Batteries

Korea EV cell materials firms race for silicon anode market

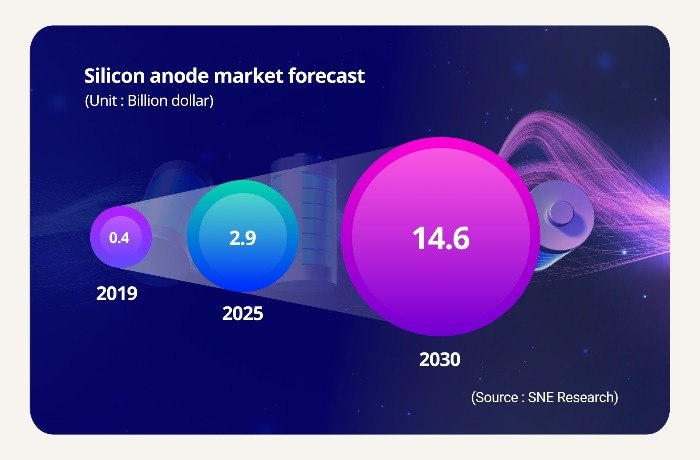

The global market of the EV battery materials that significantly increase mileage to surge to $14.6 bn by 2030 from $400 mn in 2019

By Feb 07, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s secondary battery ingredient makers are rushing to develop silicon anode materials, next-generation core substances that significantly boost the efficiency of cells for electric vehicles.

Silicon anode materials halve charging time but quadruple the energy storage capacity of lithium-ion batteries, compared to anode materials made of 100% graphite.

Large makers such as LG Chem Ltd., POSCO Chemical Co. and SKC Co., as well as smaller producers including Daejoo Electronic Materials Co., Hansol Chemical Co., Dongjin Semichem Co., LPN Co. and MKElectron speeded up research and development on the materials, according to industry sources on Monday.

Daejoo is the only company in the country, which succeeded in the commercialization of the ingredients. The company is supplying anode materials with silicon of about 5% to LG Energy Solution Ltd., the world’s third-largest EV battery maker.

The battery ingredients maker is expected to invest more than 300 billion won ($239 million) to manufacture anode materials with silicon of 7%, which will help the company bite into global competitors.

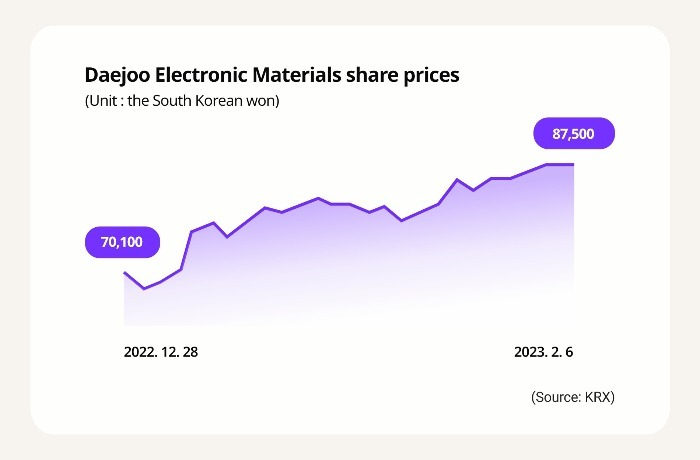

Daejoo’s share prices have risen 23.2% so far this year, far outperforming a 12.1% gain in South Korea’s tech-heavy Kosdaq.

TO COMPETE WITH GLOBAL RIVALS IN STRONG GROWTH MARKET

China’s BTR New Material Group Co. dominates the world’s silicon anode materials market with a market share of 50%, followed by Japan’s Shin-Etsu Chemical Co. with a 30% share. Daejoo was estimated to make up some 10%.

The company also plans to ramp up its annual silicon anode production capacity to 10,000 tons by the end-2024 from the current 2,000 tons by building a new plant and adding production lines in South Korea.

Its rivals among smaller companies such as Hansol, Dongjin and MKElectron are also expanding their presence in the sector. Korea Metal Silicon Co. recently completed a factory for anode active materials consisting only of silicon, not using any graphite, to target the global EV battery market.

Among major companies, LG Chem has unveiled a plan to spend 6 trillion won on battery materials sectors by 2025. SKC last year invested $80 million with private equity firms in Nexeon Ltd., a British silicon anode materials maker. POSCO Chemical is set to speed up the construction of the materials production lines.

The global silicon anode materials market is expected to surge to $2.9 billion by 2025 and $14.6 billion by 2030 from some $400 million in 2019, according to market analysis firm SNE Research.

Write to Kyoung-Ju Kang at qurasoha@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

BatteriesSKC co-invests $80 mn in battery materials maker Nexeon

BatteriesSKC co-invests $80 mn in battery materials maker NexeonJan 26, 2022 (Gmt+09:00)

1 Min read -

BatteriesSK, POSCO in heated race for next-generation silicon battery materials

BatteriesSK, POSCO in heated race for next-generation silicon battery materialsOct 04, 2021 (Gmt+09:00)

3 Min read -

BatteriesKorea silicon anode materials makers to see quantum leap in demand

BatteriesKorea silicon anode materials makers to see quantum leap in demandSep 09, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN