Automobiles

Korean tire makers poised for brisk sales on US tariff cuts

EV tires make up 20% of Korean tire makers' sales in 2023, versus 5% in 2021

By Feb 06, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

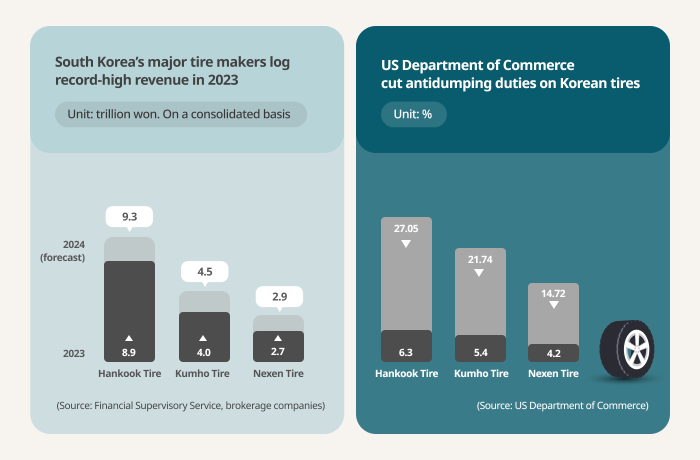

South Korean tire makers such as Hankook Tire & Technology Co., Kumho Tire Co. and Nexen Tire Corp. are expected to post new record-high revenue in 2024 thanks to a drastic cut in tariffs on their US exports and rising demand for premium tires used for electric vehicles.

The US Department of Commerce on Monday announced its decision to lower anti-dumping duties on passenger car and light truck tires shipped from South Korea.

It reduced tariffs on Hankook Tire’s products from 27.05% to 6.3% and cut those on Kumho tires from 21.74% to 5.4%. Customs duties on Nexen tires were lowered to 4.2% versus 14.72%.

The decision was made after Korean tire makers filed a petition against antidumping duties on their exports to the US imposed since June 2021.

They had been sharply hiked following a complaint by the United Steelworkers union to the US International Trade Commission that imported tires were sold below fair prices.

According to the Korea Tire Manufacturers Association and Korea Customs Service, South Korean tire makers exported a combined $1.07 billion worth of tires for passenger cars and light trucks to North America in 2023.

The sharp tariff reduction is expected to make their products more competitive in the region, which accounts for about 30% of their exports.

“In terms of quality, domestic companies have a competitive edge over foreign competitors,” said a Korean tire company’s official. “Our profit margins will go up sharply as we can cut our price by about 10%.”

The three Korean companies will also be paid a refund of duties estimated at more than 200 billion won ($150 million), including 100 billion won for Hankook Tire alone.

RECORD-HIGH SALES

They

Analysts and tire industry officials forecast Hankook Tire’s revenue to exceed 9 trillion won this year, up from last year’s 8.93 trillion won. In 2023, its operating profit came in at 1.3 trillion won.

Kumho Tire is aiming for 4.56 trillion won in sales this year, up 13% from a year earlier.

Nexen Tire, which swung to a profit of 180 billion won in 2023, projects 2.9 trillion won in revenue this year, a 7% rise on-year.

High-performance tires, primarily for EVs, are driving their sales growth. EV tires are about 20% more expensive than those for combustion engine cars because of reinforcement materials used to enhance tire grip and wear resistance.

The proportion of EV tires based on original equipment (OE) rose to 20% in 2023, compared to 5% in 2021. OE tires refer to the tires that a vehicle was originally equipped with from the factory.

“The tire replacement cycle for EVs is about three years, two years shorter than combustion engine vehicles',” said a tire industry official. "Replacement demand for EV tires will boost our sales as well."

On the downside, stubborn inflation and high interest rates could slow the demand for new cars.

Disrupted raw material supply chains due to the standoff in the Red Sea have also taken a toll on the domestic tire makers as they are spending about 3 billion won more on logistics prices per month than before.

Write to Jin-Won Kim and Nan-Sae Bin at Jin1@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

AutomobilesSouth Korea’s Hankook Tire looks to direct tire sales in Taiwan

AutomobilesSouth Korea’s Hankook Tire looks to direct tire sales in TaiwanNov 21, 2023 (Gmt+09:00)

2 Min read -

EarningsKorean tire makers post double-digit Q3 profit margins; outlook bright

EarningsKorean tire makers post double-digit Q3 profit margins; outlook brightNov 06, 2023 (Gmt+09:00)

2 Min read -

AutomobilesHankook Tire to supply tires for BYD's electric truck

AutomobilesHankook Tire to supply tires for BYD's electric truckSep 14, 2023 (Gmt+09:00)

1 Min read -

Comment 0

LOG IN