Brokerages sit on $5.3 bn of global alternative assets to sell down

Korean institutional investors curbed their overseas alternative investments amid rate hikes, travel restrictions

By Jun 14, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Korean institutional investors haven't recovered their overseas alternative investments to pre-pandemic levels due to rate hikes and increased distressed assets, said Bank of Korea (BOK) on June 9 in its quarterly report regarding the country’s monetary and credit policy.

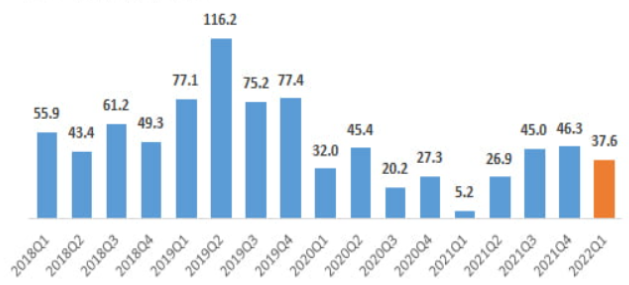

In Korea, the aggregate size of overseas alternative investment funds created during the first quarter of 2022 reached $3.76 billion, 19% down from $4.63 billion in the fourth quarter of 2021. The aggregate amount hit $11.62 billion in the second quarter of 2019 and then sharply declined during COVID-19.

The LPs' global alternative investments will continue to slow due to recent hikes in bond interest rates. This is because the LPs ramped up their global alternative assets as bond yield decreases before the pandemic, the report said.

Korea’s top eight securities firms, each with more than 5 trillion won of equity capital, had an aggregate 19.8 trillion won worth of exposure to overseas alternative investment as of end-June 2021, according to financial data firm NICE Information Service Co.

Hana Financial Investment Co. topped the list with 4.7 trillion won in global alternative investments, and Mirae Asset Securities Co. ranked second with 3.8 trillion won. NH Investment & Securities Co. and Meritz Securities Co. respectively scored 2.6 trillion won, and Korea Investment & Securities Co. and Shinhan Investment Corp. followed with more than 1 trillion won, respectively.

TO INCREASE ALTERNATIVE ASSETS AFTER RATE STABILIZES

The main reason is that Korean LPs cut their purchase of global alternative assets during COVID-19 due to difficulties in overseas due diligence and increased distressed assets, an investment banking official said.

As a number of global alternative assets turned distressed in the pandemic, the brokerage firms saw their financial conditions worsen, said Lee Kyu-hee, a senior researcher at NICE Information Service said in the report. Overdue interest and defaults occurred particularly in their hotel and airlift assets, Lee added.

Korean LPs may increase overseas alternative investments after interest rates stabilize, another IB source said. “The local LPs are pausing the global alternative investments due to the rate hikes, and their need for alternative assets will keep growing. They will be back to alternative investments after interest rates stabilize,” the source added.

Write to Tae-Ho Lee at thlee@hankyung.com

Jihyun Kim edited this article.

-

Pension fundsAlternative investment market at inflection point, says Suhyup CIO

Pension fundsAlternative investment market at inflection point, says Suhyup CIOMay 24, 2022 (Gmt+09:00)

3 Min read -

Alternative investmentsBrokerage firms see losses on $7 bn overseas alternatives

Alternative investmentsBrokerage firms see losses on $7 bn overseas alternativesJan 04, 2021 (Gmt+09:00)

2 Min read -

Asset managementBrokerages rush to outsourced fund management market

Asset managementBrokerages rush to outsourced fund management marketDec 07, 2021 (Gmt+09:00)

3 Min read -

Overseas derivativesBrokerage firms enjoy rising bets on global derivatives

Overseas derivativesBrokerage firms enjoy rising bets on global derivativesApr 14, 2021 (Gmt+09:00)

3 Min read