EV battery plants

LG Energy, GM in talks to build 2nd EV battery plant in Tennessee

By Mar 05, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

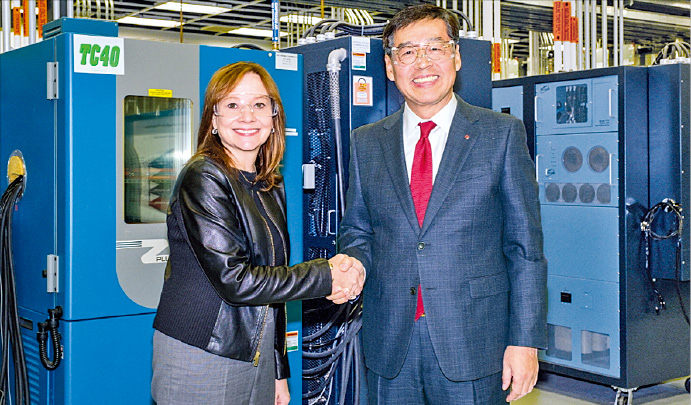

South Korea’s LG Energy Solution Ltd. is exploring building a second electric car battery plant in the US with joint venture partner General Motors Co. – a move that will solidify the Korean firm’s position in the American market.

The step to expand its battery output capacity is the latest in a series of investments by global automakers and EV battery makers in the US to ride on President Joe Biden’s green transportation policy.

The companies hope to reach a decision on the factory by the first half of 2021 and Tennessee is high on the list of possible locations for the site, according to a report by the Wall Street Journal on Thursday.

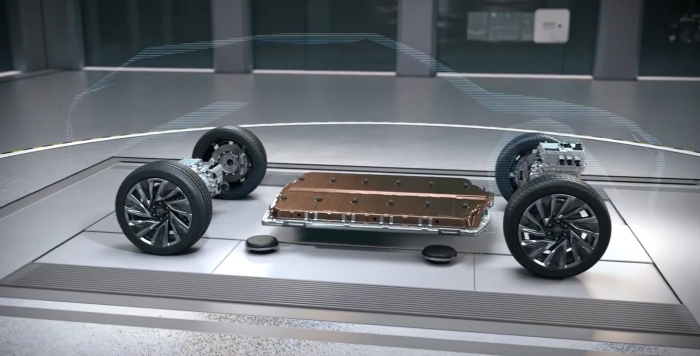

Ultium Cells LLC, GM’s JV with LG Chem Ltd., the parent of LG Energy Solution, is already at work building a $2.3 billion EV battery cell manufacturing facility in Lordstown, Ohio. The plant with a 30 GWh capacity is expected to start operations in 2022.

The second factory under consideration will likely be similar in scope to the Ohio plant.

Separately, LG Energy Solution has been running its own facility with a 5 GWh capacity in Michigan since 2012, supplying to GM, Ford Motor and Chrysler.

AIMS TO EMERGE AS DOMINANT BATTERY PLAYER IN US

If the second plant moves forward, it will add wind to LG’s goal of becoming a leading player in the US with a combined 65 GWh output capacity.

The move also comes as LG’s rivals are struggling to expand their capacity amid the ongoing shortage of battery cells with the take-off of eco-friendly cars across the globe.

China’s CATL, the world’s top EV battery maker, has just set up a representative office in the US without any specific expansion plans largely due to the trade dispute between the US and China.

Japan’s Panasonic Corp., another global player, supplies only to Tesla Inc. in the US, while Automotive Energy Supply Corp. (AESC), a Japanese JV sold to a Chinese firm, is supplying batteries in small quantity to Nissan Motor Co.

Another Korean battery maker SK Innovation Co. is currently engulfed in a legal dispute with LG Energy over a trade secret infringement case.

Last month, the ITC ruled in favor of LG Energy in the legal battle. Under the final verdict, the SK Group unit will be banned from importing some lithium-ion batteries and their components to the US over the next 10 years, making it almost impossible to run its battery plants in Georgia.

The decision is subject to Biden's approval by April 11. The US president has the power to veto the ruling after a 60-day review period.

SK Innovation is currently constructing two battery plants in Georgia. The first plant is scheduled to begin operations in the first quarter of next year, with the second plant set to begin mass production in 2023.

LG’s RIVALS STRUGGLING IN US MARKET

Analysts say the ITC ruling is expected to reinforce LG's footing in the US market, as electric car makers could exclude SK from their suppliers’ list on concerns about a possible disruption to supplies.

According to market researcher IHS Markit, the US electric car market is forecast to grow to 2.2 million units in 2025 from 1.15 million in 2021.

The second joint battery plant being discussed by LG and GM would also strengthen their business partnership.

GM unveiled a bold resolution in January to halt sales of all light-duty gasoline- and diesel-powered vehicles by 2035.

LG, which was named the sole battery supplier for the Chevrolet Volt, GM’s first mass-produced EV in 2009, is also providing the Detroit automaker with batteries for its flagship models, the Chevrolet Spark and the Chevrolet Bolt EV.

LG’s other clients include Tesla and Volkswagen, as well as Korean automakers Hyundai Motor Co. and Kia Corp.

Write to Man-Su Choe at bebop@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EV recallsHyundai, LG Energy agree to split EV recall costs, reflect in Q4 results

EV recallsHyundai, LG Energy agree to split EV recall costs, reflect in Q4 resultsMar 05, 2021 (Gmt+09:00)

2 Min read -

EV ecosystemHyundai Motor, LG Energy team up on EV battery leasing, recycling

EV ecosystemHyundai Motor, LG Energy team up on EV battery leasing, recyclingFeb 18, 2021 (Gmt+09:00)

2 Min read -

Battery spin-offLG Chem launches battery unit LG Energy Solution, eyes 2024 sales of $27 bn

Battery spin-offLG Chem launches battery unit LG Energy Solution, eyes 2024 sales of $27 bnDec 01, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN