ASK 2023

Prepare for long-term, illiquid asset management: Korean investors

Investors should consider stable income and liquidity amid prolonged economic uncertainty, they say

By Oct 26, 2023 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean institutional investors said they are preparing for prolonged high interest rates and market uncertainty, building mid- to long-term plans for alternative asset management.

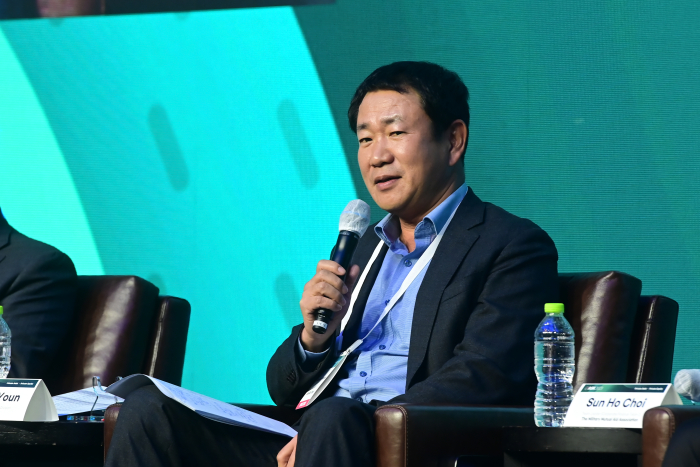

Plans should be focused on stable income generation, via first-lien term private lending, and liquidity by exiting from mature assets, four private equity and debt investment heads said during a panel session at ASK 2023 on Thursday.

The four panelists were from National Pension Service (NPS), Teachers' Pension (TP), the Military Mutual Aid Association (MMAA) and Mirae Asset Global Investments. They shared views on private markets and plans for equity and debt management.

The discussion was moderated by Jay Kim, managing director of Franklin Templeton Korea.

NATIONAL PENSION SERVICE

NPS cut the budget for new investments in private equity and debt this year, by 50% to 11 trillion won ($8.1 billion). This was owing to the denominator effect that hit private asset investors' appetite, said Choe Hyung-don, head of the pension giant's private equity and venture capital investment division.

Despite the limited budget, NPS increased its overseas direct lending's proportion to 20% this year. The pension fund also focused on co-investments in buyouts, senior secured loans and secondaries.

The pension fund manages 990.6 trillion won in assets, including 65 trillion won for private equity and debt as of July 31. Global private equity and debt, mostly in the US and Europe, make up 80%. Direct lending accounts for half of the overseas private debt.

The pension fund will maintain its steady pace of commitments and strengthen global networks to spur overseas co-investments next year, Choe noted.

NPS' fund management arm is preparing for a possible recession, he said.

"We stopped new investments in private equity and debt for two years during the 2008-2009 global financial crisis. After a few years, we found that some assets proposed to us during the period were very good vintages," Choe said.

"Internally, we've reached a consensus that we won't halt investments in certain asset classes in a recession or market slowdown, and we're setting up strategies to use in crises," he added.

TEACHERS' PENSION

Investors should keep in mind that high interest rates and inflation could continue in the mid to long term and build plans accordingly, said TP's head of alternative investment division Youn Jee-sun.

The pension fund for private school teachers and employees will consider liquidity when setting up alternative investment strategies, Youn said. The institution is reviewing open-end fund investment for the first time to address illiquidity issues, he added.

TP's asset under management (AUM) is 23 trillion won as of Sept. 30. Alternative assets make up 25%, and fixed-income and stocks account for 37% and 38%, respectively. Of alternative investments, the overseas and domestic assets ratio is 3:2.

For global private assets, TP invested $100 million in a blind-pooled fund for direct lending and injected $110 million in buyouts this year.

For domestic buyouts, it tapped three Korean private equity firms last month – VIG Partners, IMM Investment and Hahn & Company – to pour in a combined 150 billion won.

The pension fund will hire a venture capital firm by the end of this year to bet on promising enterprises.

By the end of this year, TP plans to thoroughly review its domestic alternative investment portfolio and optimize its mid- to long-term strategies for stable returns. The same measure for global alternative investments will come next year, Youn said.

THE MILITARY MUTUAL AID ASSOCIATION

MMAA reduced its new investments for private equity and debt to 700 billion won this year, from 1 trillion-1.5 trillion won in previous years due to rate hikes and Korea's tightened regulations o loans, said corporate finance team leader Choi Sun-ho.

The mutual aid fund for military personnel invested in domestic private equity, venture capital and buyouts in the first half. It focused on global private assets in the second half, investing in overseas private debt, secondaries and special situation funds. It is reviewing more global equity and debt deals, Choi added.

MMAA has 10 trillion won in AUM, including 7.5 trillion won for alternative investments. Private equity and debt amount to around 2.3 trillion won, which of half is overseas assets.

"Tough market conditions will last next year. M&A activities will slow and investors will suffer illiquidity. In this circumstance, we'll look for private debts that can mitigate the J-curve effect, or early losses, and provide high risk-adjusted returns. We also aim to identify secondaries and special situation funds with attractive asset valuations," Choi said.

In its selection of general partners, he put an emphasis on a qualitative assessment of asset managers.

"We previously focused on quantitative factors like a GP's track record or asset under management. However, as we've become more experienced, we realized that an asset manager's investment philosophy and principles are critical for good partnerships," he noted.

MIRAE ASSET GLOBAL INVESTMENTS

Mirae Asset Global Investments, a unit under Mirae Asset Financial Group, has been managing the housing fund of the Ministry of Land, Infrastructure and Transport since 2014.

The housing fund's AUM is 26.5 trillion won, including 2.7 trillion won for alternative investments as of March 31.

Many private equity firms deleverage and become more rigorous in covenants in response to rate hikes, high inflation and slow economic growth, and this move is forming a virtuous cycle, investment team head Chung Mi-kyung said.

Liquidity and stable cash flow are critical for the housing fund as it's sensitive to real estate markets, she said.

Therefore, Mirae Asset prefers buyout or growth equity strategies of which distribution to paid-in-capital ratio with reach 1.0 in a short period, as well as secondaries with fast exits and co-investments with high potential returns, Chung noted.

It focuses on sourcing mid-cap private equity deals, while taking a conservative approach to large-cap initial public offerings or M&As, she added.

Write to Jihyun Kim at snowy@hankyung.com

Jennifer Nicholson-Breen edited this article.

More to Read

-

-

ASK 2023Stability prioritized over risk-taking assets: Korean investors

ASK 2023Stability prioritized over risk-taking assets: Korean investorsOct 25, 2023 (Gmt+09:00)

5 Min read -

ASK 2023KIC eyes private debt, infrastructure in era of high interest rates

ASK 2023KIC eyes private debt, infrastructure in era of high interest ratesOct 25, 2023 (Gmt+09:00)

1 Min read -

ASK 2023Alternative investment forum ASK 2023 to begin Oct. 25 in Seoul

ASK 2023Alternative investment forum ASK 2023 to begin Oct. 25 in SeoulOct 23, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN