Banking & Finance

Korean savings banks swing to loss after 9 years

Mutual savings associations post a drop in profits on rising delinquency rates and loan loss reserves

By Mar 22, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

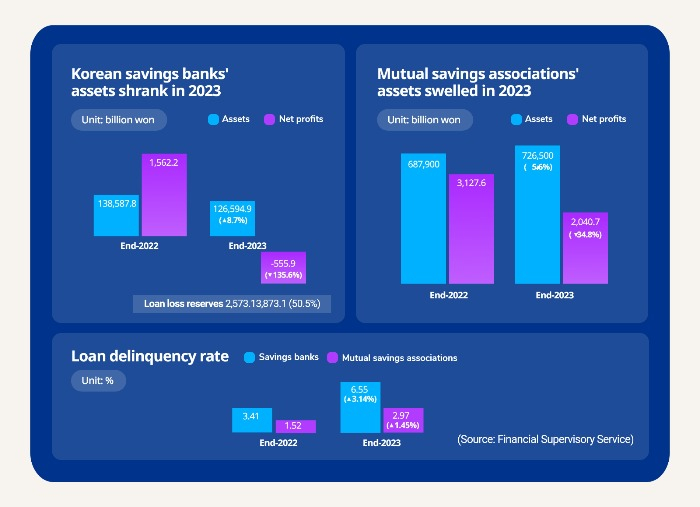

South Korea’s savings banks turned to the red after nine years in 2023 as they put aside heavy reserves on future loan losses, with their loan delinquency rate climbing at its steepest pace in over a decade.

Losses at the country’s 79 savings banks stood at a combined 555.9 billion won ($416 million) in aggregate in 2023, reversing the prior year’s profits of 1.56 trillion won, the Financial Supervisory Service said on Friday.

That marked their first shortfall since a 508.9 billion won loss in fiscal year 2013, which ended in June 2014.

But the regulator said the losses were due in large part to heavy provisioning costs against losses from project financing loans. Their loan loss reserves surged by 50.5% to 3.87 trillion won at the end of 2023, versus 2.57 trillion won at the end of 2022.

Their loan delinquency rate spiked 3.14 percentage points to 6.55% on average at the end of last year, the sharpest pace of increase since the 5.8 percentage point rise in 2011, when savings banks were at the epicenter of financial market turmoil triggered by soured construction-related loans.

That compared with their delinquency rate of 20.3% at the end of 2011.

Savings banks, main liquidity providers to builders, have suffered a direct hit from the real estate market slump caused by inflation, elevated borrowing costs and the prolonged economic slowdown.

The balance of their loans decreased 9.6% on-year to 104 trillion won at the end of last year. Their non-performing loans, or loans more than three months overdue, increased 3.64 percentage points to 7.72%.

MUTUAL SAVINGS BANKS

In comparison, mutual savings banks performed better. They include the National Agricultural Cooperative Federation (Nonghyup), the National Federation of Fisheries Cooperatives (Suhyup), the Forestry Cooperative Federation and the Credit Union.

Their net profits shrank 34.8% on-year to a combined 2.04 trillion won at the end of 2023, weighed by a rise in delinquencies from both corporate and household loans.

However, their assets grew 5.6% on-year to 726.5 trillion won at the end of last year, with the balance of loans up 2.4% to 510.4 trillion won.

The balance of their deposits swelled 5.2% to 619.2 trillion won, in contrast to a 10.9% drop to 107.1 trillion won at savings banks.

Write to Hyeong-Gyo Seo at seogyo@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google21 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN