Batteries

SK on eve of jackpot from NYSE debut of US battery maker SES

The conglomerate is expected to pocket a sixfold return from its investment in the US battery startup

By Feb 03, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Inc., the investment-focused holding company of South Korea’s SK Group, is set to pocket a sixfold return from its investment in SES Holdings Pte. as the US electric vehicle battery startup goes public on the New York Stock Exchange.

SES Holdings, one of the world’s top solid-state battery makers, is scheduled for an NYSE listing on Feb. 4 via a merger with Ivanhoe Capital Acquisition Corp., a special purpose acquisition company (SPAC).

The US company's market debut is expected to value the combined entity at $3.38 billion, or about 4 trillion won.

SK Group invested a total of $61 million, or some 73 billion won, in the US battery startup, formerly known as SolidEnergy Systems, in 2018 and 2021, to become its second-largest shareholder with a 12.7% stake after its largest shareholder Qichao Hu, the founder and chief executive of SES.

Following the initial public offering through the SPAC deal, SK’s stake in SES will be lowered to 10.6%, valuing its shareholding at 430 billion won – a sixfold increase from its investment amount.

Other investors in SES include Vertex Holdings, a subsidiary of Singapore’s sovereign wealth fund Temasek Holdings Ltd., General Motors Co., Chinese mining firm Tianqi Lithium Corp. and Anderson Investment Ptd. Korea’s Hyundai Motor Group, which has Hyundai Motor Co. and Kia Corp. under its wing, has also invested $100 million in SES. Hyundai’s stake will hover around 4% after the US startup’s NYSE listing.

“We’ll continue to seek investment opportunities in EV battery and materials companies to benefit from the global take-off of electric cars,” said an SK executive.

LEADER IN SOLID-STATE BATTERIES

Founded in 2012 as a company spun out of Massachusetts Institute of Technology, SES develops high-performance lithium-metal batteries, called all-solid-state batteries (ASSBs), which feature longer mileage and a shorter charging time than current EV batteries due to their higher energy density.

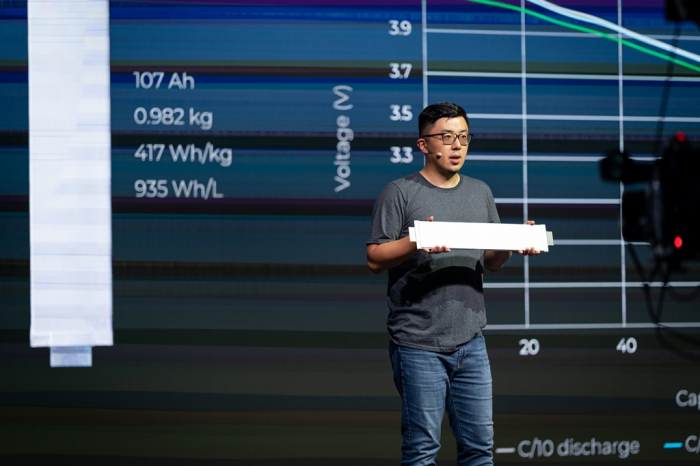

In November, SES unveiled Apollo, a hybrid 107 Ah Li-Metal battery with an energy density of 417 Wh per kilogram, much higher than the 250-300 Wh of existing lithium-ion batteries’ density.

SES is currently building the world’s largest Li-Metal battery plant in Jiading, Shanghai with an aim to commercialize the battery in 2025. The US startup is also co-working with automakers such as GM and Hyundai Motor for the development of next-generation batteries for electric vehicles.

In an exclusive interview with The Korea Economic Daily in April last year, SES Chief Executive Hu said any company that first commercializes workable solid-state batteries will dominate the battery market, leading a paradigm shift toward electrification.

Headquartered in Singapore, SES operates two battery-prototyping facilities, one in the US and the other in China.

SK GOING ALL OUT

Global automakers and battery producers are accelerating the development of next-generation EV batteries, which are safer and more durable.

Solid-state technology has been in the spotlight since lithium-ion batteries, which most EVs are currently using, have some issues such as the risk of catching fire.

The technology has the potential to deliver faster charging times and make the packs safer by eliminating the flammable electrolyte solution used in lithium-ion batteries, analysts said.

SK Group has been active with its investments in battery materials makers.

SK invested a total of 370 billion won in Lingbao Wason Copper-Foil Co., a Chinese EV battery material company, on two occasions – one in 2008 and the other in 2020.

SK Materials Co., the industrial gas manufacturing affiliate of SK Group, said in September it is jointly investing 850 billion won with US startup Group14 Technologies Inc. to build a battery material plant in Korea.

SK Inc. said in November it joined forces with Beijing Easpring Material Technology Co., a Chinese cathode materials producer, to expand their battery materials businesses.

SK’s unrealized return on investments in those battery-related companies is estimated at 1.8 trillion won, according to company officials.

SK Group has said it will additionally invest up to 1.4 trillion won to establish an EV battery materials supply chain by 2025.

Write to Jae-Yeon Ko and Jeong-Min Nam at yeon@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesUS startup SES unveils game-changing lithium-metal battery

BatteriesUS startup SES unveils game-changing lithium-metal batteryNov 04, 2021 (Gmt+09:00)

2 Min read -

BatteriesHyundai, Kia invest in US solid-state battery startup Factorial

BatteriesHyundai, Kia invest in US solid-state battery startup FactorialOct 29, 2021 (Gmt+09:00)

1 Min read -

-

LG Group joins investment in EV battery startup SES

LG Group joins investment in EV battery startup SESJul 14, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN