Automobiles

Kia’s Chinese operations turn to profit after 8 years; Export strategy pays off

For sustainable profitability, Kia aims to diversify its overseas markets to over 80 countries this year

By Mar 10, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s No. 2 automaker Kia Corp. saw its Chinese operations turn profitable in 2024 for the first time in eight years as brisk exports from China offset sluggish sales there.

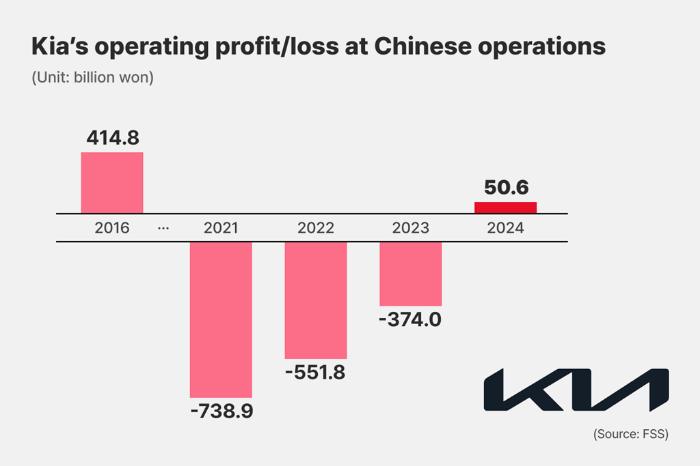

According to Korea's Financial Supervisory Service, Kia’s Chinese business posted 50.6 billion won ($35 million) in operating profit last year, swinging from a loss of 374 billion won in the previous year.

Kia, the sister firm of Hyundai Motor Co., sold 220,170 vehicles in China in 2024, up 52.9% from 144,002 units in 2023. With that figure, Kia posted the largest sales growth rate last year among foreign automakers operating in China through a joint venture scheme.

HIT BY THAAD ROW

Kia entered the Chinese market in 2003, building a factory with an annual production capacity of 400,000 units in Yancheng, Jiangsu province. The automaker later expanded its Yancheng plant output capacity to 890,000 units a year.

At its peak in 2016, Kia sold 650,000 vehicles in China, generating 414.8 billion won in operating profit on sales of 9.8 trillion won.

The Hyundai Motor Group affiliate, however, suffered a sharp dropoff in sales in China following Korea's deployment of the THAAD, or US terminal high altitude area defense missile defense system, which prompted widespread anti-Korean sentiment in China.

In 2017, its China sales plummeted to some 360,000 units, with its sales halved to 4.77 trillion won. It swung to an operating loss of 273 billion won.

Kia then continued posting losses for seven straight years.

CHINA: KIA’S EXPORT BASE

Analysts attributed Kia’s return to profitability in China to its strategy of turning its Chinese operations into an export base targeting emerging markets, including Southeast Asia, the Middle East and Latin America.

Even as sales in China floundered, Kia said its aggressive push into those emerging markets fueled the turnaround.

Recognizing the need for a strategic shift, Kia repositioned its Chinese operations as an export hub in 2023.

The Korean automaker began exporting the Pegas compact sedan and Sonet sport utility vehicle, previously sold within China, to countries such as Australia, New Zealand and Thailand.

That strategic pivot paid off.

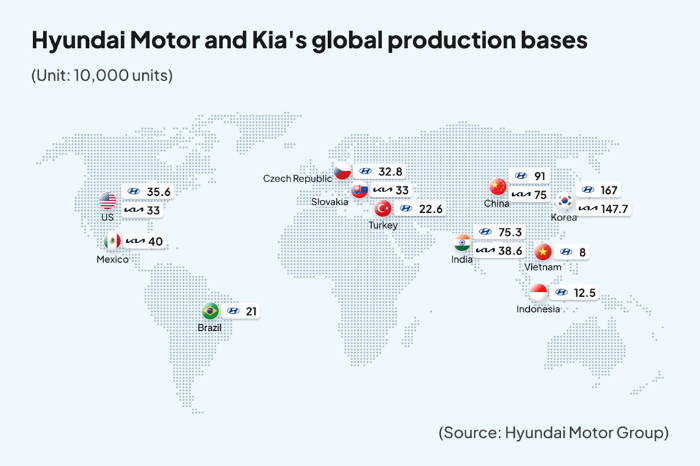

In 2024, Kia exported 140,724 vehicles from its Chinese plant — a fourfold increase from two years earlier.

The company also expanded its reach to other key regions, exporting 54,117 vehicles to the Middle East and 44,680 units to Latin America that year.

This year, Kia aims to sell 180,000 units in overseas markets, as it expands its export markets to over 80 from 76.

CHALLENGES PERSIST IN CHINA

Despite its success on the export front, Kia continues to grapple with sluggish sales within China.

Its vehicle sales in China stood at 79,446 units in 2024, down 5.3% from the previous year.

To regain momentum in China, Kia is betting on popular models such as the KX3 compact SUV, known as the Seltos in some markets, and the EV5 electric.

The KX3 is Kia’s best-selling model in China, with 15,094 units sold last year.

The EV5, equipped with cost-effective lithium iron phosphate (LFP) batteries, posted 5,705-unit sales in China last year.

Analysts said while Kia’s Chinese business has made impressive strides with its export-driven recovery, sustainable profitability will depend on further diversifying its overseas markets and navigating China’s increasingly competitive automotive landscape.

Write to Bo-Hyung Kim at kph21c@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Electric vehiclesHyundai, Kia ready to ramp up EV output in Europe, US

Electric vehiclesHyundai, Kia ready to ramp up EV output in Europe, USMar 06, 2025 (Gmt+09:00)

3 Min read -

Electric vehiclesKia CEO stands firm on electrification strategy, premieres EV4 in Europe

Electric vehiclesKia CEO stands firm on electrification strategy, premieres EV4 in EuropeFeb 27, 2025 (Gmt+09:00)

4 Min read -

Business & PoliticsChina likely to lift ban on South Korea’s K-wave as early as May

Business & PoliticsChina likely to lift ban on South Korea’s K-wave as early as MayFeb 19, 2025 (Gmt+09:00)

3 Min read -

EarningsKia hits record 2024 sales; profit margins highest among global automakers

EarningsKia hits record 2024 sales; profit margins highest among global automakersJan 24, 2025 (Gmt+09:00)

3 Min read -

Electric vehiclesKia to enter emerging markets with its latest EV5 made in China

Electric vehiclesKia to enter emerging markets with its latest EV5 made in ChinaApr 10, 2024 (Gmt+09:00)

3 Min read -

Electric vehiclesKia unveils design of EV5, its first China-made global electric car

Electric vehiclesKia unveils design of EV5, its first China-made global electric carAug 25, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN