Artificial intelligence

Nvidia invests in Korean generative AI startup Twelve Labs

Big Tech companies are fiercely competing in the generative AI sector through active investments to not get left behind

By Oct 24, 2023 (Gmt+09:00)

4

Min read

Most Read

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Nvidia Corp., a global chip designer, made its first investment in a South Korean generative artificial intelligence startup as Big Tech companies Google and Microsoft Corp. rushed to provide capital to newly established firms with competitive technology in the sector for future growth.

Nvidia recently participated in a pre-Series A round of South Korean generative AI startup Twelve Labs, which aimed to raise 13 billion won ($9.7 million), according to information technology industry sources in Seoul on Tuesday. Samsung Next, the corporate venture capital unit of the world’s top memory chipmaker Samsung Electronics Co., and Korea Investment Partners, a local venture capitalist, joined the round.

Twelve Labs secured 16 billion won in a seed round last December.

Nvidia had been supporting South Korean startups by providing technology education and consulting. But the Silicon Valley-based company was known to have not made any direct investments in any generative AI startups in the country until now.

“Nvidia is gearing up for investments in Korean startups with a schedule for an event with one of them next month,” said an industry source in Seoul.

AI MODEL FOR VIDEO CONTENT

Twelve Labs founded in 2021 develops hyperscale AI models that understand video content, an unexplored sector, while local major IT companies such as Naver Corp. and KT Corp. are focusing on text-based large language models (LLMs).

The startup was in the spotlight as it won a technology contest by Microsoft with an AI model that understands video, beating competitors including Columbia University and Tencent Holdings Ltd.

Twelve Labs raised money from major investors such as the venture capital firm Index Ventures while tapping world-renowned AI scholar Fei-Fei Li, a professor at Stanford University, and Aidan Gomez, CEO and co-founder of Cohere, as advisors. Cohere is a competitor of OpenAI, the developer of the global-hit generative artificial intelligence chatbot ChatGPT.

The South Korean company’s AI model understands various types of information in video such as conversation, objective behavior, text and logos.

With the technology, Twelve Labs was selected as one of the 50 most innovative companies developing generative AI applications and infrastructure across industries by CB Insights, a provider of market intelligence on venture capital firms and startups. Insider, a US financial and business news provider formerly known as Business Insider, chose Twelve Labs as one of the most promising AI startups of 2023.

BIG TECH COMPANIES’ CUT-THROAT COMPETITION

Big Tech companies are fiercely competing in the generative AI industry as those IT giants are feared to lose in the race if they lag behind any technologies in the sector such as LLMs, AI semiconductors, cloud and AI applications.

The global generative AI market was forecast to explode, growing to $1.3 trillion won over the next ten years from $40 billion in 2022, according to a report by Bloomberg Intelligence.

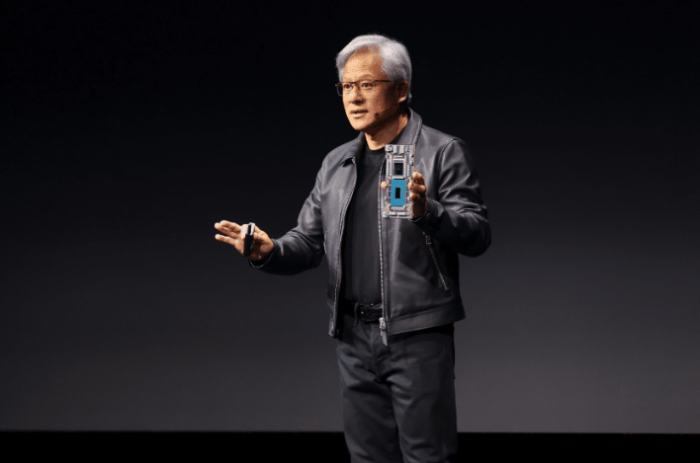

Nvidia founder and CEO Jensen Huang expected generative AI to create an impact similar to that of Apple Inc.’s iPhone, the pioneer of global smartphones.

“The generative AI era is upon us, the iPhone moment if you will,” Huang said at SIGGRAPH, the world’s premier computer graphics conference in August.

Microsoft has already poured $10 billion into generative AI startups, while Amazon.com Inc. and Nvidia have spent $4 billion and $270 million in the sector, respectively, according to the US startup industry research firm PitchBook.

FIGHT WILL BE OVER IN NEXT ONE TO TWO YEARS

Those technology behemoths are injecting money into promising generative AI startups regardless of nationality or funding stage.

Nvidia participated in Series B rounds of Adept and Inflection AI Inc. in the US, as well as Series C rounds of Hugging Face Inc. and Cohere. Microsoft, which invested in Inflection AI, joined a Series B round of AI chip startup d-Matrix. Amazon.com, which participated in Hugging Face’s funding round, agreed to spend up to $4 billion on Anthropic PBC, an LLM development startup, in September.

The generative AI market consists of three sectors – AI infrastructure, which includes LLMs and AI semiconductors, AI models, which understand languages and information, and applications, which utilize those models for consumers.

Global major technology companies are currently concentrating on the AI infrastructure while staying interested in other sectors.

“Those Big Tech firms have recently been trying to reinforce their weak areas such as LLM, AI chips, applications through investments,” said an executive at a venture capital firm in Seoul. “Microsoft and Google are manufacturing AI chips, while Amazon decided to invest in Anthropic. That means the fight for the AI hegemony will be over in the next one to two years.”

Corporate values of competitive generative AI startups, which can help major technology companies make up for their weaknesses, rocketed too much to attract investors, said another industry source in Seoul.

“It is almost impossible for venture capitalists to invest in generative AI startups founded by famous entrepreneurs or with strong name values,” said the source. “We saw a similar investment pattern in the bio sector where the enterprise values of only the companies that passed clinical trials soared.”

Write to See-Eun Lee and Jong-Woo Kim at see@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Artificial intelligenceKT ties up with Thai company for SE Asia hyperscale AI

Artificial intelligenceKT ties up with Thai company for SE Asia hyperscale AIOct 22, 2023 (Gmt+09:00)

2 Min read -

Artificial intelligenceNaver eyes global market with new LLM HyperCLOVA X

Artificial intelligenceNaver eyes global market with new LLM HyperCLOVA XAug 24, 2023 (Gmt+09:00)

4 Min read -

Artificial intelligenceS.Korea's Twelve Labs ranks among world's top 50 generative AI startups

Artificial intelligenceS.Korea's Twelve Labs ranks among world's top 50 generative AI startupsAug 11, 2023 (Gmt+09:00)

1 Min read -

Artificial intelligenceTwelve Labs secures $12 mn for AI-powered video analysis platform

Artificial intelligenceTwelve Labs secures $12 mn for AI-powered video analysis platformDec 06, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN