Automobiles

Korean auto shares shine in gloomy stock market

Hyundai Motor’s stock hits one-month high, Kia touches three-week peak

By Oct 13, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean car shares overcame slides in the country’s stock markets as the automotive chip shortage is showing some signs of easing.

Global carmakers are expected to report poor earnings in the third quarter as the shortage thwarted production despite rising demand. Their shares, however, started rebounding as chip supply is expected to gradually improve from next year while their earnings in the July-September period have been reflected in stock prices, analysts said.

ATTRACTIVE STOCK PRICES

Shares in South Korea’s two largest automakers rose even as the broader Kospi lost ground on concerns over global inflation.

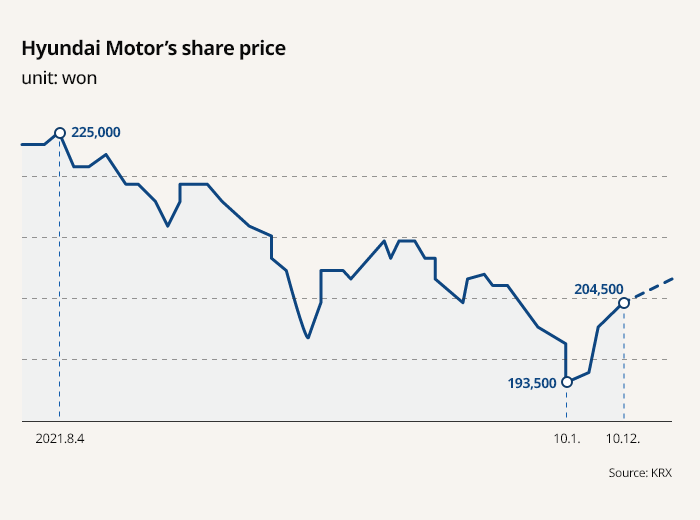

Hyundai Motor Co. jumped as high as 3.2% to 211,000 won ($176.4) early on Oct. 13, its highest point since Sept. 16. Kia Corp. also gained 2.6% to 84,300 won, its strongest since Sept. 24.

Their shares rose 2.3% and 1.2% in the first 12 days of the month, according to the Korea Exchange (KRX). During the period, the Kospi lost about 5%.

Automakers’ share prices are attractive as stocks in Asian carmakers underperformed competitors in the US such as General Motors Co. and Ford Motor Co. Hyundai’s 12-month forward price-earnings ratio fell to 8.46 times, while Kia’s ratio skidded to 6.59 times.

RELATIVELY FREE FROM CHINA SLOWDOWN

South Korean automakers are relatively free from worries about China’s economic slowdown. Hyundai and Kia have been reducing reliance on the world’s largest car market while increasing investment in other emerging countries.

“China’s car sales are falling not because of production interruption but because of slowing demand,” said Samsung Securities analyst Lim Eun-young. China is unlikely to provide active measures to support car demand since the government focuses more on easing income disparity, Lim added.

China accounts for less than 10% of Hyundai and Kia’s global sales. But they expanded their market share in other emerging countries, becoming top automakers in Russia and Vietnam. They are the No. 2 player in India and No. 4 in Brazil.

“Emerging markets such as Russia and Brazil, on which Hyundai and Kia are focusing, are commodity-oriented economies,” Lim said. “The recent surge in commodity prices has led to an overall economic recovery. Demand for deferred consumption is also expected, given sluggish demand in the past five to six years.”

Global automobile demand remained healthy. The Manheim Used Vehicle Index, an indicator of overall car demand, hit a record high in September as consumers looked for second-hand cars since they could not buy new models due to production disruption.

PARTS MAKERS

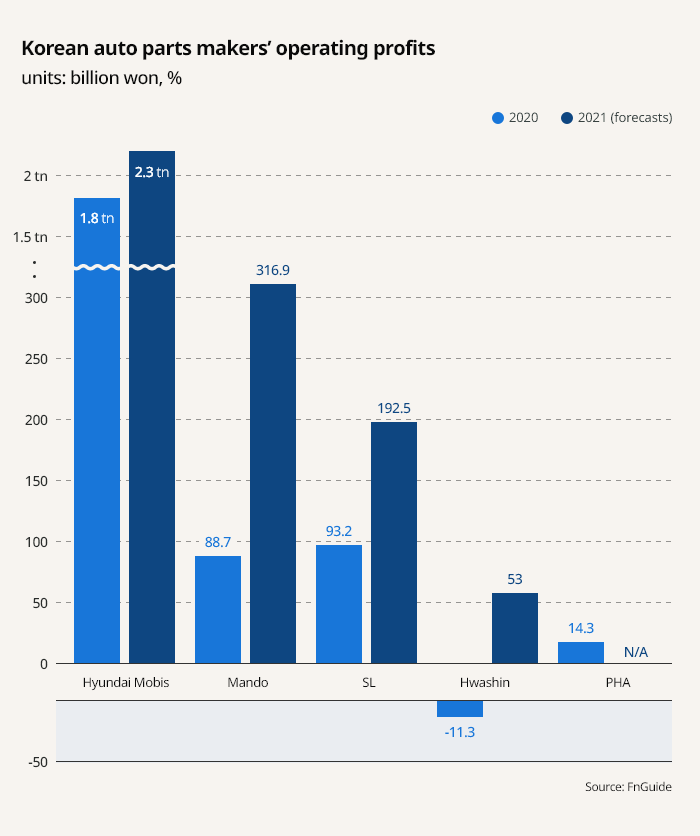

Given the strong demand, auto parts makers are also predicted to benefit from the normalization of carmakers' production.

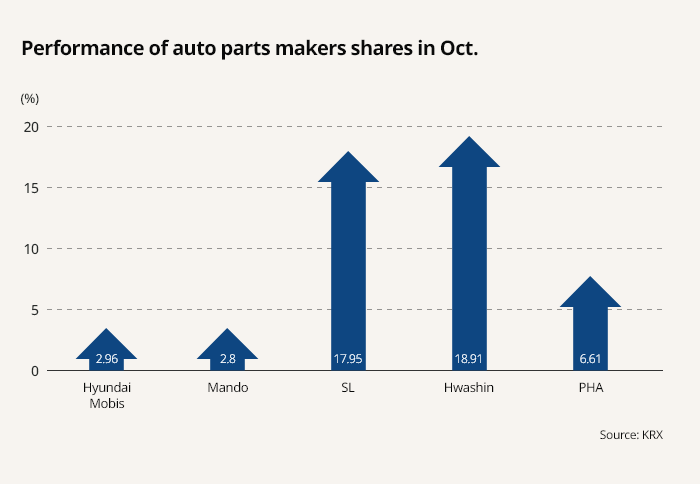

Samsung Securities recommended buying shares in small and medium-sized parts makers such as SL Corp., Hwashin Co. and PHA Co. that had been undervalued due to their heavy reliance on Hyundai and Kia.

“Mando, SNT Motiv and SL, which supply parts to North American carmakers such as GM and Ford, are forecast to report weak earnings. But they will recover if the shortage issues are resolved quickly, causing those automakers to rush for components,” said Shinhan analyst Jung Yong-jin.

Shares in South Korea’s auto industry are expected to regain momentum from stable electric vehicle production, Jung said.

“Hyundai and Kia’s global EV market shares fell as disruptions in the production of electric motors delayed output of models that sit on the dedicated EV platform E-GMP,” Jung said. “An imminent normalization of E-GMP production is predicted to boost momentum from the related value chain,” he said, picking up Hyundai Mobis as a recommended stock.

Write to Jae-Yeon Ko at yeon@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

AutomobilesChip shortage slams Korean carmakers’ new car rollouts

AutomobilesChip shortage slams Korean carmakers’ new car rolloutsOct 06, 2021 (Gmt+09:00)

3 Min read -

AutomobilesHyundai, Kia take throne in Russia on decade of investment

AutomobilesHyundai, Kia take throne in Russia on decade of investmentSep 27, 2021 (Gmt+09:00)

2 Min read -

AutomobilesCarmaker stocks hit speed bump of chip shortage, Delta variant

AutomobilesCarmaker stocks hit speed bump of chip shortage, Delta variantAug 20, 2021 (Gmt+09:00)

3 Min read -

-

Foundry businessKorean foundry firm DB HiTek sets new Q1 sales record

Foundry businessKorean foundry firm DB HiTek sets new Q1 sales recordMay 17, 2021 (Gmt+09:00)

3 Min read -

Factory suspensionGM Korea to halt 2 main plants next week on automotive chip shortage

Factory suspensionGM Korea to halt 2 main plants next week on automotive chip shortageApr 15, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN