Pension funds

NPS to commit $1.1 billion to external managers in 2024

This will be the Korean pension fundŌĆÖs largest-ever investment allocation to GPs, and will include distressed debts for the first time

By Apr 28, 2024 (Gmt+09:00)

2

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

UAE to invest up to $1 bn in S.Korean ventures

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

US multifamily market challenges create investment opportunities

South KoreaŌĆÖs National Pension Service (NPS) will select domestic general partners (GPs) to manage about 1.5 trillion won ($1.1 billion) worth of investment this year, its biggest-ever external allocation also set to invest in high-default-risk bonds for the first time.

The NPS announced on Friday that it has embarked on a process to hire external managers based in Korea for 1.55 trillion won worth of investments in private equity funds, credit and distressed securities and venture funds for 2024.

This is the largest-ever external investment commitment by the worldŌĆÖs third-largest pension fund with 1,048.8 trillion won worth of assets under management (AUM) as of January 2024.

For the first time, the NPS will add distressed securities to its external portfolio with an investment of 350 billion won this year.

The Korean pension fund will appoint up to three external managers for investments in bank credit, convertible bonds (CBs), bonds with warranty (BWs), redeemable convertible preferred shares (RCPS) and exchangeable bonds (EBs), which should make up more than 80% of each fund.

Of the total external investment, the biggest 1 trillion won will be assigned to PEF investments this year. This is 25% more than last yearŌĆÖs amount.

Last year, the NPS committed a combined 800 billion won to three private equity firms ŌĆō Hahn & Co., Macquarie Asset Management and IMM Private Equity.

This year the pension fund will choose a maximum of four private equity firms to run the funds, in which they will invest between 100 billion to 350 billion won each.

It will grant up to 200 billion won to venture funds that four GPs will likely share. ┬Ā

The NPS plans to receive PEF proposals by May 16 and pick the final winners in July. It will start the recruitment process for credit/distressed debt fund managers in July to announce the results in September.

Next, it will start receiving venture fund proposals in September to name the funds' grantees by November.

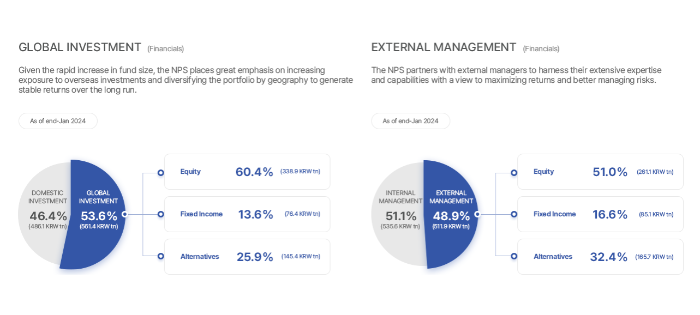

As of the end of January 2024, 48.9%, or 511.9 billion won, of the Korean pension giantŌĆÖs total AUM is committed to external managers, according to the NPS.

Its investments in overseas assets accounted for 53.6%, or 561.4 billion won, of its total assets, while the remaining in domestic investments.

The pension fund reported earlier last week that it lost 1.66 trillion won in domestic stock value in the first quarter of this year as its holdings in battery-related stocks decreased amid the prolonged slump in the global electric vehicle market.

Last year, the NPS delivered the best investment results since its inception in 1999 with a 13.59% annualized return.

In June of last year, the NPS announced its 2024-2028 asset allocation plan with more alternative investments but less fixed-income investment as part of its long-term goal to boost profitability. It has allocated 55% of its total assets in stocks, 30% in bonds and 15% in alternative assets.

Write to Byeong-Hwa Ryu at hwahwa@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketNPS to invest up to $8.2 bn in undervalued Korean stocks

Korean stock marketNPS to invest up to $8.2 bn in undervalued Korean stocksMar 01, 2024 (Gmt+09:00)

3 Min read -

Pension fundsNPS logs record return rate in 2023 on stocksŌĆÖ bull run

Pension fundsNPS logs record return rate in 2023 on stocksŌĆÖ bull runFeb 28, 2024 (Gmt+09:00)

2 Min read -

Pension fundsNPS taps Macquarie, IMM, Hahn & Co. as private equity managers

Pension fundsNPS taps Macquarie, IMM, Hahn & Co. as private equity managersJun 30, 2023 (Gmt+09:00)

1 Min read -

Pension fundsNPS vows to raise alternative investment ratio, cut bond purchases

Pension fundsNPS vows to raise alternative investment ratio, cut bond purchasesJun 01, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN