Markets

Korea to fine Credit Suisse, Nomura $40 mn on short sales

The penalties are about half the amount of the naked short-selling transactions

By May 07, 2024 (Gmt+09:00)

3

Min read

Most Read

Deutsche Bank's Korea IB head quits after country head resigns

Macquarie Korea Asset Management confirms two nominees

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Korea's Taeyoung to sell local hotel to speed up debt workout

Meritz leaves door open for an M&A, to stay shareholder friendly

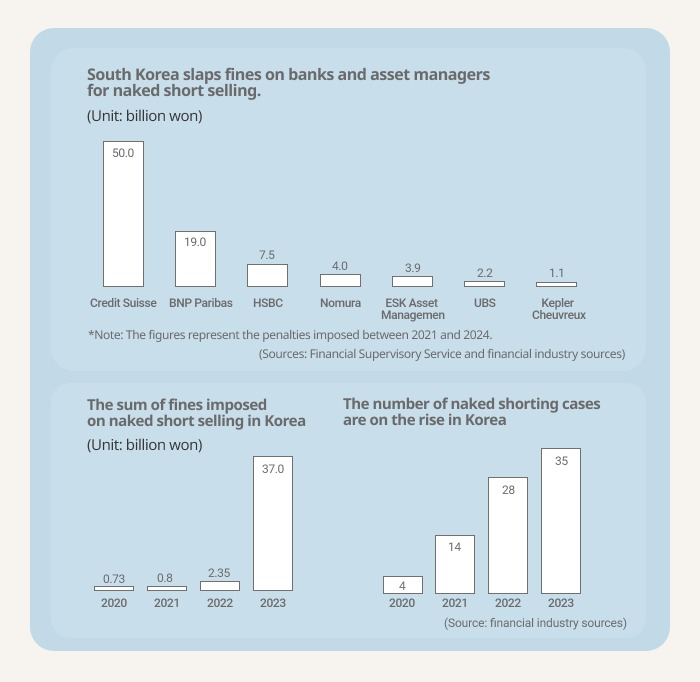

South KoreaŌĆÖs top financial regulator has recently notified Credit Suisse and Nomura Securities of a decision to fine them a combined 54.0 billion won ($40 million) for allegedly illegal short selling, including around 50 billion won to be imposed on Credit Suisse, according to financial industry sources.

The penalties charged for the Switzerland-based bank, if finalized, would be the largest-ever fine slapped on a bank for naked short selling in South Korea, which industry observers said is unprecedently high even in the global banking sector.

The amount is equivalent to about half the transaction value of the two banksŌĆÖ naked shorting conducted between 2021 and 2023 since the country adopted laws to criminalize illegal short sales in 2021.

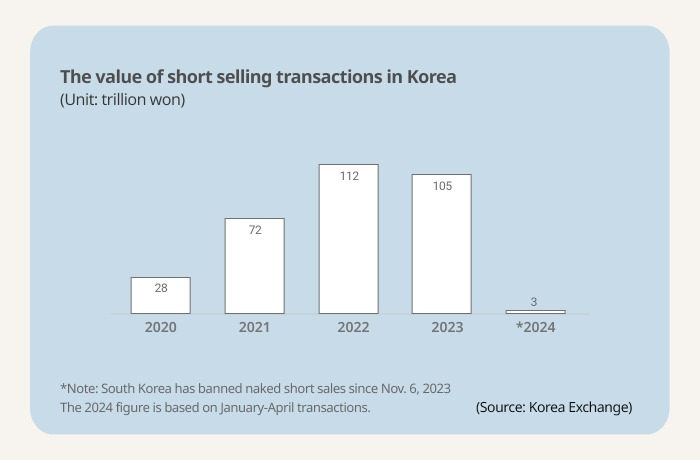

On Monday, the Financial Supervisory Service (FSS) said it has uncovered 211.2 billion won ($156 million) of naked short sales of Korea-listed stocks by Credit Suisse, Nomura Securities and seven other global banks between 2021 and 2023.

Of the total, Credit Suisse and Nomura made up more than half at 116.8 billion won.

The figure includes the 55.6 billion won of naked short selling executed by BNP Paribas and HSBC, for which they were fined a combined 26.52 billion won ($20.4 million) last December.

The remainder is 38.8 billion won conducted by five unidentified foreign banks, in which the FSS has yet to complete investigations.

The watchdog said the nine foreign banks shorted 164 stocks listed in South Korea, without first borrowing them, between 2021 and 2023. The stocks include those of Hotel Shilla Co. and Kakao Corp.

If the five unidentified banks are fined for naked short selling, the total sum of penalties to be slapped on the nine banks will likely surpass 100 billion won, according to the industry sources.

ŌĆ£The penalty for illegal short selling varies, depending on the intentionality of the order, the value of illegal transactions and profits they took from the trade, and the rate of order execution,ŌĆØ said a senior FSS official.

ŌĆ£In principle, they can be fined up to 100% of the illegal transaction amount.ŌĆØ

Credit Suisse and Nomura were not immediately available for comment.

WARNING TO GLOBAL BANKS

The FSS said their naked short selling was not involved in unfair trading practices such as stock price manipulation and trading on undisclosed information, nor aimed at taking profits from stock price moves.

Instead, their short selling was carried out to reduce borrowing costs and increase fee income from arranging the trade for hedge funds and other institutional investors.

Ham Yong-il, the deputy governor of FSS, said the nine foreign banks had taken an insignificant amount of profits from naked short selling in aggregate, with some of them incurring losses from the transactions.

ŌĆ£Slapping a fine of more than 10 billion won even on commission-based transactions again is a clear warning to global investment banks,ŌĆØ said an asset management company official.

"It is aimed at increasing the potential costs of naked short selling so that they will not accept the orders of unborrowed stock selling," he added.

According to the FSS, most of the naked short selling appeared to have been conducted due to insufficient internal controls, or the lack of a relevant system.

As an example, traders placed sell orders before fixing the number of stocks they needed to borrow for shorting, or made calculation errors while shorting stocks.

But the regulatory body said it will no longer regard these as simple mistakes.

Write to Han-Gyeol Seon and Ik-Hwan Kim at always@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Short sellingKoreaŌĆÖs top regulator detects more foreignersŌĆÖ naked shorting

Short sellingKoreaŌĆÖs top regulator detects more foreignersŌĆÖ naked shortingJan 04, 2024 (Gmt+09:00)

2 Min read -

RegulationsBNP Paribas, HSBC fined $20.4 million in Korea for naked short-selling

RegulationsBNP Paribas, HSBC fined $20.4 million in Korea for naked short-sellingDec 26, 2023 (Gmt+09:00)

3 Min read -

Short sellingHSBC, BNP Paribas reported to Korean prosecutors for naked shorting

Short sellingHSBC, BNP Paribas reported to Korean prosecutors for naked shortingDec 04, 2023 (Gmt+09:00)

3 Min read -

Korean stock marketKorea warns foreigners of stricter rules on illegal short selling

Korean stock marketKorea warns foreigners of stricter rules on illegal short sellingSep 07, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN