South Korean battery materials maker, as its share prices have risen less than the EcoPro group stocks. L&F has gained 70% so far this year.

Trading for short-selling of EcoPro and EcoPro BM more than tripled to 116.6 billion won on April 10 from 31.2 billion won on April 7.

“Some asset management companies managing overseas funds set up special forces consisting of aces to attack EcoPro after suffering massive losses due to the surges in their stock prices,” said a hedge fund manager in Seoul.

Hana Securities Co. on Wednesday recommended selling EcoPro stocks, the first local brokerage house offering such advice, with a target price of 454,000 won.

“The current market cap of EcoPro has already exceeded forecast corporate value in the next five years,” said Kim Hyun-soo, a Hana analyst.

Reflecting such concerns, EcoPro shares tumbled 16.8% to end at 640,000 won for the day, far underperforming a 0.9% decline in the wider Kosdaq. EcoPro BM also dropped 6.3% to 276,000 won.

SHORT SQUEEZE?

Individual investors remain optimistic about EcoPro and EcoPro BM.

“Let’s continue to believe in the mid-to-long-term growth of the EV ecosystem,” said a retail investor in a chatroom for stock investments.

If they extend the buying spree of those stocks, that could cause a short squeeze – a market phenomenon in which an unexpected rise in the price of heavily shorted stock prompts large numbers of short-sellers to exit their positions by buying the stock.

Stocks of South Korean biosimilar giant Celltrion Group had been under pressure from short-selling, but its founder Seo Jung-jin and other investors fought against the bearish bets, making Celltrion Inc., Celltrion Healthcare Co. and Celltrion Pharm Inc. leading shares of the sector.

Write to Man-Su Choe at bebop@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Korean stock marketS.Korean stocks at 8-month high as foreigners chase Samsung

Korean stock marketS.Korean stocks at 8-month high as foreigners chase SamsungApr 10, 2023 (Gmt+09:00)

2 Min read -

IPOsBattery material maker EcoPro Materials eyes $2.3 billion IPO

IPOsBattery material maker EcoPro Materials eyes $2.3 billion IPOFeb 28, 2023 (Gmt+09:00)

1 Min read -

BatteriesKorea’s L&F in $2.9 billion deal to supply battery material to Tesla

BatteriesKorea’s L&F in $2.9 billion deal to supply battery material to TeslaFeb 28, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN