Korean pension funds, insurers seek customized investment vehicles

The Government Employees Pension Service is keen on unlisted BDCs as a hybrid strategy within private debt

By 6 HOURS AGO

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

South Korean institutional investors are increasingly interested in separately managed accounts (SMAs) that offer customized strategies, as well as exploring niche opportunities through business development companies (BDCs).

A BDC is an investment vehicle established to lend to small companies. They often deliver higher returns than other alternative vehicles as they are exempt from corporate taxes if certain regulatory conditions are met.

Korean limited partners are also looking to raise exposure to private equity to rebalance their private debt-heavy portfolios.

However, the implementation of the Korean Insurance Capital Standard (K-ICKS) in 2023 discouraged them from actively expanding into the asset class, said senior portfolio managers of Kyobo Life Insurance Co. and DB Asset Management Co. at a panel discussion during the global investment conference ASK 2025 on Wednesday.

The Korean Insurance Capital Standard (K-ICS), implemented in 2023 alongside the International Financial Reporting Standards (IFRS) 17, requires insurers to apply the mark-to-market value of liabilities rather than book value, thereby improving risk-based capital buffers.

The Government Employees Pension Service (GEPS) and the Military Mutual Aid Association (MMAA) advise general partners (GPs) to understand their stricter decision-making structures and allow sufficient time to review investment proposals.

GOVERNMENT EMPLOYEES PENSION SERVICE:

(Ticket size: $50 million per fund. $100 million per separately managed account)

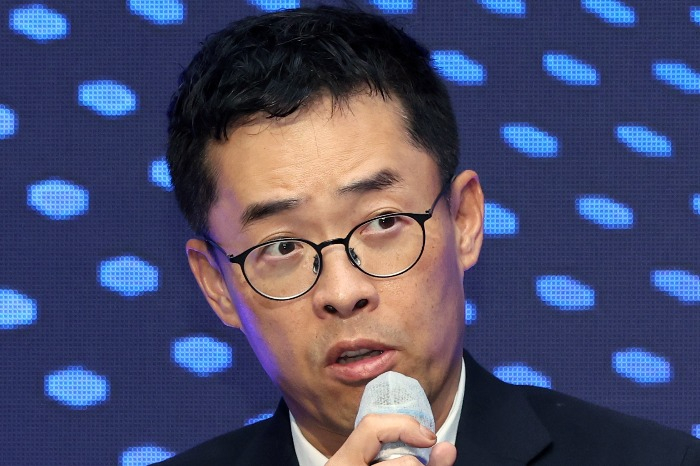

Ro Seunghwan, head of alternative investments at GEPS, said it prioritizes restructuring its portfolio to achieve further diversification.

"We're looking to expand allocations to secondaries and structured credit, while diversifying our GP pool and vintage year," he said. "We want to build long-term partnerships with those who understand our investment culture and constraints."

“We’re focusing on unlisted BDC as a hybrid strategy within private debt," he said.

BDCs serve as a bridge role between public and private markets, offering regular dividends and incurring relatively low losses.

"But what's concerning is that BDCs are now siphoning off debt like hippos and aggressively attracting assets, the quality of their portfolios could deteriorate," Kim said. "But we are positively considering investing in BDCs to diversify our liquidity and cash management."

MILITARY MUTUAL AID ASSOCIATION:

(Ticket size: $50 million-$100 million per fund and $100 million-$200 million per SMA)

“We want to diversify our portfolio tailored to us by actively using SMAs,” said Kim Hyun Wook, a senior portfolio manager of the MMAA.

The MMAA has initiated investments in open-end funds, but their size remains relatively small compared to those managed for global investors, making it difficult to increase the allocation.

Moreover, open-end funds have yet to provide detailed scenarios on how they will handle redemption requests and ensure liquidity at the request of limited partners, he said.

KYOBO LIFE INSURANCE:

(Ticket size: $70 million per fund)

“We want to increase private equity investments, but it’s difficult to do so without incurring higher risk charges,” said Cho Yunsam, overseas alternative investment head at Kyobo Life.

Kyobo Life is overweight in private debt, but due to regulatory constraints, particularly under K-ICS, it will continue focusing on that asset class.

"We are looking for SMAs. We want to make an evergreen vehicle customized to us," said Cho.

An evergreen fund is an open-ended private equity vehicle with no fixed end date, which accepts new investments and allows investors to withdraw capital.

DB ASSET MANAGEMENT:

(Ticket size: $20 million-$50 million per fund. $100 million per SMA. Target yield from alternatives is in the mid-to-upper 7% range)

Taein Kim, head of equity at DB Asset Management, said it is unlikely to increase equity investments in 2024 due to the K-ICS.

"From my perspective, this will be the most difficult year for deal-making," he said of equity investment.

The asset manager had reviewed investing in open-end funds several times, but decided not to proceed due to redemption risks.

Write to Yeonhee Kim at yhkim@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

-

-

ASK 2025KIC bets on Asian real estate; eyes residential, data centers

ASK 2025KIC bets on Asian real estate; eyes residential, data centersMay 21, 2025 (Gmt+09:00)

2 Min read