South Korea’s economic contraction deepens recession woes

January's semiconductor exports are on course to post the largest decline since the 2008-09 global financial crisis

By Jan 26, 2023 (Gmt+09:00)

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

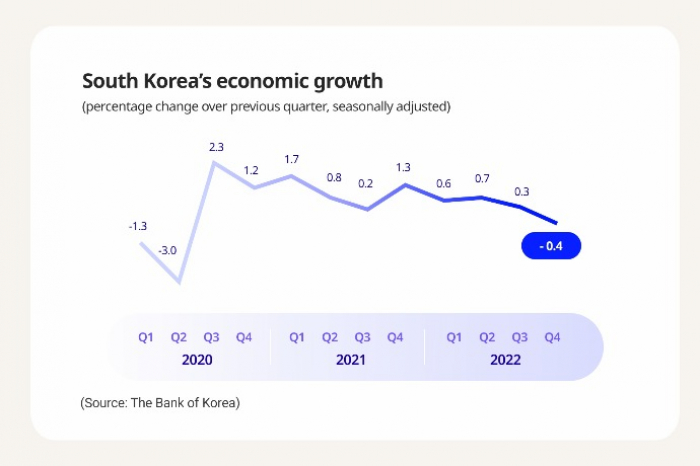

South Korea suffered its first economic contraction in two and half years due to sluggish exports and weak domestic demand during the fourth quarter of 2022, adding to concerns over a recession in Asia’s fourth-largest economy.

The economy shrank by a seasonally adjusted 0.4% in the October-December period from the previous three months, central bank data showed on Thursday. The gross domestic product (GDP) last contracted in the second quarter of 2020 with the deepening impact of COVID-19 on the global economy.

A senior Bank of Korea official said it was hard to predict an economic rebound in the current quarter.

“Exports remained sluggish but private consumption is increasing on-year with personal credit card use growing,” said Hwang Sang-pil, head of the BOK’s economic statistics bureau, after releasing the growth data. “It is difficult to gauge now whether the economy in the first quarter will grow or contract.”

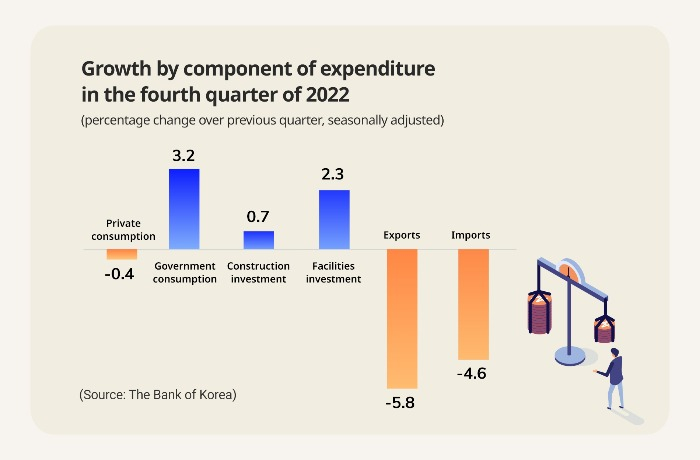

Overseas sales skidded 5.8% in the fourth quarter of last year from the prior three months on lower shipments of semiconductors, the country’s top export item, and chemical products. Private consumption also dipped 0.4% as rising inflation and higher interest rates, as well as falling asset prices, hurt sales of both goods and services.

The manufacturing sector shrank by 4.1%, the largest contraction in two and a half years, extending its falling streak to a third straight quarter.Finance Minister Choo Kyung-ho said the economy was expected to grow in the first quarter on the base effect and China’s economic reopening.

The outlook for the economy remained gloomy, however, as falling semiconductor exports hurt the country’s overall overseas sales.

Semiconductor exports tumbled 34.1% to $4.4 billion in the first 20 days of January from a year earlier, which would mark the largest decline since March 2009 – when the 2008-09 global financial crisis rattled the global economy – if maintained until the end of this month, according to separate data from the customs office on Wednesday.

Electronics component exports have been falling for the fifth straight month, since August of last year.

Semiconductor exports accounted for 19.3% of South Korea's total overseas sales last year. The country is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

South Korea’s total exports declined 2.7% to $33.6 billion in the first 20 days of January while imports grew 9.3% to $43.9 billion, generating a trade deficit of $10.3 billion, 21.6% of the country’s record trade shortfall for the whole of 2022.

Exports to China, the country’s top overseas market, tumbled 24.4% but imports rose 9.7%, producing a trade deficit of $3.2 billion against the mainland, nearly triple the record monthly trade shortfall of $1.3 billion against the world’s second-largest economy reported in October 2022.

“The global economic slowdown has slashed demand for South Korea’s export products. Falling prices of a key item – semiconductors – also weigh on overall exports,” said Minister of Trade, Industry and Energy Lee Changyang. “The economy is likely to improve in the second half, helping exports recover.”

Write to Mi-Hyun Jo, Eui-Jin Jeong and Byung-Uk Do at mwise@hankyung.com

Jongwoo Cheon edited this article.

-

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by half

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by halfJan 06, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung may cut spending as foundry players brace for downturn

Korean chipmakersSamsung may cut spending as foundry players brace for downturnJan 13, 2023 (Gmt+09:00)

3 Min read -

-