LG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slows

LG plans to supply batteries for Ford’s commercial vehicles from other factories, vowing to expand their partnership

By Nov 12, 2023 (Gmt+09:00)

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

A planned battery manufacturing joint venture between South Korea’s top battery maker LG Energy Solution Ltd., US carmaker Ford Motor Co. and a Turkish partner has been scrapped amid growing concerns over the slowing pace of electric vehicle adoption.

LG said Turkish investment holding company KOC Holding AS canceled the three-way agreement to build a battery cell JV for commercial EVs in Baskent, a city near the Turkish capital of Ankara.

KOC revoked its commitment to the JV, citing a slowdown in EV uptakes in Europe, saying the timing is not “appropriate.”

The Turkish firm said future battery cell investments will be evaluated in line with the dynamics of the European EV market.

The three partners signed a non-binding agreement in February, aimed at establishing one of Europe’s largest EV battery cell facilities near Ankara.

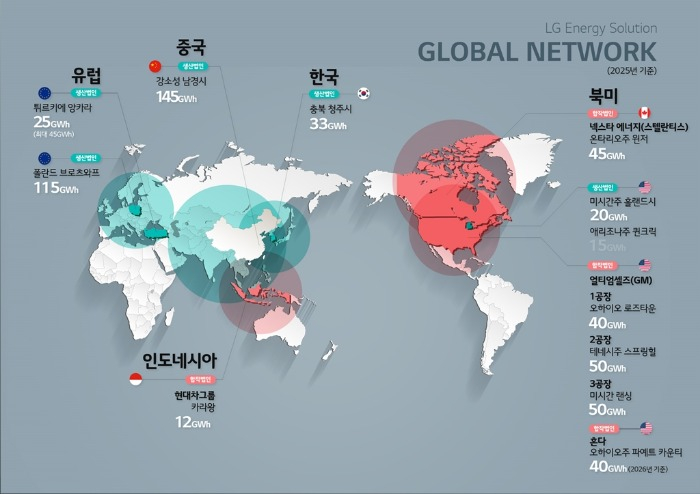

Under the deal, the companies were to break ground on the JV factory by the end of this year with production scheduled for 2026. LG said the plant initially would have an annual productional capacity of 25 gigawatt hours (GWh) before eventually expanding to 45 GWh, enough for 500,000 electric cars.

Sources said last week that the three-party battery JV is likely to be postponed as the global EV market is slowing.

Battery cells produced at the factory were supposed to be supplied to Ford for its commercial vehicles, mostly the E-Transit, the electric version of the Transit van.

Ford and KOC operate an electric car JV, Ford Otosan, which can produce 450,000 commercial vehicles in Turkey, targeting the European market.

LG SUPPLIES TO FORD COME FROM OTHER FACTORIES

LG Energy said the scrapped JV project won’t affect its battery cell supplies to Ford.

“Batteries for Ford’s commercial vehicles will be supplied from our existing factories elsewhere. We expect our partnership with Ford to continue to expand,” said an LG official.

He said LG will continue to support Ford’s vision to offer a variety of EVs, including commercial vehicles, throughout Europe by 2035.

A global leader, LG has a combined annual production capacity of 200 GWh worldwide, with its production bases in six countries, including Korea, Poland, China and the US. As of the end of 2022, the company had an order backlog worth 385 trillion won ($295 billion).

LG, a Ford partner since 2011, last year said it would double its battery production capacity at its factory in Poland. As demand slows, however, the company recently said it plans to lower its operation rates in Poland.

EVOLVING NATURE OF EV INDUSTRY

The cancellation of the LG-Ford-KOC JV reflects the rapidly evolving nature of the EV industry with carmakers and battery producers taking a more cautious approach when navigating changing demands and market trends.

A Ford spokesman recently said EV sales are growing everywhere but “the pace of adoption is slower than what folks in the industry, including Ford, originally expected.”

Ford’s scrapped JV project with LG Energy follows a similar decision in January to cancel a 4 trillion won battery JV in Turkey with another Korean battery maker, SK On Co., citing higher interest rates and borrowing costs.

Battery materials makers in Korea are also adjusting their investment plans.

Korea Zinc Inc., the world’s largest non-ferrous metal smelter, recently delayed mass production of copper foil, a battery material, until the first half of next year from its original plan to start operations in the third quarter of this year.

L&F Co., which counts Tesla Inc. among its major clients, postponed a planned ramp-up of its cathode plants while reducing the size of its facilities for the anode, precursors and lithium iron phosphate (LFP) materials.

EcoPro BM Co. slashed its 2023 facility investment by 10% to 1.2 trillion won, citing an industry view that capacity will exceed demand for at least three years.

Write to Nan-Sae Bin at binthere@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLG Energy, SK On to delay battery JVs with Ford as demand slows

BatteriesLG Energy, SK On to delay battery JVs with Ford as demand slowsNov 07, 2023 (Gmt+09:00)

4 Min read -

BatteriesLG Energy may partner with JSW to make EV batteries in India

BatteriesLG Energy may partner with JSW to make EV batteries in IndiaSep 22, 2023 (Gmt+09:00)

2 Min read -

BatteriesKorea Zinc likely to supply copper foil to LG Energy for EV batteries

BatteriesKorea Zinc likely to supply copper foil to LG Energy for EV batteriesJul 17, 2023 (Gmt+09:00)

3 Min read -

BatteriesFord, LG Energy to build Turkey EV battery plant for Europe

BatteriesFord, LG Energy to build Turkey EV battery plant for EuropeFeb 22, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in Kentucky

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in KentuckyDec 06, 2022 (Gmt+09:00)

3 Min read -

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK On

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK OnSep 16, 2022 (Gmt+09:00)

3 Min read