South Korean defense industry thriving on strong overseas demand

The combined operating profit of S.Korea’s listed defense companies places it in the nation's top five manufacturing industries

By Apr 15, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The South Korean defense industry's current heyday is expected to continue for a while as global demand for Korean-made weapons and combat systems has surged amid growing geopolitical conflicts around the world.

According to Seoul-based financial data company FnGuide Inc., the combined sales of 31 listed defense companies in Korea stood at 43.1 trillion won ($30.3 billion) in 2024, up 16% from 2023.

Their sales have steadily increased since 2021's 29.6 trillion won.

Their combined operating profit also more than tripled to 3.64 trillion won from 2021, elbowing out the steel industry to become one of the country’s top five mainstay manufacturing industries alongside the semiconductor, auto, smartphone and shipbuilding sectors.

A jump in exports of Korean-made conventional weapons has led to the Korean defense industry boom, said industry experts.

Especially, orders for Korean artillery weapons and armored vehicles from Eastern Europe and the Middle East have increased significantly since the outbreak of the Russia-Ukraine war.

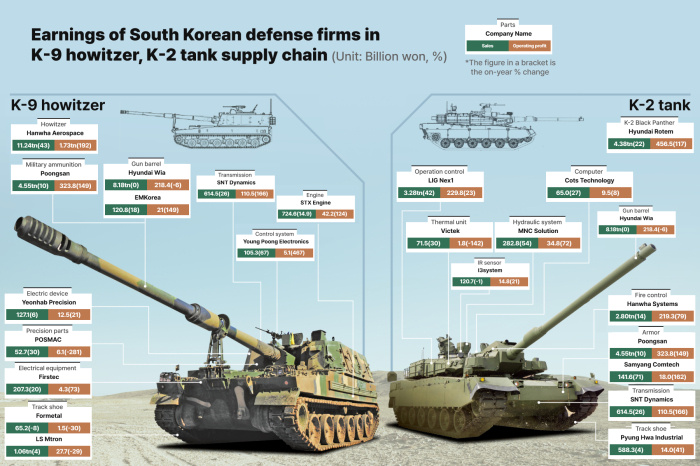

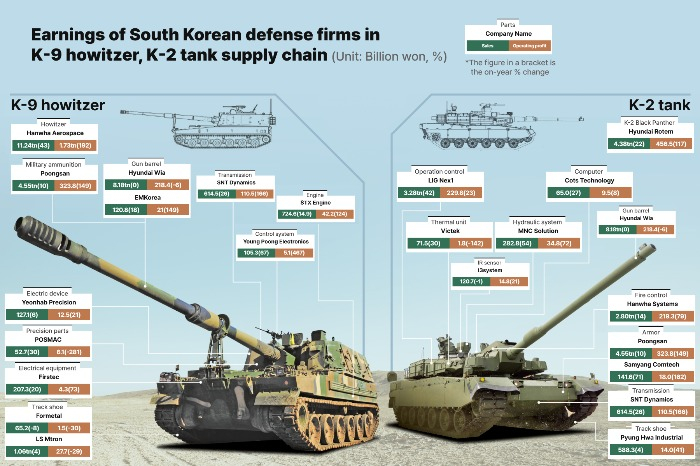

Sales of Hyundai Rotem Co., the supplier of the K-2 Black Panther tank, and Hanwha Aerospace Co., the supplier of the K-9 Thunder howitzer, have skyrocketed over the same period.

Their parts suppliers have also seen their sales double over a year.

“Because key export destinations of K-defense systems are located in Europe and the Middle East, they are free from the US tariff risk, meaning sales of the related companies are forecast to continue increasing,” said Park Hye-ji, an analyst at the Korea Institute for Industrial Economics and Trade.

SUSPENSION OF CFE IN EUROPE

Korean defense companies have benefited largely from European Union member countries’ decision to suspend the operation of the Treaty on Conventional Armed Forces in Europe (CFE) in response to Russia’s attacks on Ukraine in 2022.

The treaty, which had been in place since early 1990, has effectively limited the size of military forces in Europe, and the suspension of the treaty has opened a new market for Korean weapons.

South Korea, which is technically at war with North Korea, is one of the world’s three major producers of conventional weapons, along with the US and Germany.

The country’s defense technologies are largely home-grown, with an 80% localization rate.

The US administration led by President Donald Trump has also tightened the screws on the EU to share more defense costs, boding well for Korean defense systems’ sales in overseas markets.

SURGE IN DEFENSE EXPORTS

Since then, Poland and Romania have ordered 3.43 billion won and 1.24 trillion won worth of K-9 howitzers, respectively.

Poland will bring in an additional 7.08 trillion won worth of the K-9 next year.

Poland and Romania also ordered 9 trillion won and 4.5 trillion won worth of K-2 Black Panther battle tanks, respectively, last year.

More orders valued at 21.12 trillion won are also expected from Poland in 2026.

Thanks to such orders, Hanwha Aerospace and Hyundai Rotem raked in 11.24 trillion won and 4.38 trillion won in sales, respectively, in 2024.

LIG Nex1 Co. also reported its historic high annual sales of 3.28 trillion won in 2024, thanks to brisk exports of its air defense systems – mainly missiles and integrated systems.

The country’s major defense firms’ stellar performance has trickled down to their smaller crosstown parts suppliers.

Korea’s sole gun barrel maker, Hyundai Wia Corp., reported 345.7 trillion won in defense division sales in 2024, up 55% from the year prior.

The country’s military ammunition supplier, Poongsan Corp., also reported that its defense business logged 1.18 trillion won in sales last year, breaking the 1 trillion won threshold for the first time since its inception.

Other parts makers, including not only those supplying conventional weaponry systems but also electronic warfare and digital systems suppliers such as Firstec Co. and Cots Technology Co., enjoyed upbeat earnings last year.

Still, Korea lags behind other countries in military aircraft and spacecraft.

Defense industry experts said it is time for Korean defense companies to advance their defense aircraft technologies to expand their presence in the global defense supply chain.

Write to Jin-Woo Park and Jong-Hwan Won at jwp@hankyung.com

Sookyung Seo edited this article.

-

Aerospace & DefenseS.Korea’s defense order backlog reaches record $73.1 billion at end-2024

Aerospace & DefenseS.Korea’s defense order backlog reaches record $73.1 billion at end-2024Feb 17, 2025 (Gmt+09:00)

3 Min read -

Aerospace & DefenseS.Korea’s LIG Nex1, Iraq set for $2.6 billion deal on M-SAM missile system

Aerospace & DefenseS.Korea’s LIG Nex1, Iraq set for $2.6 billion deal on M-SAM missile systemSep 12, 2024 (Gmt+09:00)

3 Min read -

Aerospace & DefenseHyundai Rotem’s earnings, shares set to rise; defense deals in the offing

Aerospace & DefenseHyundai Rotem’s earnings, shares set to rise; defense deals in the offingAug 29, 2024 (Gmt+09:00)

2 Min read -

Aerospace & DefenseHanwha Aerospace, Poland sign $1.6 billion Chunmoo rocket launcher deal

Aerospace & DefenseHanwha Aerospace, Poland sign $1.6 billion Chunmoo rocket launcher dealApr 25, 2024 (Gmt+09:00)

1 Min read -

Aerospace & DefenseHanwha Aerospace to export more K9 howitzer to Poland

Aerospace & DefenseHanwha Aerospace to export more K9 howitzer to PolandDec 04, 2023 (Gmt+09:00)

1 Min read -

Aerospace & DefenseHyundai Rotem delivers first batch of K2 tanks to Poland in $3.4 bn deal

Aerospace & DefenseHyundai Rotem delivers first batch of K2 tanks to Poland in $3.4 bn dealDec 07, 2022 (Gmt+09:00)

1 Min read -

Aerospace & DefenseHyundai, Hanwha ink $5.8 bn defense deals with Poland

Aerospace & DefenseHyundai, Hanwha ink $5.8 bn defense deals with PolandAug 26, 2022 (Gmt+09:00)

1 Min read -

Aerospace & DefenseS.Korean defense firms receive $15 bn order from Poland

Aerospace & DefenseS.Korean defense firms receive $15 bn order from PolandJul 27, 2022 (Gmt+09:00)

2 Min read -

Aerospace & DefenseS.Korea defense firms poised to ink $7.7 bn in deals with Poland

Aerospace & DefenseS.Korea defense firms poised to ink $7.7 bn in deals with PolandJul 20, 2022 (Gmt+09:00)

3 Min read