POSCO Future M to supply LG Energy Solution $22.6 bn worth of cathodes

The latest long-term cathode deal has bumped up the company’s cumulative battery materials orders to nearly 100 trillion won

By Apr 26, 2023 (Gmt+09:00)

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

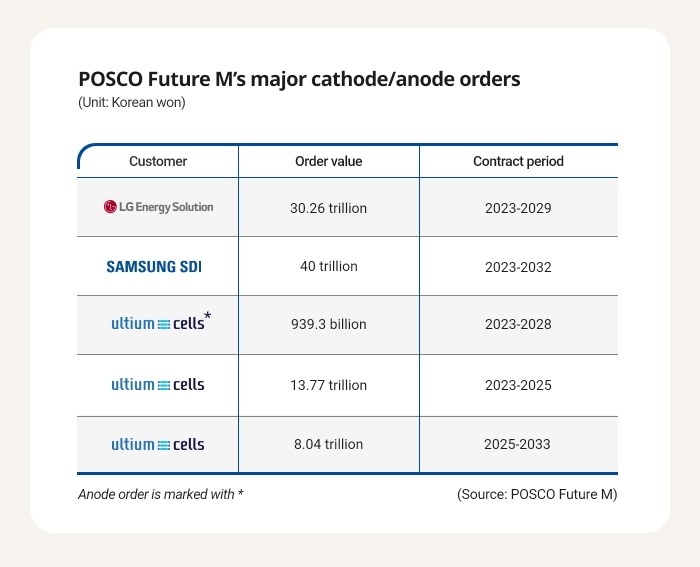

POSCO Future M Co. on Wednesday signed a long-term contract with LG Energy Solution Ltd. (LGES) to supply 30.26 trillion won ($22.6 billion) worth of cathodes to the world’s second-largest electric vehicle battery maker, the battery materials manufacturing unit under South Korean steel giant POSCO Holdings Inc. announced on the same day.

Under the deal, POSCO Future M will supply high-nickel cathodes to LG Energy Solution’s battery-producing facilities across the world from 2023 to 2029.

This is the company’s second-largest battery materials order after the 40 trillion won cathode order from another major secondary battery maker Samsung SDI Co. But considering that is a 10-year contract, the seven-year cathode order from LG Energy Solution is bigger on a yearly basis.

Combined with the latest order, POSCO Future M’s cumulative cathode orders have reached 92 trillion won, of which 52 trillion won is from LG Energy Solution, the top secondary battery maker in Korea, underscoring deepening business ties between the two companies.

Since POSCO Future M entered the battery materials market in 2011, it has been working closely with LG Energy Solution to develop battery materials.

It first delivered cathodes and anodes to the world’s second-largest battery maker in 2012, followed by another major cathode order worth 1.85 trillion won in 2020. It also won a 22 trillion won cathode order from Ultium Cells LLC, a battery cell joint venture between LG Energy Solution and General Motors Co. in the US.

The cathode is a core material of a lithium-ion battery that determines battery volume and power level. It also accounts for more than 40% of the total battery raw materials cost.

High-nickel cathodes are mainly used in EV batteries and are considered high-value-added materials because they significantly improve EV driving range with larger energy storage capability thanks to maximized nickel use. But as cobalt, manganese and aluminum are used together, batteries with high-nickel cathodes are guaranteed to have higher stability and power.

AS A GLOBAL TOP-TIER BATTERY MATERIALS PLAYER

After bagging a number of major battery materials orders in quick succession, POSCO Future M is readying to for its next leap in becoming a global top-tier battery materials player by diversifying its product portfolio centered around high-nickel cathodes, synthetic graphite and silicon anodes to meet growing demand for advanced materials amid burgeoning EV demand.

It is also reviewing plans to expand its production lines not only in Korea but also in other key EV markets such as the US, China and Europe.

The company on Monday announced a plan to invest 614.8 billion won to build a new cathode factory in Pohang to churn out an additional 46,000 tons of high-nickel cathodes.

When the new production facility construction is completed by end-2025, the company’s total cathode production capacity will jump to 271,000 tons a year.

It currently produces a total 105,000 tons of cathodes from its factories in Korea and China, while building new cathode manufacturing facilities in Pohang, a port city on Korea’s southeast coast that is home to POSCO Holdings, as well as plants in Canada and China, each with an annual production capacity of 30,000 tons.

With the additional investments, POSCO Future M aims to ramp up its global cathode production capacity to 610,000 tons and anode capacity to 320,000 tons in 2030. It currently produces 82,000 tons of anodes annually.

POSCO Future M, formerly POSCO Chemical, is expected to build manufacturing facilities in Gwangyang, where POSCO’s major steel mills are located, to produce key battery materials such as anodes, cathodes and precursors under its parent company’s grand plan to turn the reclaimed land into a manufacturing center for the group’s new growth engines of rechargeable battery ingredients and hydrogen, with 4.4 trillion won in investment by 2033.

Write to Jae-Fu Kim at hu@hankyung.com

Sookyung Seo edited this article.

-

BatteriesPOSCO Future M to inject $461 mn to bulk up cathode production

BatteriesPOSCO Future M to inject $461 mn to bulk up cathode productionApr 24, 2023 (Gmt+09:00)

2 Min read -

-

Chemical IndustryPOSCO Future M to spend $300 million on NCA cathode plant in Pohang

Chemical IndustryPOSCO Future M to spend $300 million on NCA cathode plant in PohangMar 21, 2023 (Gmt+09:00)

1 Min read -

-

BatteriesPOSCO Chemical breaks ground on second anode material plant

BatteriesPOSCO Chemical breaks ground on second anode material plantFeb 01, 2023 (Gmt+09:00)

1 Min read -

BatteriesPOSCO Chem, Samsung SDI ink $33 bn EV battery material deal

BatteriesPOSCO Chem, Samsung SDI ink $33 bn EV battery material dealJan 30, 2023 (Gmt+09:00)

4 Min read -

BatteriesPOSCO Chemical completes world's largest cathode materials plant

BatteriesPOSCO Chemical completes world's largest cathode materials plantNov 10, 2022 (Gmt+09:00)

1 Min read