Banking & Finance

Korea's loan delinquency rates soar; outlook to worsen in H2

Past-due rates by households in April hit three- to five-year highs; the ratio for the non-bank sector is the worst since Q1 2016

By May 22, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

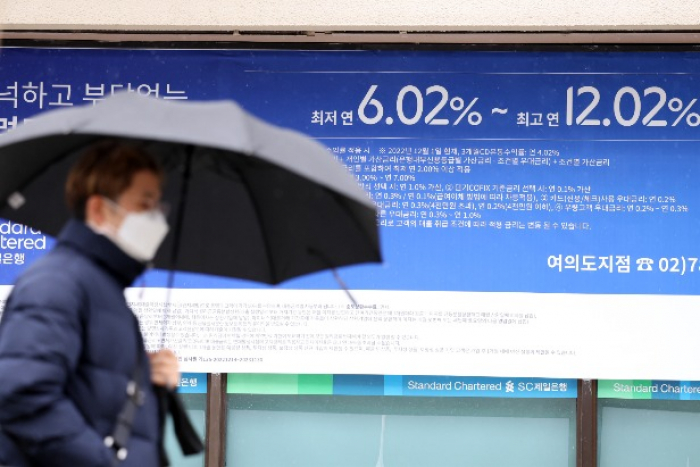

South Korean banks are seeing loan delinquency rates surge due to the increase in lending during the pandemic and a series of rate hikes. The rates for households hit three- to five-year highs last month as those who borrowed heavily to finance their real estate, business or stock investments cannot afford their payments.

Based on data from the five largest Korean banks — Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank and Nonghyup Bank — the won-denominated loan delinquency rate as of end-April averaged 0.304%. That's 11.8% higher than a month earlier and 63.4% higher than a year ago.

The rate for households reached 0.27% as of end-April, up 13.4% from a month earlier and 75.3% from a year ago. The figure for businesses was 0.328% as of end-April, up 11.6% from a month earlier and 56.2% higher than a year ago.

Delinquency rates in April reached their highest level in the past three to five years, according to internally aggregated bank data.

Delinquency rates on credit card loans have also soared. The major card companies, including Shinhan Card, Samsung Card, KB Kookmin Card, Lotte Card, Woori Card and Hana Card, reported that loans to members overdue for at least a month exceeded 1% in the first quarter.

The rate at Shinhan Card hit 1.37%, its highest since the third quarter of 2019. KB Card’s 1.19% was also the highest figure since the first quarter of 2020.

MORE DEBTORS TO FALL INTO DELINQUENCY IN H2

Past-due rates of households and small- and medium-sized businesses have risen since early this year amid a slash in property values, rate hikes and an economic downturn, a banking industry source said.

Although many banks sold distressed debts in March 2022, delinquency rates are increasing at a steep pace and worsening their financial condition, the source added.

There are growing concerns that delinquency rates will rise further in the second half of this year.

“More individuals and smaller businesses will struggle with loan repayments later this year as Korea’s higher benchmark rate is forecast to stay at its current level. Also, a large proportion of loans in Korea apply floating rates, which have also risen,” said another banking industry source.

A growing number of businesses and individuals will become delinquent as they become unable to afford the high interest rates on loans, the source added.

SIX-YEAR HIGH OVERDUE RATE FOR NON-BANK FINANCIAL FIRMS

The delinquency rate for Korea’s non-bank financial institutions, such as insurers, hit a six-year high during the fourth quarter of 2022.

Loans from these institutions reached 652.4 trillion won ($495.4 billion) in the October-December quarter of 2022, up 82.6% from 357.2 trillion won in the same quarter of 2016. Businesses’ past-due rates to these institutions amounted to 2.24% in the fourth quarter of 2022, the highest since the first quarter of 2016, when it hit 2.44%.

“Interest rates normally start to impact consumption, investment and housing six months to a year after the rates are raised. The elevated rates will hit the financial sector in earnest during the second half of this year,” LG Economic Research Institute economist Cho Young-moo said.

Write to Eui-Jin Jeong at justjin@hankyung.com

Jihyun Kim edited this article.

More to Read

-

-

EconomyS.Korea sees first decline in household loans in 20 years

EconomyS.Korea sees first decline in household loans in 20 yearsFeb 22, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea inflation at 7-mth low; BOK may slow rate hike pace

EconomyKorea inflation at 7-mth low; BOK may slow rate hike paceDec 02, 2022 (Gmt+09:00)

2 Min read -

Debt financingConglomerates lead loan growth to record high in July

Debt financingConglomerates lead loan growth to record high in JulyAug 11, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN