AI-based healthcare

Samsung, Bayer join $90 mn investment in AI healthcare app Ada Health

Another joint investment in May by Samsung and Bayer after $130 mn Series C funding on UK's Huma Therapeutics

By May 28, 2021 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. and Germany’s pharmaceutical giant Bayer AG have made a joint investment in the Berlin-based artificial intelligence (AI) healthcare app Ada Health.

Samsung’s US-based venture capital fund Samsung Catalyst Fund said on May 28 that it participated in the recent Series B round of funding that raised a total of $90 million for Ada Health.

The former chief strategy officer of Samsung Electronics, Young Sohn, is reported to have managed Samsung’s investment in the healthcare app.

This round of funding was led by Bayer through its investment unit Leaps by Bayer. Other than Bayer and Samsung, Vitruvian Ventures, Inteligo Bank, F4 and Mutschler Ventures joined the investment round.

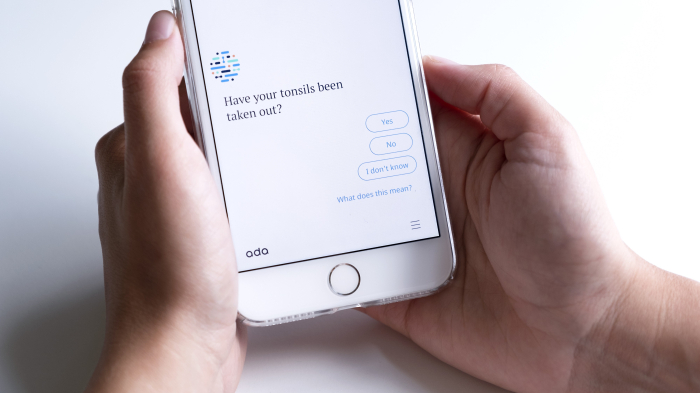

Founded in 2011, Ada Health’s AI-based remote healthcare app Ada provides services to around 11.4 million users globally. Ada’s AI chatbot asks a series of questions to the users to determine their health issues and offer guidance on the next steps accordingly.

Ada Health is reported to have more than 10 physicians under direct employment to answer more professional queries made by its users.

The fresh funding of $90 million primarily on expanding its services in the US market, according to Ada Health.

Samsung has been making regular investments in healthcare startups in recent years. Another investment made during this month, also together with Bayer, was the $130 million Series C funding by the British health-tech startup Huma Therapeutics.

Samsung made the investment through its other venture capital unit Samsung NEXT.

Write to Hyung-suk Song at click@hankyung.com

Daniel Cho edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN