Clean energy remains top pick for Korean infrastructure investors

Traditional energy, real assets and power plants were the least favored; secondaries were the preferred tranche

By Apr 28, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

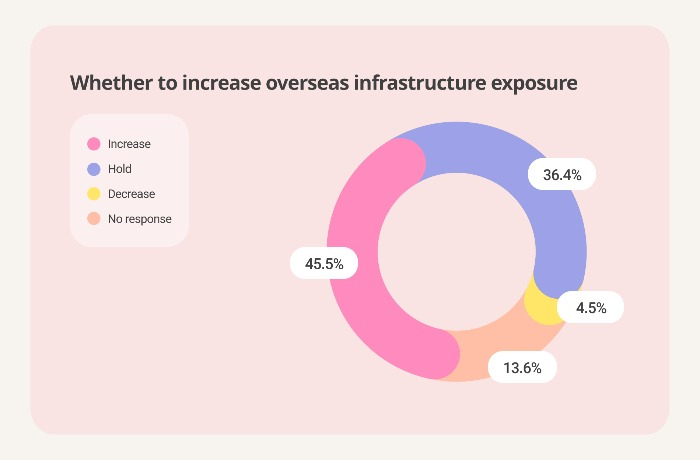

The survey was conducted in January of this year for Korea's 22 major institutional investors, including pension funds, mutual aid associations and insurers. Together they manage 2.11 quadrillion won ($1.59 trillion) in assets. Of the 22 investors, 20 manage 411.4 trillion won ($308.9 billion) in alternative assets.

The asset class attracted Korean investors thanks to its valuation. Some 40.9% said the asset class is fairly valued, while 45.5% thought it is moderately overpriced. None of them said it is highly valued or undervalued.

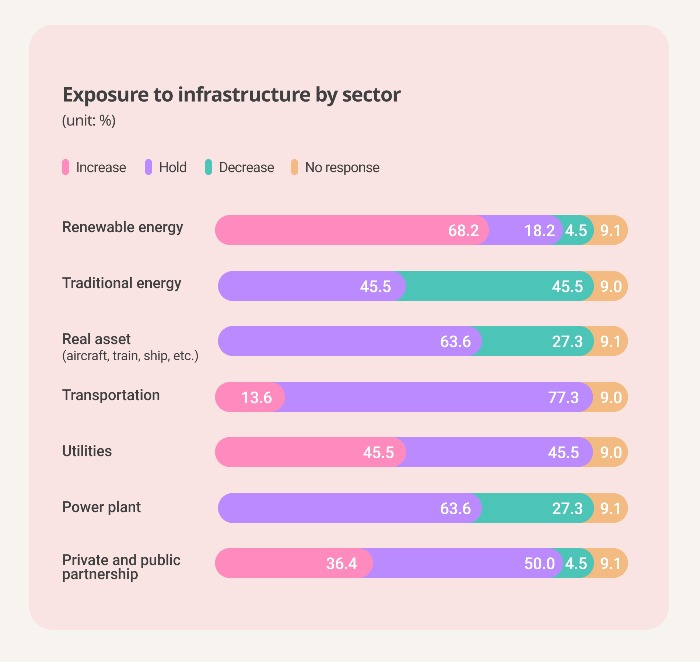

Renewable energy, such as solar, wind and water power, has topped infrastructure themes for Korean LPs for two straight years. More than 68% will increase the exposure, while 18.2% will maintain the current proportion. Only 4.5% will reduce the asset size.

Utilities, such as water, gas and electricity, ranked second on the investors’ list. Some 45.5% will raise the exposure, similar to the poll conducted last year. Another 45.5% will hold the current proportion; no surveyees will decrease it, the survey showed.

In contrast to renewables, traditional energy, or upstream, midstream and downstream, was the sector that investors plan to decrease the most. Some 45.5% said they will reduce and the same number said they will hold the current proportion; no surveyees said they will increase it.

Their disfavor of real assets -- such as aircraft, trains and ships -- as well as power plants has become more pronounced due to surging oil prices. Some 63.6% said they will hold exposure to the two sectors. Some 27.3% plan to decrease their investments in both themes; none of them will increase assets in the two sectors.

Private and public partnerships (PPP) won 36.4% of investors’ votes, dropping from 53.8% last year. Half of the surveyees stated they will keep the current proportion to the theme this year.

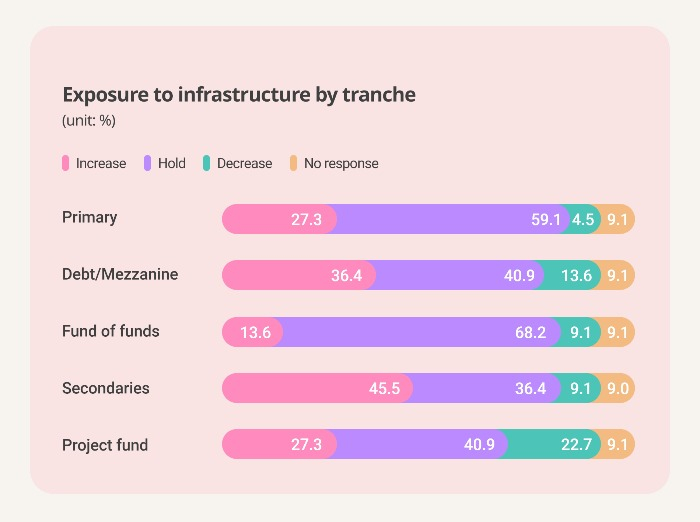

By tranche, secondaries came first, scoring 45.5%. Featured with mature and yielding portfolios, infrastructure secondaries transactions have rapidly grown with expanding primary markets in recent years.

Mezzanine debt, which has embedded equity instruments as warrants thus offering flexibility to investors, ranked second with 36.4%. Primary and project funds each followed with 27.3%, while fund of funds, requiring higher management fees and providing less transparency, was the least popular tranche with only 13.6%.Core plus, which aims for better income by upgrading well-located assets essential for living, has been the preferred strategy for two straight years. Value-add, or developing new assets targeting great profits, followed with 40.9%.

Some 27.3% said they will employ more core strategies, the safest scheme that provides steady cashflow. None of the respondents said they will increase opportunistic strategies, the riskiest and most complicated targeting tremendous gains through sales.

It has become clearer that Korean LPs prefer brownfield, or land previously built on, than greenfield, which has yet to be used for property. Some 45.5% said they will increase infrastructure on brownfield, while 13.6% are planning to expand greenfield assets.

Like other asset classes, infrastructure in North America and Europe is more favored than that in Asia, the survey showed. Some 45.5% will increase their infrastructure investments in North America, and 50% look to expand exposure to Europe.

About 27.3% of the surveyees are slated to sell their Asia-based infrastructure assets this year. Only 18.2% plan to increase exposure to the asset class in the region.

To view responses of individual institutions on their alternative asset allocation and fund manager selection, please visit Asset Owners Report.

Participants in this survey are as follows:

Public pensions and SWF

National Pension Service

Korea Investment Corporation

Government Employees Pension Service

Teachers' Pension

Korea Post (Insurance)

Mutual aids & associations

Yellow Umbrella Mutual Aid Fund

Military Mutual Aid Association

Public Officials Benefit Association

Korean Federation of Community Credit Cooperatives

The Korean Teachers' Credit Union

Insurers

Kyobo Life Insurance

Samsung Life Insurance

NongHyup Life Insurance

NongHyup Property and Casualty Insurance

Meritz Fire & Marine Insurance

Samsung Fire & Marine Insurance

Shinhan Life Insurance

Hanwha Life Insurance

Hyundai Marine and Fire Insurance

ABL Life Insurance

KB Insurance

KB Life Insurance

Write to Jihyun Kim at snowy@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

Private equityMore Korean LPs look to buyouts, special situations for private equity

Private equityMore Korean LPs look to buyouts, special situations for private equityApr 24, 2023 (Gmt+09:00)

4 Min read -

Private debtDirect lending tops private debt strategy again for Korean LPs

Private debtDirect lending tops private debt strategy again for Korean LPsApr 26, 2023 (Gmt+09:00)

4 Min read -

Asset Owners ReportS.Korean LPs to up exposure to private debt, infrastructure in 2023: Survey

Asset Owners ReportS.Korean LPs to up exposure to private debt, infrastructure in 2023: SurveyApr 19, 2023 (Gmt+09:00)

3 Min read -

Korean InvestorsRenewables emerge as LPs' top infrastructure sector

Korean InvestorsRenewables emerge as LPs' top infrastructure sectorMay 03, 2022 (Gmt+09:00)

3 Min read