Used SUVs pricier than new ones? Yes, in South Korea thanks to Russia

Many used cars sent to Central Asia end up in Russia as Moscow has suffered a dire vehicle shortage since its war with Ukraine

By 5 HOURS AGO

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Seoul-backed K-beauty brands set to make global mark

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Prices of certain used sport utility vehicles in South Korea are defying the broader economic slowdown, with used models like Hyundai Motor Co.'s Palisade fetching significantly more than their new trims.

The phenomenon is being driven by a surge in exports to Russia, where Western sanctions and supply shortages have upended the new car market, analysts said.

According to data from Encar.com, a major Korean online marketplace for used cars, on Monday, a 2025 model seven-seater Palisade is listed at 79.99 million won ($56,315), nearly 20 million won above its new car price of 60.34 million won.

A nine-seat variant is sold at 75.8 million won, compared to the new model price of 58.14 million won.

The latest Santa Fe models show similar price distortions, with a 2025 five-seat version listed at 48.99 million won, 2.3 million won higher than its new car equivalent.

This price surge shows no sign of abating.

The average price of a 2022 Palisade in Korea has risen 3.2% on-month so far in May, reaching 39.84 million won.

ECONOMIC SANCTIONS, DEPARTURE OF WESTERN CARMAKERS

Industry officials attributed the recent rally in used car prices to a sharp rise in demand from Russia and its neighboring countries, where economic sanctions and the departure of Western carmakers have created acute shortages of both new and quality used vehicles.

"Russian buyers are aggressively turning to Korean used cars, especially SUVs, which are durable and well-suited for Russian roads," said an industry executive. "This has created a ripple effect, pushing up domestic prices in South Korea."

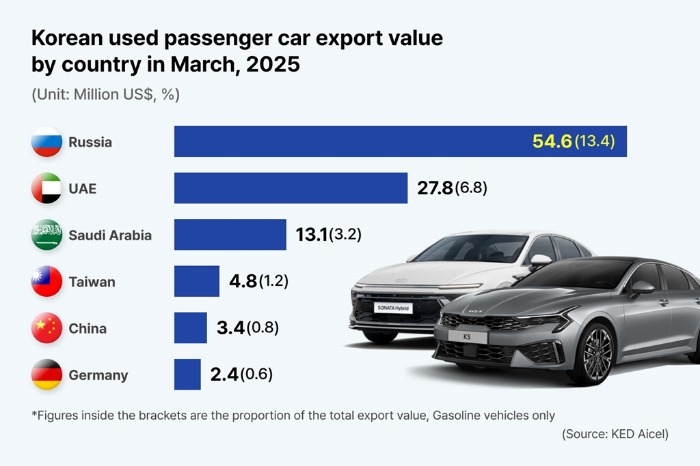

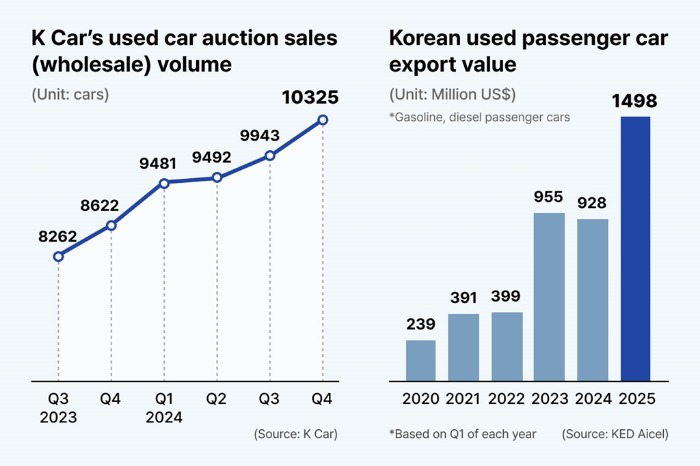

Official data showed Korea exported 78,842 used vehicles in April, a 56% increase from the same period last year.

Exports to Russia stood at 3,511 units, while neighboring countries such as Kyrgyzstan and Kazakhstan imported 9,342 and 2,177 units, respectively, from Korea.

Sources said that many of these vehicles ultimately make their way into the Russian market through indirect routes.

"Considering the limited size of economies like Kyrgyzstan, the volumes suggest much of this is for re-export to Russia," said a used car dealer.

The spike in demand has also been fueled by the collapse of domestic supply chains in Russia, where international automakers exited the market after the invasion of Ukraine.

Last year, Hyundai Motor pulled out of Russia by selling its St. Petersburg plant, Hyundai Motor Manufacturing Rus (HMMR), for just 10,000 rubles ($116) to a Russian company.

Write to Gil-Sung Yang and Eui-Myung Park at vertigo@hankyung.com

In-Soo Nam edited this article.

-

AutomobilesExports of Korea-made used cars to hit record high in 2025

AutomobilesExports of Korea-made used cars to hit record high in 2025Apr 29, 2025 (Gmt+09:00)

4 Min read -

AutomobilesCentral Asia emerging as South Korea’s new used car export market

AutomobilesCentral Asia emerging as South Korea’s new used car export marketJul 31, 2024 (Gmt+09:00)

2 Min read -

AutomobilesS.Korean used cars flow into Russia via Central Asia

AutomobilesS.Korean used cars flow into Russia via Central AsiaFeb 16, 2024 (Gmt+09:00)

2 Min read -

AutomobilesHyundai Motor set to exit Russia with St. Petersburg plant sale to AGR

AutomobilesHyundai Motor set to exit Russia with St. Petersburg plant sale to AGRSep 14, 2023 (Gmt+09:00)

2 Min read -

AutomobilesHyundai Motor to take 1st crack at Korea’s used car market

AutomobilesHyundai Motor to take 1st crack at Korea’s used car marketJun 26, 2023 (Gmt+09:00)

3 Min read -

AutomobilesAnother war in Russia: Hyundai, Kia versus Chinese carmakers

AutomobilesAnother war in Russia: Hyundai, Kia versus Chinese carmakersApr 21, 2023 (Gmt+09:00)

2 Min read -

AutomobilesHyundai, Lotte to join used car market, seen as boost for small players

AutomobilesHyundai, Lotte to join used car market, seen as boost for small playersMar 18, 2022 (Gmt+09:00)

3 Min read