Automobiles

Hyundai Motor to collect $5.9 bn in dividends from abroad for EV push

This year’s dividends from overseas subsidiaries to the S.Korean headquarters are nearly five times more than the year previous

By Jun 12, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

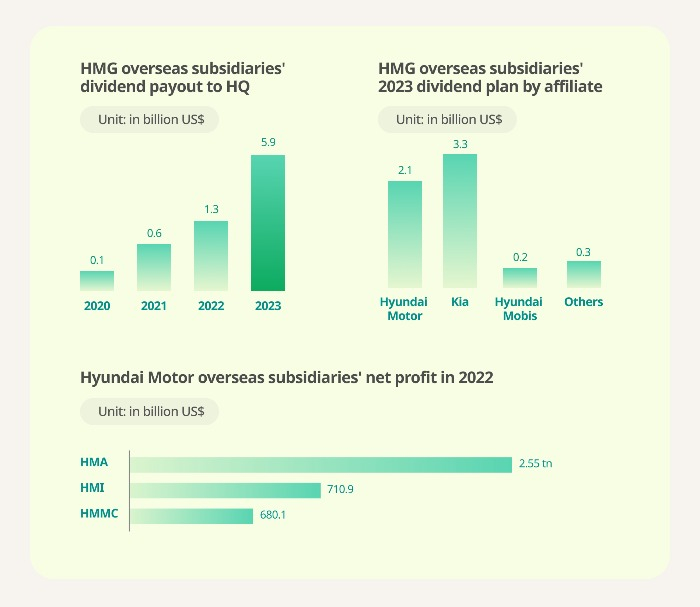

Hyundai Motor Group’s overseas subsidiaries will repatriate $5.9 billion in dividends in total to their parent in South Korea this year to help the Korean auto giant meet its goal of joining the world’s top three electric vehicle companies by 2030.

Hyundai Motor Group announced on Monday that the Korean headquarters will receive $5.9 billion in dividends this year from its overseas operations, up 4.6 times from the previous year thanks to the stellar performance of its foreign subsidiaries.

Hyundai Motor America (HMA) posted a net profit of 2.55 trillion won ($2 billion) in 2022, more than double that of 2021. Kia America (KUS) also reaped 2.53 trillion won in net income last year, nearly triple the year before. The results were their best-ever performances.

Hyundai Motor India (HMI) and Hyundai Motor Manufacturing Czech (HMMC) will also pay dividends to their Korean parent, while Kia America (KUS), Kia Autoland Slovakia (KaSK) and Kia Europe (Kia EU) will also take part. They all have massive retained earnings after upbeat business performances last year.

The Korean parent company will use the money from its overseas subsidiaries to beef up investment in its local EV production capability under a long-term goal announced in April to invest a total 24 trillion won to jack up local annual EV production capacity to 1.51 million units by 2030, allowing it to leap to become the world’s No. 3 EV seller with a global EV output of 3.65 million units.

BOLD EV AMBITION

Under the Korean auto behemoth’s new capital reshoring plan, its biggest car-making unit Hyundai Motor Co. will collect $2.1 billion from its offshore subsidiaries this year, accounting for 71% of the total sales of HMA, HMI and HMMC. Its smaller sibling Kia Corp. will receive $3.3 billion from overseas subsidiaries, and its auto part-making affiliate Hyundai Mobis Co. $200 million.

Of the total $5.9 billion, 79% will be funneled to the Korean headquarters in the first half of this year, and the rest in the latter half.

The money will be used primarily on building Hyundai Motor’s EV lines in Ulsan and Kia’s EV-dedicated plant at its Autoland Hwaseong in Gyeonggi Province, as well as converting the second factory at Kia’s Autoland Gwangmyeong to EV lines.

The auto giant will also invest in developing the next-generation EV platform, its EV lineup diversification, developing EV core parts and technologies and R&D centers.

CAPITAL RESHORING

Hyundai Motor Group has decided to relocate more earnings from its overseas operations home after the Korean government amended the country’s corporate tax law last year to bolster local investment.

Under Korea’s revised corporate tax law, only 5% of dividends from a Korean company’s foreign subsidiaries will be levied at home if the dividends are already taxed in foreign countries. The remaining 95% is tax-free in Korea to ease the double taxation burden on businesses.

As Hyundai Motor can utilize more capital from its foreign subsidiaries, it could rely less on loans for business operations, improving its financial soundness.

This is also part of the company’s efforts to offset any adverse effects from increasing protectionistic moves on the global trade front, such as US' Inflation Reduction Act (IRA).

Hyundai Motor’s $5.9 billion dividends from abroad are also expected to help improve Korea’s current account balance, which reversed to a $790 million deficit in April from a $160 million surplus in March, according to the Bank of Korea on Friday.

Korean companies’ increased dividend payments to foreign investors were largely owed to the country’s current account deficit, the central bank said.

Write to Il-Gue Kim at black0419@hankyung.com

Sookyung Seo edited this article.

More to Read

-

AutomobilesKorea’s first integrated car plant being transformed into Kia’s EV base

AutomobilesKorea’s first integrated car plant being transformed into Kia’s EV baseMay 29, 2023 (Gmt+09:00)

3 Min read -

EarningsHyundai Motor to pay quarterly dividends with record Q1 profit

EarningsHyundai Motor to pay quarterly dividends with record Q1 profitApr 25, 2023 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai to invest $2.45 bn in India, eyes spot in global EV top 3

Electric vehiclesHyundai to invest $2.45 bn in India, eyes spot in global EV top 3May 12, 2023 (Gmt+09:00)

3 Min read -

AutomobilesHyundai Motor posts largest share of global hydrogen car market in Q1

AutomobilesHyundai Motor posts largest share of global hydrogen car market in Q1May 12, 2023 (Gmt+09:00)

1 Min read -

Business & PoliticsHyundai Motor, Kia to receive 25% tax credit for EV plant spending

Business & PoliticsHyundai Motor, Kia to receive 25% tax credit for EV plant spendingMay 09, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN