KTCU bumps up global PE investment by 90% since end-2018

By Sep 08, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

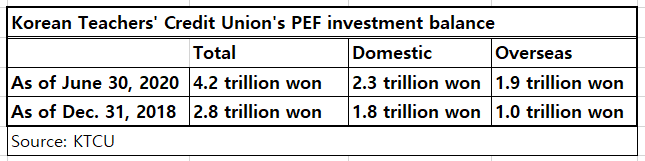

Between the end of 2018 and the end of June 2020, the retirement fund boosted the balance of its PE investments by 1.4 trillion won, of which the global portfolio accounted for 900 billion won, KTCU said on Sept. 8.

It has ramped up overseas PE investments since launching the PEF-focused corporate finance division in 2018.

“We have been meeting capital calls from blind-pool funds since 2018, which has sharply boosted the balance of our overseas PE investment,” said an KTCU source. “We have been investing in PEFs focused on developed markets such as North America, Europe and Australia for safe returns.”

In the first half of this year, KTCU posted an average investment return of 5.4%, slightly below the 6.3% a year earlier. But its first-half results still outperformed those of other Korean pension funds, including the National Pension Service's.

“Thanks to diversification into various investment sectors and a larger number of global management companies, we were able to secure solid returns from PEF investments. We will continue to increase investment in PEFs,” said the KTCU source.

Write to Seon-pyo Hong at rickey@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)