Short-selling resumption

Korea to lift short-selling ban on large stocks; retail investors resist

By Feb 04, 2021 (Gmt+09:00)

2

Min read

Most Read

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

South Korea’s financial regulator has decided to allow the short selling of large-cap stocks from May 3 despite opposition from retail investors, who are calling for a complete ban for good.

The decision also comes following criticism from foreign and institutional investors over the ban, which has been in place since mid-March of last year to tame volatility on the local stock market amid the pandemic.

The Financial Services Commission (FSC) said on Wednesday that the short-selling ban will be lifted for stocks on the benchmark Kospi 200 Index and the junior Kosdaq 150 Index.

Except for these 350 relatively large stocks, short selling for some 2,000 other stocks on the two local bourses will continue to be prohibited beyond May 3.

In early Thursday trade in Seoul, Samsung Electronics Co., the largest stock on the Kospi, fell 2% at 82,900 won, while Celltrion Healthcare Co., the biggest-cap share on the junior Kosdaq market, was down 1.7% at 146,700 won.

The government imposed a six-month blanket ban on short selling on Mar. 16, 2020, as the local market was plummeting, gripped by fear of the spread of COVID-19.

The regulator has since extended the ban twice until March 15, 2021.

PARTIAL LIFTING

The FSC’s latest decision means the short-selling ban on all stocks will remain valid until May 2.

“There has been heated debate for some time on whether to extend the ban or not. We’re announcing this measure now to remove market uncertainty over the issue,” said FSC Chairman Eun Sung-soo at a press conference.

The partial lifting of the ban comes after the local stock market staged a strong recovery, following a coronavirus-driven market rout over the past year, and was trading at record highs on the back of heavy retail trading.

Korea’s individual investors, widely known as the Ants, emerged as an influential buying force amid ample liquidity in the pandemic era, boosting the benchmark Kospi index about 30% last year.

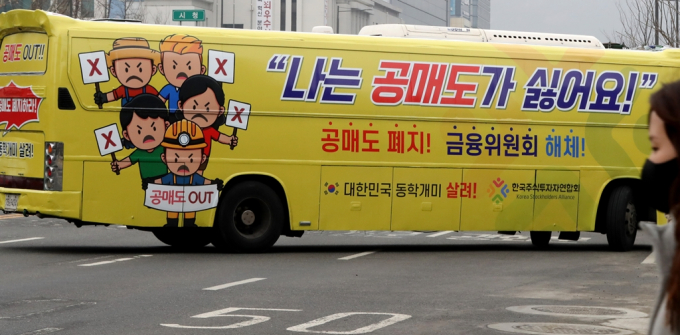

Emboldened retail investors have criticized the short-selling system, saying the practice puts them at a disadvantage over powerful foreign investors and institutions and fuels share price declines when the market falls.

ANTS VOW TO FIGHT TO MAKE BAN PERMANENT

As smaller investors in the US apparently reigned victorious against hedge funds over the short selling of GameStop shares, a US video-game retailer, the Korean Ants have taken similar moves in their defiance of the short-selling practice.

“We want a total ban on short selling. The FSC’s announcement on partial lifting will make neither side happy,” said the Korea Stockholders Alliance.

Korean politicians backed the retail investors’ move, pressuring financial regulators to extend the ban on short selling ahead of the important by-elections in April.

However, a senior official of the International Monetary Fund (IMF) last week warned against the extension of the ban, saying that Korea’s economic and financial market conditions have now improved sufficiently to lift the ban.

Analysts said the FSC’s decision is a compromise because regulators are aware of the need for short selling but cannot ignore the public opposition.

Write to Hyeong-Ju Oh at ohj@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

-

Kospi market capS.Korea's stock market cap tops nominal GDP for the first time

Kospi market capS.Korea's stock market cap tops nominal GDP for the first timeJan 03, 2021 (Gmt+09:00)

2 Min read -

Year of ants investorsKorea’s retail investors shed loser image, turn pandemic into bonanza

Year of ants investorsKorea’s retail investors shed loser image, turn pandemic into bonanzaDec 21, 2020 (Gmt+09:00)

4 Min read -

Kosdaq outlookKosdaq at 20-yr high, eyes opportune moment to emerge from bush league

Kosdaq outlookKosdaq at 20-yr high, eyes opportune moment to emerge from bush leagueDec 18, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN