Batteries

Diverging lithium, nickel prices unnerve Korean battery makers

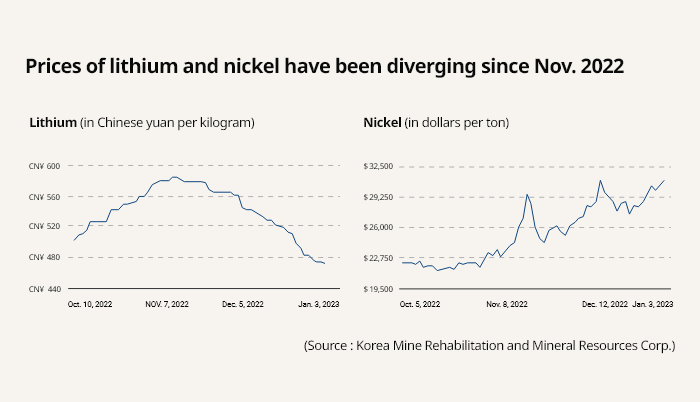

The price of nickel has soared 40% since November 2022, while the lithium price dropped 20%

By Jan 05, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The prices of lithium and nickel, key minerals for electric vehicle batteries, have been diverging since late last year, which is set to further widen the price gap between South Korean and Chinese battery makers.

The lithium price has come off the peak touched last year on growing supply, shedding 20% in the past two months.

On Jan. 3, the price of lithium tumbled to 474.5 yuan ($70) per kilogram. The so-called “white oil” makes up 40% of the manufacturing costs of EV batteries.

By contrast, nickel has reversed its downward price trend. It has surged more than 40% since November of last year.

Korean companies focus on high-nickel batteries, whereas Chinese rivals' main products are lithium-ion phosphate (LFP) batteries that do not contain nickel.

According to the Korea Mine Rehabilitation and Mineral Resources Corp., nickel traded at $31,200 per ton on Jan. 3, returning to the price level seen in May of last year.

Nickel plays a vital role in enhancing the performance of EV batteries. A higher nickel content increases their mileage and energy density.

Until the first half of last year, its price had remained soft, as it had been for other battery materials such as cobalt and manganese. They had suffered weak demand amid fears of an economic downturn.

NCM BATTERIES

The soaring nickel price is posing a threat to South Korean battery makers, further weakening their price competitiveness over Chinese rivals.

Unlike nickel-free LFP batteries produced by Chinese companies, nickel-cobalt-manganese (NCM) batteries have a nickel content of more than 90%.

LFP batteries boast greater stability than NCM. But they have lower energy density and shorter mileage than NCM batteries, as well as longer charging time.

The declining lithium price will likely slash the manufacturing costs of LFP models and prompt EV makers to shift from high-nickel batteries.

Write to Kyung-Min Kang at Kkm1026@hankyung.com

Yeonhee Kim edited this article

More to Read

-

BatteriesKorea battery makers suffer under growing China dominance

BatteriesKorea battery makers suffer under growing China dominanceDec 24, 2021 (Gmt+09:00)

3 Min read -

-

Comment 0

LOG IN