Hyundai Motor, Toyota compete to take upper hand in Brazil

The neighboring rivals are also investing heavily in Brazil to gain ground in the hybrid and EV segments

By Mar 10, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s top automaker Hyundai Motor Co. and Japan’s No. 1 carmaker Toyota Motor Corp. have been competing for decades to take the upper hand in major markets across the globe, including the US.

Hyundai Motor and Toyota are not just competing to expand their market share but also investing heavily in Brazil to take advantage of the country’s move toward electrification and eco-friendly future mobility projects in line with its carbon neutrality targets.

According to the Brazilian Automobile Industry Association, known as ANFAVEA, Hyundai ranked fourth with a market share of 9.4% in Brazil by selling 14,237 units in January.

Toyota ranked fifth with vehicle sales of 13,724 units, accounting for 9% of the Brazilian market.

Data showed Italian automaker Fiat topped the January sales list with 30,846 units, or 20.3% of the market, followed by Volkswagen, which sold 22,329 units for 14.7%, and General Motors with 18,917 units for 12.4%.

Hyundai and Toyota have gone back and forth in Brazil’s vehicle sales rankings since 2020.

In 2020 and 2021, Hyundai was ahead of Toyota. But in 2022 and also last year, Toyota sold more vehicles than Hyundai.

ECO-FRIENDLY VEHICLE MARKET

The two rivals are now investing heavily in eco-friendly vehicles to ride on the Brazilian government’s carbon neutral policy.

The Korean carmaker currently operates a production plant in Piracicaba, São Paulo, with an annual production capacity of 210,000 units. The factory is Hyundai’s sole manufacturing base across the Central and South American region.

Fueled by models tailored for the local market such as the Creta SUV and the HB20 hatchback mini sedan – both from the Piracicaba factory, Hyundai sold 186,247 vehicles in 2023. Japan’s Toyota sold 192,309 vehicles last year.

The HB20, short for Hyundai Brazil 20, was developed to be powered by ethanol produced from fermented sugar cane mixed with gasoline.

The Brazilian government implemented a policy to promote ethanol as a biofuel to reduce its dependence on oil following the global oil crisis in the 1970s.

It is now estimated that more than 80% of cars running in Brazil are flexible fuel vehicles (FFVs) that can use both gasoline and ethanol.

Toyota is also actively targeting Brazil with its hybrid models.

In 2019, the Japanese company launched the Corolla compact sedan locally that uses ethanol for its hybrid system. In 2021, it unveiled the Corolla Cross compact SUV using the same type of fuel.

INVESTMENT PLANS

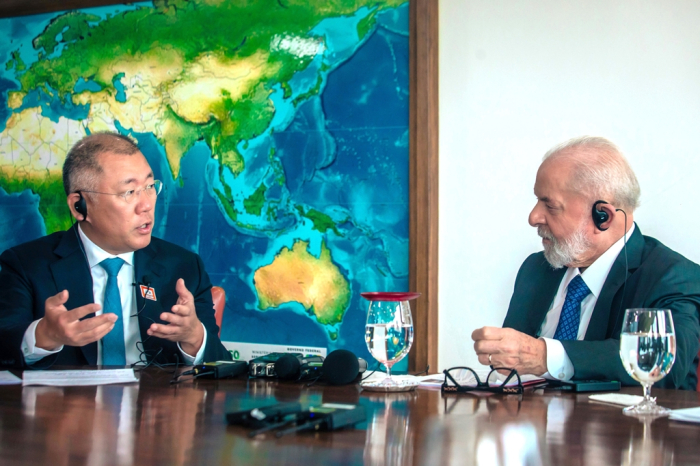

Last month, Hyundai Motor Group Chairman Chung Euisun visited Brazil and announced a $1.1 billion investment plan to reinvigorate the South American country’s car industry, which is swiftly adopting electrification.

During a courtesy call to Brazilian President Luiz Inacio Lula da Silva, Chung promised Hyundai’s active support in Brazil’s eco-friendly future mobility projects, including the development of FFVs and hydrogen-powered vehicles.

Hyundai, Iveco solidify partnership with E-WAY H2 hydrogen fuel cell bus - KED Global

Hyundai Motor and its sister firm Kia Corp. plan to bring their three latest electric models to Brazil this year – the Hyundai IONIQ 5 crossover, the Hyundai Kona Electric and the Kia EV5.

Last week, Japan’s Toyota announced that it would invest 11 billion real ($2.22 billion) in Brazil by 2030 to increase the local production of new vehicles designed for the country’s consumers.

The company said it intends to build a new hybrid flex vehicle by 2025 and a car specially designed for the Brazilian market.

WEALTHIEST IN SOUTH AMERICA

With a population of 210 million at the end of 2022, Brazil is South America's wealthiest country boasting a GDP of $1.9 trillion. It is the world's eighth-largest car producer.

The Brazilian government is implementing various eco-friendly policies to halve its greenhouse gas emissions by 2030 compared to 2005 levels and achieve carbon neutrality by 2050.

Last year, the government announced the “National Green Mobility and Innovation Program (MOVER),” which will provide 19 billion Brazilian real to automakers and related firms investing in decarbonization projects.

Write to Nan-Sae Bin at binthere@hankyung.com

In-Soo Nam edited this article.

-

AutomobilesHyundai to reignite Brazil’s mobility push with $1.1 billion investment

AutomobilesHyundai to reignite Brazil’s mobility push with $1.1 billion investmentFeb 23, 2024 (Gmt+09:00)

4 Min read -

Electric vehiclesHyundai NEXO retains fuel cell EV leadership; Toyota Mirai follows fast

Electric vehiclesHyundai NEXO retains fuel cell EV leadership; Toyota Mirai follows fastSep 11, 2023 (Gmt+09:00)

2 Min read -

AutomobilesHyundai, Kia, Toyota unveil new SUVs in head-to-head showdown

AutomobilesHyundai, Kia, Toyota unveil new SUVs in head-to-head showdownJul 25, 2023 (Gmt+09:00)

2 Min read -

AutomobilesHyundai, Kia post record sales in the US, poised to overtake Toyota

AutomobilesHyundai, Kia post record sales in the US, poised to overtake ToyotaSep 02, 2022 (Gmt+09:00)

4 Min read -

AutomobilesHyundai NEXO, Toyota Mirai to compete in fuel cell cars as Honda exits

AutomobilesHyundai NEXO, Toyota Mirai to compete in fuel cell cars as Honda exitsJun 18, 2021 (Gmt+09:00)

2 Min read