Shareholder activism

JB Financial refuses activist fund's request to increase dividends

JB says a sharp rise in payouts will hurt its growth; it will put the matter to a vote at the March 30 shareholders' meeting

By Mar 03, 2023 (Gmt+09:00)

1

Min read

Most Read

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

South Korea’s JB Financial Group Co. has refused a local activist fund’s request to raise dividend payouts, stressing such a measure will significantly hurt the group’s growth.

JB, the parent of local banks Kwangju Bank and Jeonbuk Bank, is set to vote on its dividend policy at the general shareholders’ meeting on March 30. The group has proposed a 715 won ($0.55) dividend per share, while Align Partners Capital Management, the activist fund and the second-largest stakeholder of the group, demands 900 won.

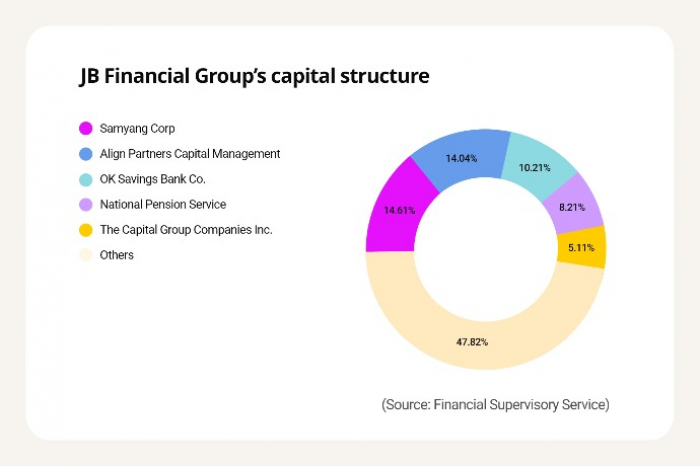

Align holds a 14.04% stake, similar to top shareholder Samyang Corp.’s 14.61% ownership. The No. 3 stakeholder is OK Savings Bank Co. with 10.21%.

Align is requesting that JB reduce the ratio of its risk-weighted assets (RWA) to total assets.

JB is slated to set the annual increase rate of the ratio at 7-8%, while the activist fund is demanding 4-5%. A lower RWA ratio to total assets raises a bank’s common equity tier 1 (CET1), the highest quality of regulatory capital, which allows more dividend payouts.

The activist fund insists that JB’s target total returns to shareholders, the company's earnings after taxes divided by total shareholders' equity, should be 35% when its CET1 is 11-12%.

On the other hand, JB said a simulation analysis has shown the lower RWA ratio will halve the group’s current yearly profits in three to five years.

Align’s proposal on dividend payouts would be akin to killing a golden goose for JB, an official for the group’s board said.

JB has also recommended its three outside directors, whose term will end later this month, as candidates for directors next term.

Market watchers say the group won’t accept Align’s demand to appoint Kim Ki-seok, Bank of America Securities Inc.'s former Korea branch manager and current managing partner at crowdfunding platform Crowdy Inc., as an outside director.

Write to Sang-Yong Park and Bo-Hyung Kim at yourpencil@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Shareholder activismSouth Korean companies rattled by activist shareholders

Shareholder activismSouth Korean companies rattled by activist shareholdersFeb 06, 2023 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsKorean activist fund KCGI buys Meritz Asset Management

Mergers & AcquisitionsKorean activist fund KCGI buys Meritz Asset ManagementJan 09, 2023 (Gmt+09:00)

1 Min read -

Private equityKorean banks must increase total shareholder returns: Align Partners

Private equityKorean banks must increase total shareholder returns: Align PartnersJan 02, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN