Automobiles

Hyundai Motor’s China restructuring continues with Chongqing plant sale

Hyundai says it is actively pursuing measures to improve its sales performance in China, including optimizing operations

By Aug 23, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

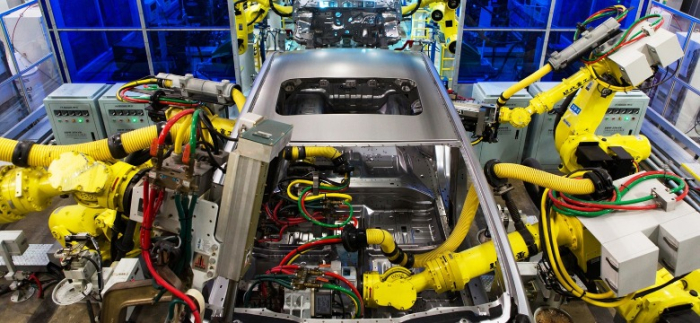

Hyundai Motor Co., reeling from its weak car sales in China, has put its Chongqing plant up for sale as South Korea’s top automaker continues its rigorous restructuring to survive in the world’s largest auto market.

Beijing Hyundai Motor Co., a joint venture between Hyundai and China’s BAIC Motor Corp., is selling the factory’s land use rights, equipment and other facilities in the southwestern city of Chongqing, according to an Aug. 11 disclosure on the China Beijing Equity Exchange.

The starting price of the plant is 3.68 billion yuan, or $505 million, according to a Reuters report.

Beijing Hyundai has been bleeding for years amid fierce price competition and slowing demand.

With an annual production capacity of 300,000 units, the Chongqing plant ceased operations last year due to weak sales. Hyundai built the plant in 2017 with a 1.6 trillion won ($1.2 billion) investment.

“Regarding the plant sale, the buyers and schedule haven’t been decided as of now,” said a Hyundai official.

The Korean carmaker is rejigging its strategy in China, where homegrown brands such as BYD Co. and Changan Automobile Co. are raising their market shares whereas imported brands are struggling with falling sales.

Since its entry into the Chinese market in 2002, Hyundai has built five plants there – three in Beijing, one in Changzhou and another in Chongqing.

As sales slid, Hyundai sold one of the factories in Beijing to Li Auto, a Chinese electric vehicle maker, formerly known as Lixiang Automotive, in 2021.

The Changzhou plant may be put on hold sometime this year if Hyundai’s sales slump in China continues, industry officials said.

PEAKED IN 2016

Hyundai’s China sales peaked at 1.13 million units in 2016. Last year, Beijing China sold a mere 273,000 units with its market share hovering around 1%.

The JV posted an 800 billion won operating loss in 2022.

Following the heavy loss, the company reduced its small- to mid-sized vehicle lineup to eight models from 13.

Hyundai’s sister firm Kia Corp. also runs operations in China but has been mired in the red for years.

The two Korean automakers’ sales in China have been declining since 2017 amid aggressive marketing by their global rivals and in the aftermath of a diplomatic dispute between Seoul and Beijing over the deployment in Korea of a US anti-missile system.

The Korean companies’ heavy sedan-focused lineups in China also contributed to their lackluster sales there amid a worldwide boom in sport utility vehicles, analysts said.

MEASURES TO IMPROVE CHINA SALES

Hyundai officials said the company is actively pursuing various measures to improve its sales performance in China, including optimizing the operation of its product lineups and launching new SUVs and EVs.

As part of its efforts to revive sales in China, Hyundai in November of 2021 unveiled an electric variant of the GV70, a premium SUV under its standalone Genesis brand, at the Guangzhou International Automobile Exhibition.

Last year, Hyundai and its Chinese partner BAIC Motor said they will inject $942 million into the JV, to spend mostly on their EV business.

The JV said last month that its first-half sales rose 13% year on year to 123,259 units, marking its first gains since 2019.

Hyundai Motor Chief Executive Chang Jae-hoon said in a new year’s message that 2023 should be the year to normalize its Chinese business.

This year, it is aiming to jack up its China sales by 20.5% to 306,000 units, led by the Mufasa compact crossover launched in June.

Hyundai said it will launch new premium models such as the revamped compact sedan Avante N while Kia plans to bring the all-electric SUV EV5 to China later this year.

Write to Nan-Sae Bin at binthere@hankyung.com

In-Soo Nam edited this article.

More to Read

-

AutomobilesHyundai, Kia firm up ranking as world's 3rd; first-half profits improve

AutomobilesHyundai, Kia firm up ranking as world's 3rd; first-half profits improveJul 31, 2023 (Gmt+09:00)

3 Min read -

AutomobilesHyundai, Kia, Toyota unveil new SUVs in head-to-head showdown

AutomobilesHyundai, Kia, Toyota unveil new SUVs in head-to-head showdownJul 25, 2023 (Gmt+09:00)

2 Min read -

-

Electric vehiclesHyundai, BAIC Motor to inject $942 mn in China JV for EVs

Electric vehiclesHyundai, BAIC Motor to inject $942 mn in China JV for EVsMar 20, 2022 (Gmt+09:00)

2 Min read -

Electric vehiclesHyundai launches electrified GV70’s global premiere in China to boost sales

Electric vehiclesHyundai launches electrified GV70’s global premiere in China to boost salesNov 19, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN